The Big Problem Underlying Trump’s Tax Cut for Business Owners

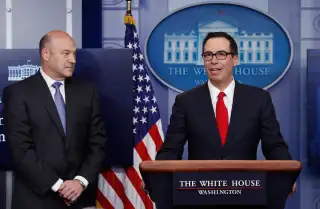

On Wednesday the Trump administration unveiled the latest iteration of the president's tax plan, aiming to reinvigorate the American business. But number crunching shows that one of the president's biggest proposals -- a special, lower tax rate for certain business owners -- could mean a huge handout to wealthy Republican voters without delivering a major jolt to the economy.

The proposal, which would allow business owners to pay a special 15% tax rate instead of the (typically higher) income-tax rates that apply to salaried workers, is sure to fire up the GOP base. The small business lobby has pushed hard for it, and research has shown that small business owners lean heavily Republican.

Yet while it's likely to boost the economy -- as tax cuts generally do -- the effect could be far less dramatic than other proposed tax changes, especially rate cuts for big public corporations. And reviews of the proposal by think tanks from both sides of the political spectrum suggest it could add roughly $1 trillion to the deficit over the next 10 years.

What's more, experts worry that the proposed cut would generate some unintended consequences -- worsening inequality and promoting tax avoidance, as workers scramble to qualify for the attractive lower rates. Indeed, when a similar move was implemented in Kansas in 2012, the tax moves generated a ballooning deficit and surge in newly minted "small business owners." The results sank Gov. Sam Brownback's popularity, and the state is still trying to clean up the mess.

How the Tax Break Works

The centerpiece of the Trump plan is a cut to the corporate income tax rate, from a maximum of 35% to 15%. This cut applies to what the tax code calls "C corporations" -- think Fortune 500 companies like Bank of America and Exxon. That goal has broad bipartisan support because the U.S. rate is among the highest in the world, and economists believe it could prompt companies to hire and invest, spurring the economy. (President Obama proposed something similar, although less dramatic, a couple of years ago.)

Trump's plan doesn't stop there, however. The president also proposed that taxpayers who own their own businesses -- a group including millions of doctors, lawyers, and shop owners, as well as freelancers and real estate moguls like Trump himself -- pay that same 15% rate. Currently owners of these "pass-through" businesses report business profits as income, meaning they pay maximum rates of up to 39.6% currently (and would pay up to 35% under Trump's plan) on those profits, the way salary earners do.

Small business has a lot of clout in Washington, particularly among business-friendly Republicans. The preferential rate for business owners is a goal lobbying groups have pushed hard for. Indeed, when Trump floated this proposal last August, the National Federation of Independent Business quickly endorsed the idea, saying it would "level the playing field for small businesses."

On Wednesday morning its website included a link to a form letter that small business owners could send to their lawmakers; among other things, it argues that "tax discrepancies between corporate and individual rates must be addressed in this once-in-a-generation window of opportunity."

Allowing all businesses, from Microsoft to the corner store, to pay the same 15% rate may have a instinctive appeal. But Trump's plan wouldn't necessarily create parity. That's because after the C corporations pay tax on their corporate profits, the owners of those businesses -- namely, shareholders -- pay a second tax on their share of profits when companies pay those out as dividends; dividend tax rates are currently up to 23.8%.

Weaker Economic Impact

Of course, letting business owners pay unusually low taxes might be still be justified if it created significant economic growth. And in general, tax cuts do tend to boost growth by spurring hiring and investment.

One recent analysis by the tax-cut-friendly Tax Foundation found the tax cut for "pass-through" business owners would indeed help spur the economy -- but there is a caveat. Although the special, lower rate for these business owners would likely boost annual U.S. GDP growth by 0.13 percentage points (going up to to 2.03% from 1.9%) over the next decade, it would also increase the deficit by $1.3 trillion, even after factoring in higher tax receipts as a result of the extra growth, according to the Tax Foundation.

By contrast, other tax cuts proposed by Trump are expected to deliver a lot more bang for the buck. His corporate tax cut, the one designed to benefit Fortune 500 companies, would boost growth by 0.41 percentage points per year -- three times the economic impact -- while increasing the deficit by a smaller $1 trillion, the Tax Foundation found. And eliminating the estate tax -- a frequently floated Republican tax priority -- would boost growth by a smaller 0.09 percentage points per year, but would cost less than $50 billion.

One big reason for the discrepancies: While large public companies are likely to pour tax savings into hiring new employees or opening new production plants, only a small minority of small businesses have the economic heft to do so. Although there are 28 million small businesses in the U.S., only 5.7 million employ anyone other than the owner. And of these, only about 200,000 are the kind of “high growth” companies that tend to add lots of workers, a recent Harvard study found.

With its growth impact relatively modest, Trump's business tax proposal could still suffer from the law of unintended consequences. One potential outcome, say tax experts, is that many workers who currently serve as salaried employees could rush to become independent contractors, hoping to lower their tax bills. While the Trump plan has pledged to write rules to prevent this, independent analysts suggest such rules could be hard to enforce.

Another drawback is that the policy would make the tax code far more regressive, with most of the benefits going to taxpayers who are already wealthy. A February report from the left-leaning Center on Budget and Policy Priorities noted that last year, roughly half of all income from these so-called "pass-through" businesses targeted by the Trump plan went to the top 1% of earners, those making $693,500 or more. Meanwhile, only about 27% went to households in the bottom 90% of households.