What are smart tax cuts?

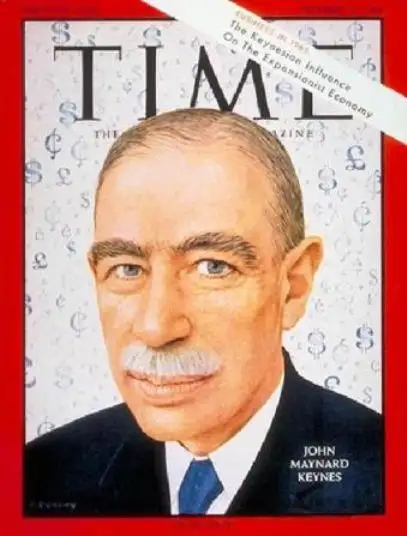

John Maynard Keynes coined the phrase The Paradox of Thrift, an odd but accurate way to describe the situation many Americans find themselves in at the moment. The worse the economic times, the more people squirrel away their money. That sounds like a smart move if you've lost your job or you're retired and your nest egg has shriveled. Even if you’re lucky enough to still have a job, you're probably so worried about the economy that that last thing you're doing is spending money by eating out, taking vacations, shopping for new clothes, a car or even groceries at your local Whole Foods.

Trouble is, of course, when everyone pulls in their horns and stops spending, the economy grinds to a halt and it's a fast but vicious downward spiral to an even deeper recession and we all end up worse off. So, is it better to save or spend in these scary economic times? Of course there’s no one right answer. But my colleague Pat Regnier tackles that question in a thought-provoking column in the March issue of Money. He says not buying a new flat screen TV or the latest iPods won’t really make that much difference in the long run, so we should stop punishing ourselves for that kind of spending. The real answer lies in finding a way to reduce the cost of the big ticket items – college tuition, a home, health care, child care - that will enable people to start saving again.

There are no easy ways to do that but one way to tackle the spend or not to spend conundrum is to give people an incentive to spend in a way that will save them money in the long run. Call it is smart tax cuts. As David Leonhardt wrote in a recent New York Times piece, there are number of ways to spend money now that will save you money later. We saw some of that in the stimulus bill that was signed by President Obama last week (to see how the stimulus money is being spent, go here), with tax credits for home improvements that improve energy efficiency. We all know that tax code in the U.S. rewards people who own homes by allowing big tax deductions for the interest we pay on our mortgages. If more smart tax incentives are designed and implemented, perhaps we will all find ways to spend some money that will save us even more money in the long term.

-- Donna Rosato