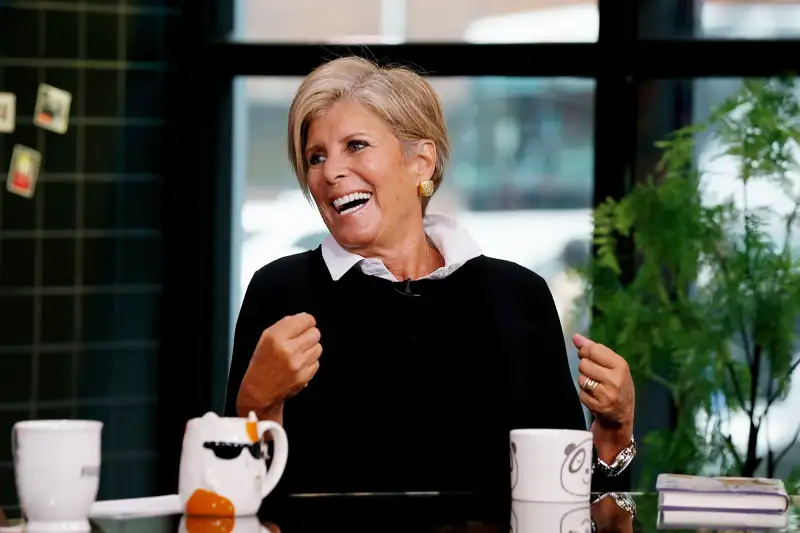

Suze Orman: This Is the One Thing I Want You to Know About Retiring Early

I have spent 40 years helping people become financially independent. I am the queen of needs vs. wants. One of my most emphatic messages is that getting the same pleasure from saving as you do from spending will put you on the road to wealth.

That gives me plenty of common ground with the FIRE movement. But I also have some serious concerns.

For anyone who isn’t up to speed on FIRE, it stands for Financial Independence, Retire Early.

Financial Independence: count me in!

Retire Early: yikes, that’s where I jump off the bandwagon.

When I was first asked my opinion about the FIRE movement, I had plenty of questions. I wanted to know about the Retire Early part of the equation. In my world, retirement means not working. Full stop. I was told that this was indeed the focus of FIRE, and that early was 30s or 40s, not 55.

The math of that makes absolutely no sense. And I said so.

But I now realize that I was given bad information. Retire Early for FIRE followers is not about stopping work completely. It is about stopping work that you don’t like, or just do for the money, and finding work that you actually enjoy, and that fulfills you.

Hello! We are so on the same page. In fact, I have been telling people that they should never work at a job they hate. And I have long said that living below your means, but within your needs is how you set up your life to be able to live life On. Your. Terms.

That seems to be right in line with what the FIRE movement is all about. If you want to retire from a long commute, a corporate hierarchy you loathe and work that you don’t look forward to, I am 100% cheering you on. But that assumes your next goal is to segue into a new “career” that speaks to you, and that yes, brings in some money.

For here’s the one thing I can tell you from my perch at a young 67-years-old: Money will never make you happy, but you need a base level of money to give you and your family security. Saving 25 times your current income and then retiring before age 40 without continuing to make money is just way too risky in my opinion. The notion that you can then afford to live off of your savings by limiting your withdrawals to just 4% of your assets each year — adjusted for inflation — is of course borrowed from a popular retirement strategy.

But that strategy was designed to work for someone who retired at 65 and wanted to make sure their money had a solid chance of outlasting them. What works for a 25 to 30 year time horizon shouldn’t be assumed to work for a 50 or 60 year time horizon.

So that’s why I have been so emphatic that Retire Early is incredibly dangerous. If you want to ditch your dreary life-sucking job, go for it! But to be financially independent in your 70s, 80s and beyond will require that what you have saved today can keep compounding for a few more decades. You don’t want to tap your principal today. So that likely requires continuing to bring in income today. Right? And given what I know and see about the high cost of being old—supported my mother who lived to be 97—I encourage every FIRE follower to keep saving more. A Roth IRA. A SEP-IRA if you are self-employed.

If that’s your plan, I am so with you. If you are able to construct a life that avoids the financial insecurity that so many of your parents and grandparents are living with right now—too little saved for retirement, a too-expensive lifestyle to support—and you actually enjoy your life along the way, you will have lived the richest of lives.