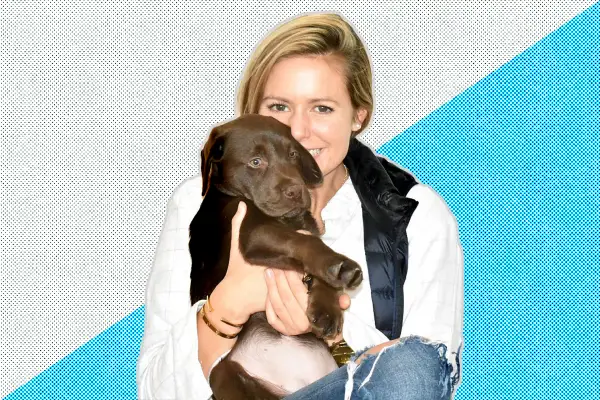

This 28-Year-Old Financial Advisor Says You Don't Have to Understand the Stock Market to Be a Good Investor

When Corbin Blackwell first interviewed for a job on Wall Street after college, she knew almost nothing about investing. Now six years later she regularly doles out financial advice to millionaires.

“I love talking to people, and I love that a-ha moment when they understand that they can have control of their future,” says Blackwell, 28, a certified financial planner for Betterment, an online financial advisor that uses technology provide low-cost investment advice and management.

Investing can be as simple or as complicated as you want to make it – but the nuances of the stock market should never be a barrier to just get started, she says. In fact, the advice she routinely gives her friends is to just keep it simple. “It’s not sexy, but over the long term a more of a passive investment strategy tends to outperform,” says Blackwell, referring to index funds or exchange-traded funds. “I don't care what the hottest weed stock, or Bitcoin is doing.”

Nor does she care to hear the excuse of not having enough money to invest. “You can get started with $100, which in New York city is a dinner and a night out, maybe,” she says. “That excuse doesn’t go very far with me.”

Money talked with Blackwell about how she learned the ropes, and some of the biggest misconceptions and mistakes she sees among younger investors.

How did you start your career?

I started at Morgan Stanley Wealth Management in Washington D.C. right out of college in a support role for a team of advisors. I didn’t know a lot about financial planning, and I was very candid about it when I interviewed. But they sort of said, ‘You don't know what you don't know. You'd be great with our clients, and we’ll teach you along the way.’ It just snowballed from there.

What was the most striking thing you learned early on the job?

That taxes and fees are two things that you can control when you're looking at your investments, and they can have the biggest impact on how much you can save over the longer term. I think taxes were the most eye opening because I was freshly out of college and starting to see the net of my own paychecks.

The other thing is just how there is a lack of knowledge in this area. So many people use either tips that they pick up from friends, or at a cocktail party, or after reading one thing, or half of a snippet. And then they base their decisions off of that even though it's their life's work essentially, built up.

When your friends ask you for investing advice, what’s the first thing you tell them?

Just start. I think people are afraid to start investing until they have a lot of money, or just afraid to start investing because they don't have the knowledge. I have friends who will say, "I don't know anything about the stock market," but the most powerful wealth building tool that you have is to just start somewhere.

Other people get hung up on savings percentages. They read somewhere that they need to have this amount saved by age 30, or this percentage of their income saved. Some people find that daunting, especially in high-cost cities like New York, and then they bury their heads in the sand instead of just choosing a much lower percentage. At least it's something.

Can you be a good investor without knowing a lot about the stock market?

I would say yes and no. The great thing is that with online advisors and target date funds you can basically outsource investing decisions, just like you outsource a lot of other things in your life. You do not have to be an expert to do really well. I think for your own sake, however, it's always smart to know what you own, even if it’s a general understanding – because it is your money.

Most younger investors start with a 401(k) or other employer-sponsored retirement plan. Any advice there?

Always take advantage of the full employer match. I think that's one that a lot of people know, but I want to reiterate that. Also, make sure that you actually invest the funds because some places, if you haven't picked an asset allocation, it could just sit in a money market fund. Keeping your savings in cash won’t do you any favors.

If you know nothing else, go with a target-date fund [which allocates your assets based on when you expect to retire]. That's usually the easiest, most straightforward way to start, and it's not going to lead you wildly astray. You can always customize your portfolio or change things around later. But start early, and stay invested.