An Important Tax Deduction for Seniors and Their Families Is on the Chopping Block

Tucked into the GOP tax bill released on Thursday is a proposal that would hurt older adults, the sick and disabled, as well as the family members who help pay for their care.

House Republicans recommended eliminating the medical tax deduction, a provision that allows people to write off qualifying medical and dental expenses that exceed 10% of their adjusted gross income. As of now, individuals can deduct their own expenses and those of their tax dependents, which includes aging parents who live with the individual and meet other criteria.

Roughly 6% of tax filers take advantage of this deduction, and their ranks include those with expensive care needs: seniors in nursing homes, people with chronic medical conditions, and parents of disabled children.

The proposal is part of a sweeping tax reform package that would disproportionately benefit corporations and the wealthy. Lawmakers also proposed cutting the estate tax, which is paid by only the wealthiest of families: some 11, 310 individuals dying this year will leave estates large enough to require filing an estate tax return, according to the Tax Policy Center.

“The middle-class is losing out,” says Michael J. Amoruso, an elder law attorney in Rye Brook, N.Y. and president-elect of the National Academy of Elder Law Attorneys.

Proponents of the bill say it would put more money into middle-class pockets due to a proposed increase in the standard deduction for individuals and married couples, to $12,000 and $24,000, respectively. But this increase isn’t going to offset the loss of the medical expense deduction for those who claim it, Amoruso says.

Here’s how the deduction works: let’s say a single senior with $40,000 in annual gross income has medical expenses of $6,000 annually. The amount over 10% of her income, or $2,000, would not be subject to tax. If her taxable income puts her in the 15% bracket, she’d lose out on $300 of federal income tax savings, according to Greg Geisler, professor of accounting at the University of Missouri-St. Louis.

Those who use the deduction to pay for long-term care costs stand to lose a lot more. Amoruso has a client in her mid-80s who pays, on her own, the $11,000 monthly cost of her assisted living facility. She can afford to do this by selling highly appreciated stock and using the medical expense tax deduction to eliminate any taxes she would owe. An increase in the standard deduction would not help her, as it would not equal her savings under the medical expense deduction, and she would be faced with a higher tax burden on top of her substantial care costs.

If the medical deduction went away, his client would run through her money quicker and likely wind up on Medicaid, Amoruso says. Medicaid pays the long-term care costs of people who have exhausted their income and meet other criteria, and some experts say the elimination of the medical expense deduction would ultimately increase costs for the government program.

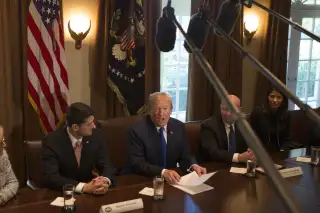

The Senate is expected to offer its own tax proposal, and then lawmakers from both chambers will work to reconcile their versions and pass legislation they can send to President Donald Trump to sign into law.