The Deadline for Retirees to Return Unwanted RMDs Is Almost Here

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

Some older Americans will get a special tax break this year. But if you're eligible and you don't act fast, you could lose it.

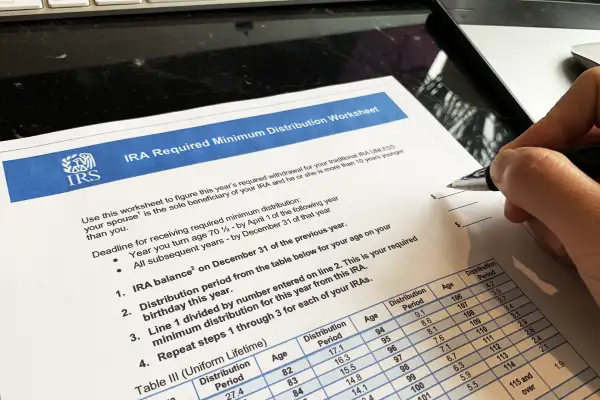

Retirees aren’t required to take minimum distributions (RMDs) from their retirement accounts in 2020. If you withdrew money earlier this year and don’t need it to live on, then you have until Aug. 31 to return it if you don't want those funds counted toward your income for the year.

In a typical year, people age 72 and over must take a set amount of money based on an IRS formula from their retirement accounts and pay income taxes on that money. These withdrawals are Uncle Sam’s way of finally collecting his cut of the savings that's grown tax-deferred over the decades. But 2020 is hardly a typical year, and in March Congress waived the RMD requirement for all types of retirement plans including IRAs, 401(k)s, 403(b)s, 457(b)s, and inherited IRA plans. (Lawmakers took similar action during the Great Recession, waiving the RMD requirement for 2009.)

Returning an unwanted RMD to your account can save you on income taxes for the year. Also, if your RMD would have pushed you into a higher income bracket for the purpose of calculating Medicare premiums and the portion of your Social Security income that’s taxed, then it could save you additional money.

Fidelity Investments recommends making sure the money is received by the Aug. 31 deadline, not postmarked by then, says Melissa Ridolfi, the company's vice president, college and retirement leadership. Fortunately, digital banking can make it easy to meet the deadline. Fidelity has seen a sharp increase in customers' use of mobile check deposits during the pandemic.

Your brokerage firm sends you a Form 1099-R when you withdraw money from your retirement account and a Form 5498 when money is contributed to the account. Hang onto both for when you file your 2020 taxes.

Another key point: Many people automate their RMD withdrawals. Those who turned that function off for this year should make sure to turn it back on for next. The penalty for skipping an RMD is hefty: 50% of the money you didn't distribute on time. "2021 is around the corner," Ridolfi says.

More from Money:

1 in 4 Baby Boomers Say They'll Postpone Retirement Due to the Pandemic