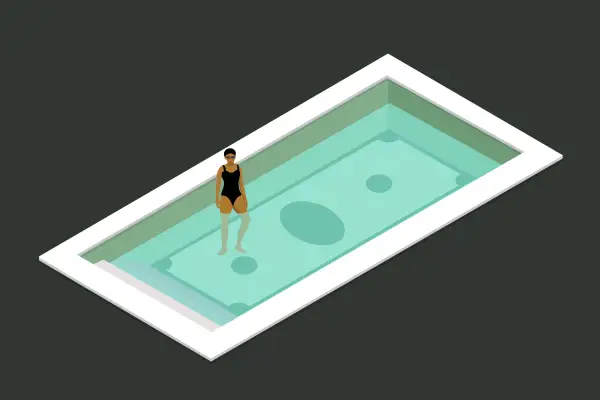

Here's Why You Should Ask for a 5% Raise Right Now

It's time to start thinking about year-end raises. And at U.S. many companies, big battles may be brewing this year over pay. The good news: For the first time in a long time, workers may actually have the upper hand.

In keeping with a decade-long trend, American employers are planning to increase average salaries by about 3% heading into 2022, according to two recent reports — one from consulting firm Willis Towers Watson and the other from The Conference Board.

The problem? With the economy finally emerging from COVID lockdowns, the cost of living for millions of Americans has been rising even faster. The latest government figures show that the consumer price index (CPI) jumped 5.3% in the last 12 months.

And with such a strong job market, workers aren't likely to be happy with pay increases that, in so-called real terms, leave them poorer than before.

A 3% raise this year? “Insulting,” declares Tara Furiani, chief executive and host of the web series, Not the HR Lady.

Instead of falling back on old habits, companies should take a cue from what’s expected to be the biggest cost-of-living adjustment (COLA) for Social Security recipients in decades, with current estimates suggesting a 6% increase for these benefits, she adds. “Employers need to be thinking about a similar, more realistic, cost of living increase for their employees, too.”

The Social Security Administration has made cost-of-living adjustments to benefits since 1975, based on a measure of CPI for urban wage earners and clerical workers. In the past decade, COLAs have averaged 1.65%, or about half of the reported salary increases in that time. While government employees may receive across-the-board COLAs, only 11% of companies reported they are a factor for salary increases, according to a survey by WorldAtWork.

While COLA doesn’t drive how most employers design their pay systems, Americans are feeling the pinch of higher prices for basic necessities like rent, food and gas, notes Bill Dixon, managing director with Pearl Meyer, a compensation consulting company. “Any salary increase in that 3% range is causing you to fall behind in terms of inflation.”

Employees Have Options

Companies that opt for a status quo salary bump also may underestimate the reality of the labor market: Employees currently enjoy the most bargaining power they’ve had in at least 20 years, Dixon estimates. Thanks to a global labor shortage and a lot of job turnover, employees have options.

“The environment is quite unique for negotiating your salary increase,” Dixon says. “If your employer is not willing to entertain those conversations, that might be a reason to reassess your gratitude.”

Employers can stave off a mass exodus just by being “decent human beings” and offering pay increases that reflect the true cost of living for the people who make the company successful, Furiani says. “People are willing to walk away because they know there are companies out there that are doing better.”

Companies are reporting persistent and extensive labor shortages caused by increased turnover, early retirements, childcare needs, challenges in negotiating job offers, and enhanced unemployment benefits, according to the latest edition of the Federal Reserve’s so-called Beige Book, which details current economic conditions. Because many employers are finding it difficult to fill open positions for a wide range of roles, that’s contributing to higher wages.

These dynamics make for an employee’s market, and such cycles typically last about two to three years, Dixon says. So it’s especially important to capitalize on the opportunity to push for a higher raise while you’re in the driver’s seat, he adds.

COLA is a Starting Point

While it’s important to understand COLAs, this amount may not be sufficient for your salary increase heading into 2022. In a highly competitive job market, a 5%, 10% or even 15% raise is the “minimal” amount that companies can offer to let employees know they’re valued, Furiani says.

Companies should do an analysis of their compensation and hiring practices to ensure fair and appropriate pay for any employees who aren’t in-line with market rates, but you should also take an active role in salary negotiations, Furiani recommends. While there’s “plenty of data” to support a raise, you should also demonstrate how your work directly translates to your employer’s success, she adds.

Your employer pays attention to how its competitors are paying workers, and you should do the same when outlining your case for the salary you deserve, Dixon advises. First, research what your role is worth in the marketplace, then focus on your relative worth and competency in your job, and how your salary compares to your peers. “It is a self assessment of: What’s my job worth, what am I worth and am I being paid what I’m worth,” he says.

At the start of the pandemic, many employees were grateful just to have a job as the U.S. economy careened into a brief recession and the unemployment rate surged to nearly 15%. Employees now need to capitalize on the rare opportunity to demand more -- be it a raise, a better work-life balance, or other benefits, Furiani says. “If it doesn’t work out, maybe it’s not the place for you anymore.”