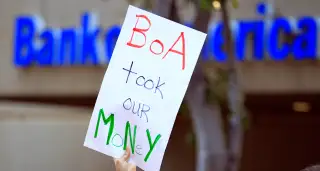

What Bank of America Did to Warrant a $17 Billion Penalty

Bank of America has agreed to pay $16.65 billion dollars in penalties—the largest settlement ever between the U.S. government and a private corporation—for its role in the financial crisis. As Attorney General Eric Holder said Thursday morning, the payout will help "hold accountable those whose actions threatened the integrity of our financial markets and undermined the stability of our economy.”

So what did Bank of America actually do? As part of the settlement, the Justice Department has issued a 30-page "Statement of Facts," signed by the bank, detailing the actions Bank of America is paying for today. The document includes events that took place at Merrill Lynch and Countrywide, which Bank of America later acquired. It's full of e-mails and statements from employees and executives, which often make for infuriating, if sometimes grimly funny, reading.

Here's what happened. In the years leading up to the financial crisis, Bank of America and Merrill Lynch sold various securities based on home loans. If the buyers paid their loan back, investors made money, but if too many defaulted, investors lost. To make sure investors knew what they were getting into, the two companies were required to report to investors on how safe these loans actually were.

The problem? Both BoA and Merrill, the statement says, knew with increasing certainty that many of their loans were troubled or at least likely to be risky, and didn't fully disclose this.

At Merrill, one consultant in the company's due diligence department complained in an email:

[h]ow much time do you want me to spend looking at these [loans] if [the co-head of Merrill Lynch’s RMBS business] is going to keep them regardless of issues? . . . Makes you wonder why we have due diligence performed other than making sure the loan closed.

The Merrill email pales next to the almost-cartoonish cynicism on display in some Countrywide emails. In addition to selling mortgage-backed securities, Countrywide was on the front lines giving mortgages to home buyers. Justice Department documents suggest that the company increasingly offered loans to almost anyone who walked in the door. What mattered was whether the loan could later be sold to someone else. Wrote one exec:

My impression since arriving here, is that the company's standard for products and Guidelines has been: 'If we can price it [for sale], then we will offer it.'

In an email from 2007, another executive reflected that:

[W]hen credit was easily salable... [the desk responsible for approving risky loans] was a way to take advantage of the ‘salability’ and do loans outside guidelines and not let our views of risk get in the way.

Because why should a mortgage company care about risk?

But what makes Countrywide special isn't just that they gave out a lot of bad loans, it's that they sold those bad loans to others while keeping the good ones for themselves. In a 2005 email, the Countrywide Financial Corporation (CFC)'s chairman—not named in the statement, but it was Angelo Mozilo—wrote that he was "increasingly concerned" about a certain adjustable rate loan. He feared that the average borrower was not "sufficiently sophisticated to truly understand the consequences" of their mortgage, making them increasingly likely to default. He wrote:

…the bank will be dealing with foreclosure in potentially a deflated real estate market. This would be both a financial and reputational catastrophe.

So what did Countrywide do about it? Sell the products on the secondary market, and keep only the mortgages given to more qualified buyers. According to the settlement document, Countrywide's public releases "did not disclose that certain Pay-Option ARM loans included as collateral were loans that Countrywide Bank had elected not to hold for its own investment portfolio because they had risk characteristics that [Countrywide Financial Corporation] management had identified as inappropriate for [Countrywide Bank]."

In another email, this time from 2006, CFC chairman Mozilo explicitly spelled out this policy to the president of Countrywide Home Loans, writing:

important data that could portend serious problems with [Pay- Option ARMs]. Since over 70% have opted to make the lower payments it appears that it is just a matter of time that we will be faced with a substantial amount of resets and therefore much higher delinquencies. We must limit [CB’s retained investment in] this product to high ficos [credit scores] otherwise we could face both financial and regulatory consequences.

What do you know? Looks like those "financial and regulatory consequences" happened anyway.