The Best Time to Buy Bitcoin, Explained in One Chart

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

What drives Bitcoin's price? Unlike stocks or bonds, cryptocurrency doesn't throw off any cash that investors can use to peg its value. Instead, the worth of a Bitcoin is due entirely to investors' collective belief in the digital currency.

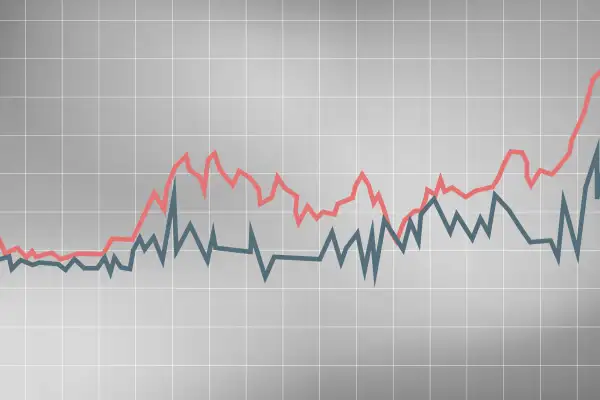

While Bitcoin enjoys unquestioned devotion among hard-core fans, the broader public's interest has waxed and waned over the years. As the chart below makes clear, Bitcoin's price has tended to follow that fascination, almost in lock step. Created by Jeremy Schneider, founder of online education company, the Personal Finance Club, the graph compares Bitcoin's price in U.S. dollars to Google Search volume for the phrase "Buy Bitcoin" on a 1 to 100 scale.

Following the graph, you can see that as search interest in Bitcoin first spikes in mid-2017, the cryptocurrency's price soon picks up momentum and peaks at about $20,000 late that year. At the same moment, "Buy Bitcoin" search interest jumps off the charts. However, it doesn't last. Both soon plunge to a fraction of their previous highs, until they begin to spike again in late 2020.

Bitcoin advocates have long argued that investors should view the currency as an inflation hedge or a safe haven asset. But its record in both those regards is somewhat spotty. Looking at Schneider's chart, it's hard to conclude that Bitcoin's price tracks anything so much as the number of people wondering at any given moment if they can make money in Bitcoin.

One lesson for investors seems obvious: If you want to buy Bitcoin, don't buy it today, just when mainstream investors' fascination is higher than its almost ever been. Wait for those investors to move on to other things.

But that reasoning also lands prospective investors in a kind of Catch-22. Without cash flow or earnings to go by, Bitcoin investors can ultimately point to little other than the broader public's interest in and acceptance of Bitcoin to justify Bitcoin's price. And when that fascination demonstrably drops, shouldn't it follow that Bitcoin's value proposition has too?

More from Money:

Robinhood and Free Trades: What Every Investor Needs to Know

Robinhood for Beginners: A Complete Guide to Investing With the Controversial Stocks App