The Commencement Speech You Won't Get—But Should

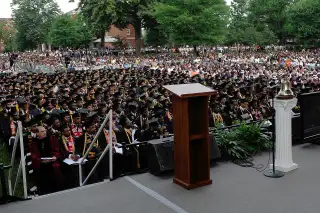

My youngest child graduates college this month, and one thing I do not expect to hear at the commencement is the wisdom of saving, sticking to a budget, and managing credit well. These big moments are reserved for the expression of loftier ideals. But few life lessons would have more lasting personal impact.

If Warren Buffett were giving the speech, he’d likely dwell on the importance of personal money management—and offer some surprising counsel. He has said that his top piece of advice for young people is to avoid credit cards. Not to manage them well. Avoid them. When a fellow panelist pointed this out at a financial literacy seminar last month, I took exception.

In the age of debit cards and Venmo, it is possible to live your life without credit cards. But they are still hugely convenient and offer some protection against fraud and faulty products. Careful use improves your credit score. I don’t relish being on the other side of an argument with Buffett, who is most concerned about high interest rates, annual fees, and late fees. No disagreement there. But those costs are what you should avoid—not the card itself. Many young people leaving college would benefit by smart charging to build a credit record.

Getting an Early Start

Building a credit record is by no means job one for a new grad with a new career. That would be saving for retirement. You’ll also want to pay off those student loans, build an emergency fund, get insured, and tackle a few other basics. But saving for retirement should begin as soon as you are employed. Here’s why: millennials will need $2 million in the bank to retire in their 60s with a median-level income, research shows.

That’s a lot of greenbacks. You will need to save $20,000 a year—that’s $1,667 a month—for 30 years with 6% average annual returns to get there. For perspective, that is a 15% savings rate on annual pay of $134,000. Of course, your pay will change over the years, likely starting much lower and hopefully growing larger. You likely will work longer too. So don’t give up hope. The point is you must start right away.

Read next: The New College Grad's Guide to Money

If millennials earning a median income save around 6% of pretax income they will be able to maintain their standard of living in retirement, according to estimates by J.P Morgan Asset Management. Affluent millennials should save about 11% and high-net-worth millennials should save about 16% to retire as well as they lived while working. All these figures assume the money is in a 401(k) plan with an employer match and saving started no later than age 25.

The good news is that young people have got the message. Two-thirds say they are concerned and thinking about retirement, according to a study from the Navy Federal Credit Union. Today's twentysomethings have begun saving much earlier than previous generations. Eight in 10 millennials say the recession convinced them they must save more now, and more than half are putting away money regularly, according to Wells Fargo.

An Easy Way to Save

One big problem, though, is that young adults are unsure where to put the money and are playing things way too safe. With 35 years to retirement, millennials need a portfolio dominated by stocks. Few are taking that route, which is why the most valuable piece of financial advice I can offer is to say that saving and investing does not have to be difficult.

Sign up for—or do not opt out of—your company’s 401(k) plan. Sign up for—or do not opt out of—the auto-escalation feature that raises your contributions by one or two percentage points every year until you get to 15%. Contribute enough right away to get the full company match. Earmark it all for the plan’s default target-date mutual fund. Then go live your life. You’re done. If you do not have a 401(k) plan at work, you can approximate this strategy with an IRA that you automatically fund from your bank account.

Calculator: How much should I save to reach my goal?

You may want to check in a few years down the road and fiddle. You may decide you are better off in a more or less aggressive target-date fund. You may decide you are better off switching to a mix of low-cost index funds. Fine. But you’ll have done no harm in the meantime—and you will be okay staying with the original plan for many years. Getting started saving is what it’s all about. That's the hard part. I won’t hear that at my child’s commencement this month. But it is what I most want her and all other grads to know.