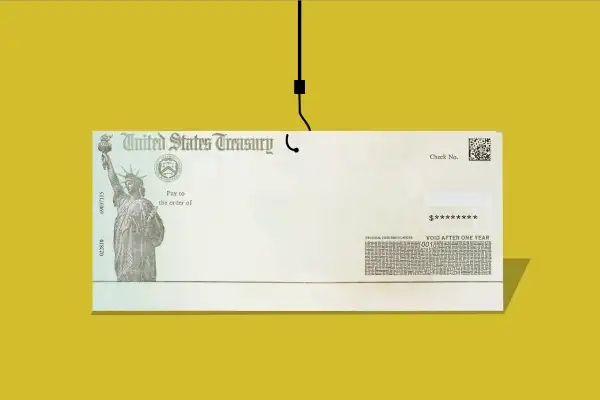

How to Spot a Stimulus Check Scam

The coronavirus pandemic has changed almost every aspect of our daily lives. We’ve turned our couches into offices, learned how to cook those lentils we all hoarded, and can’t remember what it feels like to shake hands with someone. But in the midst of all this change, there remains one constant: scammers are still scamming.

“Never before have so many people been this distracted,” says Adam Levin, the chairman and founder of the cybersecurity firm, CyberScout. “We’re concerned about our health and our families, and scammers are taking advantage of that.”

On April 2, the IRS issued a statement, warning taxpayers to be on the lookout for phishing scams related to coronavirus stimulus checks, the part of the CARES Act that is paying out up to $1,200 per adult and $500 per child to millions of American households. The IRS has followed up by putting out at least one or two warnings a day about coronavirus scams on social media.

Retirees are specifically being targeted by scammers looking to gain personal information because they don’t typically have to file tax returns, the IRS says. “No one from the agency will be reaching out to them by phone, email, mail or in person asking for any kind of information to complete their economic impact payment,” the IRS warns.

Stimulus Checks and Coronavirus Scams

The IRS included a list of tricks that scammers might use to access information, including:

- Emphasize the words "Stimulus Check" or "Stimulus Payment." The official term used by the IRS is "economic impact payment."

- Ask the taxpayer to sign over their economic impact payment check to them.

- Ask by phone, email, text or social media for verification of personal and/or banking information saying that the information is needed to receive or speed up their economic impact payment.

- Suggest that they can get a tax refund or economic impact payment faster by working on the taxpayer's behalf. This scam could be conducted by social media or even in person.

- Mail the taxpayer a bogus check, perhaps in an odd amount, then tell the taxpayer to call a number or verify information online in order to cash it.

But sometimes phishing (digital personal information scams) goes completely over peoples’ heads, regardless of their age or tax-payer status. How can you tell if an offer is legitimate or not, especially with so much misinformation and confusion floating around online about the stimulus package? And furthermore, what measures can you take ahead of time to keep your information secured?

“The first thing to know is that you should never authenticate yourself to anyone who contacts you,” says Levin.

A financial institution or government agency will never call you and then ask you to identify your personal information — they already have it. The only time it makes sense to give over personal information, like the last four digits of your social security, is if you made the call yourself and the person on the other end needs to verify that you are who you claim to be. The IRS uses traditional mail as its main form of correspondence, and no legitimate bank or agency will ever call you to ask for your information.

Additionally, Levin says that the best way to establish whether the email or phone call you just got from an alleged institution is to go directly to the source.

“If you get a call or email, independently confirm where it came from,” says Levin. “Search directly to the government agency or financial institution’s website and see if there’s been any actual announcements.”

But before you even get to the point of approaching potential phishing, there are a few ways you can protect your information.

First and foremost, have strong, unique passwords linked to each of your online accounts.

“A lot of people have the same username and password for every website because they’re afraid to forget them, but this makes it easier for hackers to access their information,” says Levin.

Levin advises signing up for two-factor authentication on websites when it’s offered, which sends a code to your phone via text or an authentication app whenever someone attempts to log into your account. It’s also good to sign up to get alerts from your bank for whenever a purchase is made, and routinely check your credit score online to see if there’s been any radical changes.

“This is a scammer’s full-time job and there’s an awful lot of money to be made, so you have to be proactive,” says Levin.

More From Money:

Here's When Your Stimulus Check Should Arrive

Coronavirus Scams Are on the Rise

True of False: Your Stimulus Check Is Just an Advance on Next Year's Tax Refund