When It's Time for the Adviser to Fire the Client

Sometimes there’s a client relationship you sense is no longer as functional or effective as it once was.

Perhaps the client engagement was never ideal in the first place, but you took on the client even when your gut suggested it wasn’t an optimal fit. Or, in some cases, the client did once fit the ideal client description in your practice, but your own practice changed rather than the client. In other cases, the client chemistry changed just like it can between two spouses. Life circumstances sometimes prompt this shift, but other times you can’t even put your finger on why things aren’t quite like they used to be.

How do you decide if it would make more sense to discontinue the relationship? When do you make the change? And how do you do it? I have sometimes struggled with the ifs, whens and hows.

I think it is part of the DNA of advisers to want to serve our clients no matter what, and thus very difficult to see that it is not always best for each party, even if it seems obvious. I give a lot of credit to a financial coaching firm I worked with many years ago for encouraging us as advisers to try to recognize when it’s time to say goodbye. They told us if we could recognize that the relationship was not working for everyone, it might be time to consider parting ways. In the end, they said, it’s often better for the client, better for the adviser, and better for the other client relationships.

Years ago, I had a client who, at the beginning of the relationship, fit the description of my ideal client. This person even added services over the years to the point where he was one of my highest revenue clients. In time, he began making requests that I felt were unrealistic and unreasonable. But, for a time, I stretched and successfully responded to each request, even though I was stressed by them. He persisted and made the same request again and again, also saying he was going to reach out to other advisers to get other quotes.

The stress on my business grew as the demands continued, even though each time he apologized afterward. After four of these anxious experiences, I realized that if it happened again, I would need to let the client go. Remembering the coaching, I thought it through on all fronts.

It would be better for my client to find another adviser who might provide a better overall fit, and thus my client would be better served in the long run. But also, I’d be less stressed as a result of no longer attending to requests that seemed inappropriate. And I’d be that much more fully available to help out my clients who were still with me. Ultimately it would be a win, win, win for all.

If realizing the need for a break up is tough, working through the breakup can seem worse – but try to remember the end result of things getting better for everyone.

Such was the case when I informed this particular client — in an email followed by a phone call — that I was resigning from our work together and that I felt I wasn’t the financial adviser to take him through the next phase of his financial life. As could be expected, he was at first upset and unhappy. I don’t know what happened with that client and his next advisers, but I do know that I slept better the first night after that conversation and went into the office the next day feeling much more relaxed.

And despite having to make some adjustments when that client revenue ended, in time, the loss of that client actually propelled me to make some major changes to my practice that took me to new professional heights. In the end, the move helped me better serve my remaining clients, add more ideal clients, and pursue other professional and personal goals for myself.

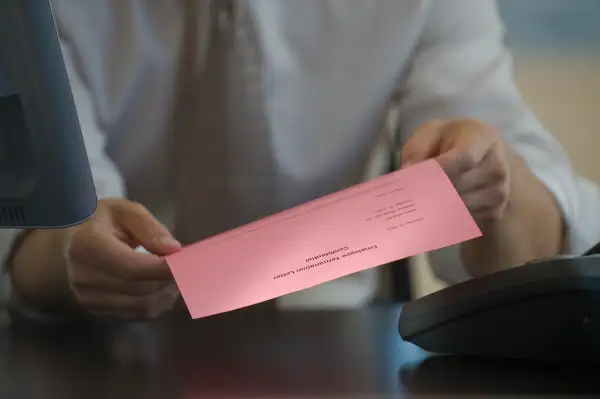

How to end a client relationship depends on the client relationship. Sometimes a letter is sufficient. Other times a phone call is best. And from time to time, an in-person meeting is the way the go. The breakup can be awkward, no doubt, and I don’t think there’s a template to follow. But it’s best to formalize the end of the relationship so the client knows his or her next steps, your staff knows what is happening — when and why — and everyone can go forward with eyes wide open.

In the end, this is all about the client and making sure your client is well served…even if you have decided you no longer want to be the adviser serving him.

-----------

Armstrong is a certified financial planner with Centinel Financial Group in Needham Heights, Mass. He has guided clients since 1986 in matters of financial planning, insurance, investments, and retirement. He currently serves on the national boards of the Financial Planning Association and PridePlanners. His website is www.stuartarmstrong.com.