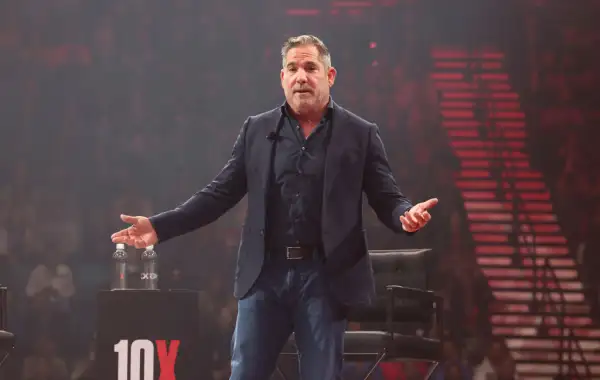

Grant Cardone’s Debt Strategy, Explained: When Borrowing Can Actually Help You Build Wealth

Unlike fellow personal finance guru Dave Ramsey, Grant Cardone subscribes to the idea that some debt is good. Cardone has used debt to build his real estate business, and he often talks about this credit card usage.

One of Cardone’s arguments for the use of good debt is that Fortune 500 companies use huge amounts of debt all the time to continue building their businesses. While your personal finances likely aren’t comparable to the balance sheet of those major companies, there are lessons you can take away from Cardone’s approach.

Must Read

'Good' debt can help you better your finances

Financial experts often consider debt that can help you build wealth over the long term as "good debt." Examples are a mortgage, which allows you to build equity in a home, as well as a business loan that can set you up to create a business that will profit in the future. Student loans are also considered "good," since they allow you to pursue education that could give you a higher earning potential.

If you can pay back a loan on your "good" debt responsibly and according to the terms of your agreement, that debt could give your finances a boost.

Need Cash? Check out Credible's personal loan options

'Bad' debt can do damage

"Bad" debt, on the other hand, can be a hindrance to your finances. This is generally considered debt with high interest rates that are for items or services that won’t grow in value over time. Taking out a personal loan so you can go on vacation, or racking up credit card debt on a shopping spree that you can’t pay back would be in the "bad" debt category.

To be clear, Cardone does use credit cards, which can offer significant savings on groceries, gas, travel and other items via their rewards programs. But he says that he pays off his credit card at the end of each month so that he never has to pay interest on it.

Pet Protection: See Lemonade's pet insurance options — save and protect your cat or dog from high vet bills

How to avoid 'bad' debt

The key to not accumulating bad debt is to avoid living above your means. Setting a budget and tracking it can help ensure you are able to pay your credit card balance each month while saving for your short- and long-term financial goals.

It’s also important to have an emergency fund that can cover three to six months of expenses should the unexpected happen, like you need to pay for an urgent, expensive car repair.

Bonus Money: Deposit funds into a new SoFi Invest Account to earn up to $1,000 in stock