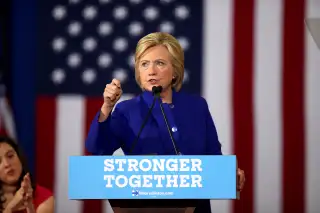

Hillary Clinton Wants to Raise Top Rate for Estate Taxes to 65%

Still hoping to boost her middle-class bona fides in a tight presidential race, Hillary Clinton just took another swipe at the super-rich.

A new version of the Democratic nominee's proposed tax plan, unveiled on Thursday, calls for a 65% tax on the largest estates -- up from 45% in her previous plan -- further limiting wealthy households' ability to pass on assets to heirs.

The Clinton campaign says it would use the proceeds to pay for initiatives such as simplifying small business taxes and expanding the child tax credit. The change, together with two other new tax proposals, would generate $260 billion over the next decade, according to the nonpartisan Committee for a Responsible Federal Budget.

Clinton's new plan not only has a top tax rate not seen since 1981, but also introduces three new tax brackets: a 50% rate for estates valued at more than $10 million per person, 55% for estates of more than $50 million, and 65% for estates exceeding $500 million.

Read Next: How Many People Actually Pay the Estate Tax?

That's a big departure from the current top tax rate of 40%, and her rival, Republican presidential nominee, Donald Trump's plan to repeal the estate tax all together.

Despite Clinton's own proposals, she and husband Bill have created property and insurance trusts as a tax strategy to ensure that, after they die, at least some of their millions of dollars in assets will be shielded from the estate tax. A move Trump's campaign called "hypocritical."

Read More: Hillary Clinton Has Managed Her Estate the Way She Does Everything Else

Increased estate taxes aren't the only major change Clinton wants. The plan would also repeal a feature of the tax code known as the "step-up basis" that dramatically reduces capital gains tax bills heirs pay after inheriting valuable assets.

Typically, investors pay capital gains tax on the profit they reap whenever they sell an asset that has appreciated in value. But assets can be passed onto heirs with out paying tax on the appreciation. If and when heirs sell, they do pay the tax. But the size of the heirs' profits is calculated based on the value of the assets at the time the heirs inherited them, not when they were originally bought by the heirs' ancestor.

Under Clinton's plan, investors, or rather their estate, would owe the tax when they passed away, according the Committee for a Responsible Federal Budget. There are some exceptions though exactly what they are is not clear. The campaign did support a variety of exemptions "to prevent the tax from applying to taxpayers making less than $250,000 and to limit its impact on various non-financial assets such as farms, businesses, and real estate," the Committee for a Responsible Federal Budget wrote in a statement. Such a change would generate an estimated $150 billion in revenue.

Clinton's final plan change would limit like-kind exchanges, which is a feature of the tax code real estate investors commonly use to defer capital gains taxes.

In total, Clinton's tax code reforms would raise taxes by $1.5 trillion over the next decade, boosting overall tax receipts by about 4%. But the burden of this new tax structure would be concentrated on very wealthy households. Trump's current tax plan -- which features large cuts -- would decrease revenue by about $5.8 trillion.