Is It Safe to Buy Life Insurance From a Startup?

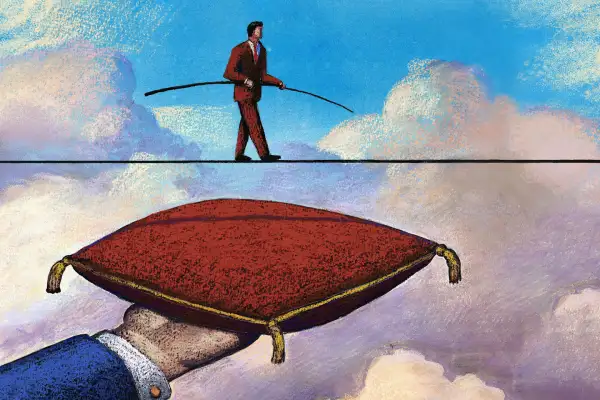

Innovative start-up life insurance companies promise fast online policies, among other attractions. But are such “insurtechs” risky because the company may not be around in decades, when your family will need to collect on your policy?

Insurer stability and reputation matter more to life insurance buyers than to shoppers for other types of insurance. The 2021 edition of the J.D. Power U.S. Life Insurance New Business Study, released in November, reported that car insurance buyers were ten times more likely to choose the company that offers the lowest price over any other. By contrast, those buying life insurance were only twice as likely to pick the lowest-priced policy -- a factor that tied I'm importance among shoppers with the perceived stability of the company. Company stability barely registered as a buying priority for car insurance.

According to Robert M. Lajdziak, J.D. Power’s director of global insurance intelligence, life insurance buyers have a long-term view and put more stock into “confidence in the long term viability of the company, and its expertise in the space.”

That could pose a consumer quandary when it comes to insuring with a company that’s been around a few years rather than multiple decades. But insurtechs are taking steps to reassure customers of their stability. Here’s what you need to know.

Insurtechs are partnering with old hands in life insurance

Insurers are scored on financial stability by specialized agencies that crunch data such as net income, profitability and net worth. For example, AM Best, a leading insurance ratings agency, rates companies between A++ (beyond superior) to D- (worse than poor) on their “ability to meet their ongoing insurance obligations.”

Since companies can’t get rated immediately — at least not with the biggest agencies — insurtech companies have scrambled to seek and project financial stability. Many have managed it through forming partnerships with established companies with strong ratings and long reputations, according to Lajdziak. ”Most of the life insurtechs are backed by an incumbent,” he says. “The most mass market example is Brighthouse by MetLife.”

The long-established partner often writes the upstart’s policies — that is, issues the policies themselves, and backstops them with their financial assets. That allows shoppers to use the ratings for the senior partner as an arbiter of the financial stability of the upstart’s policies.

As an example, policies from Bestow, one of our life insurance picks, are issued by top-rated insurer North American Company for Life and Health Insurance. That means Bestow sets the terms and pricing for policies, but should its business falter, NACL is there to back the death benefit.

For consumers, the alliance can also lend market credibility to the upstarts. “When ‘challenger brands’ are competing in a marketplace with companies such as New York Life, which just celebrated its 175th anniversary, they need to make it apparent [to consumers] they have expertise in the space,” Lajdziak says.

Some start-up insurers are rated with smaller agencies

Not all insurtechs write policies through a partner. Some write their own policies, and so qualify for their own ratings.

A challenge for shoppers, though, is that the upstarts probably won’t be rated by the agencies that rate the most life insurers, such as AM Best, Moody’s and Fitch. Rather, they could be scored by lesser-known names in scoring. For example, leading upstart Lemonade is rated (and well) by Demotech, an agency founded in 1985 — more than a hundred years later than AM Best opened shop, in 1899.

The newer agency has slightly different criteria for stability; it rates insurers on “their area of focus and execution of their business model rather than solely on financial size,” according to non-profit consumer advocate United Policyholders. Demotech has been deemed a competent ratings agency by the National Council of Insurance Legislators, along with AM Best, Fitch, Moody’s and others.

Different agencies, differing scoring schemes

The experience and standing of insurers matters and reviewing financial stability ratings is a good place to start when you’re researching life insurance. It’s not guaranteed that a top-rated company won’t go bankrupt, writes life insurance agent Michael Quinn on lifeinsuranceblog.net, “but it’s very unlikely it will.”

Most insurance reviews, including Money's for life insurance, consider financial stability when making their picks, and may even include the actual ratings scores in reviews. If not, you can usually find the ratings on the insurers’ websites.

To fully understand the scores, though, a little homework is in order, especially when you are comparing across agencies. As an example, Haven Life, another of our life insurance picks, points out that “A+ is A.M. Best’s second-highest rating, but an A+ is Fitch’s fifth-highest rating.”

If you’re nervous about the future of your policy, even after choosing a stable insurer, know that the likelihood your life insurer will fail and leave you uninsured is low, statistically speaking. Of some 800 companies currently writing life insurance in the U.S., fewer than 40 that have a multistate presence have run into trouble in the past twenty years, according to the National Organization of Life and Health Insurance Guaranty Associations.

The troubled companies were not upstarts, but established smaller traditional firms. And many did not fail outright, but were put into what’s called “rehabilitation,” a court-supervised process that seeks to steady and preserve the company and its assets.

Guaranty associations do cover losses, to a point

There’s a safety net of sorts if you hold a policy with a life insurer that goes out of business. If a company fails, the guaranty association in your state — every state has such a group, as do Puerto Rico and the District of Columbia — will step in and cover the lost death benefits. Or will do so at least to a point.

However, if your policy has a death benefit in the mid-six figures or more, you probably won’t be made whole on the entire amount. In most states, reimbursement by the guaranty association maxes out at $300,000, although certain states do have a higher maximum (the limit is $500,000 in New York State, for example).

Given that it’s commonplace (and often recommended) to insure your life for 10 times your annual income, a $300,000 limit could easily fall short of your actual death benefit.

More from Money:

The Best Life Insurance Companies of 2021