How Millennials Will Change the Way You Bank

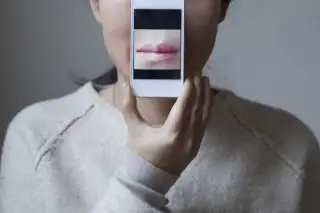

If a picture is worth 1,000 words, soon we may not need words anymore. Nearly nine in 10 young adults are never without their smartphone, and a similar percentage say the camera function is among the most important features, new research shows. This love of the visual has broad implications for all businesses, perhaps most notably banking.

The youngest millennials have almost no memory of cell phones without cameras. They post pictures to avoid writing about events in their lives and snap photos as reminders to perform ordinary tasks. A third of all pictures taken are selfies, according to a report from Mitek Systems and polling firm Zogby Analytics.

This generation wants to do everything with a snapshot—from clicking a picture for online purchases to depositing money or paying a bill by snapping an image of a check or invoice. Four in five millennials say it is important for retailers to have a high quality mobile app; nearly nine in 10 either have or would deposit money in their bank with mobile technology, the report found.

“There is a substantial disconnect between what young people have come to expect and the often horrendous consumer experience they get with mobile,” says Scott Carter, chief marketing officer at Mitek. Banks have been among the slowest to respond, he says. About half of consumers who try to open a bank account online give up because it is so tedious, Carter says.

A bank that adopts more sweeping image technology such as facial recognition or fingerprint identification and uses it to replace passwords and the need to fill in account numbers would be a big winner—and not necessarily just with the younger set. Mobile banking is taking off with all generations. Only 12 million people used mobile banking services in 2009, according to Frost & Sullivan, a research firm. That number was expected to hit 45 million this year.

More than one in eight Americans have deposited a check within the past year using a mobile app, the American Bankers Association found. Of those, 80% use the app at least once a month. Other findings from the Mitek survey of millennials:

- 34% have deposited a check by taking a picture

- 54% would pay for goods using their smartphone as a mobile wallet instead of credit cards

- 45% would pay a bill by taking a picture if the technology were available to them, vs. the 21% who do so now

- 36% have switched where they do business based on a company’s mobile app

- 60% believe that in the next five years everything will be done on mobile devices, much of it through images

We will never be a wordless society. But just think about those awful assembly instructions that come with a box of parts at IKEA or Target. If a YouTube video or other image makes it easier, why fight? A lot of people think of banking and personal finance the same way—and for them, a picture really is worth 1,000 words.