Money Classic: It's Deja Vu All Over Again in the Housing Market (2005)

Money is turning 50! To celebrate, we’ve combed through decades of our print magazines to uncover hidden gems, fascinating stories and vintage personal finance tips that have (surprisingly) withstood the test of time. Throughout 2022, we’ll be sharing our favorite finds in Money Classic, a special limited-edition newsletter that goes out twice a month.

This excerpt, featured in the 19th issue of Money Classic, comes from a story in our June 2005 edition.

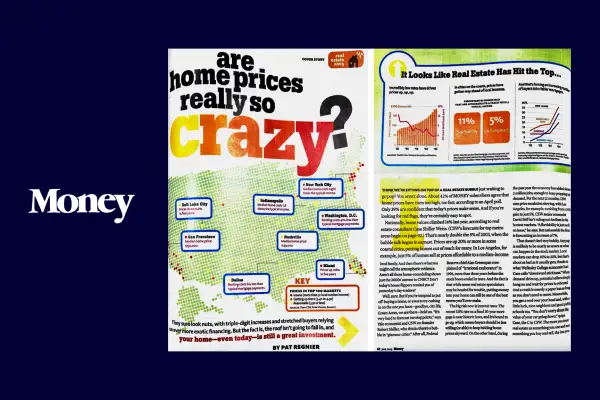

Think we're sitting on top of a real estate bubble just waiting to go pop? You aren't alone. About 42% of Money subscribers agree that home prices have risen too high, too fast, according to an April poll. Only 39% are confident that today's prices make sense. And if you're looking for red flags, they're certainly easy to spot.

Nationally, home values climbed 14% last year, according to real estate consultant Chase Shiller Weiss. That's nearly double the 8% of 2003, when the bubble talk began in earnest. Prices are up 20% or more in some coastal cities, putting homes out of reach for many. In Los Angeles, for example, just 5% of homes sell at prices affordable to a median-income local family. And then there's what you might call the atmospheric evidence. Aren't all those home-remodeling shows just the 2000s' answer to CNBC? Don't today's house flippers remind you of yesterday's day traders?

Well, sure. But if you're tempted to put off buying a home, or even to try cashing in on the one you have — goodbye, city life; Green Acres, we are there — hold on. "It's very hard to forecast turning points," says Yale economist and CSW co-founder Robert Shiller, who thinks there's a bubble in "glamour cities." After all, Federal Reserve chief Alan Greenspan complained of "irrational exuberance" in 1996, more than three years before the stock boom ended in tears. And the fact is that while some real estate speculators may be headed for trouble, putting money into your home can still be one of the best moves you'll ever make.

The big risk is now interest rates: The recent 5.8% rate on a fixed 30-year mortgage is near historic lows, and it's bound to go up, which means buyers should be less willing (or able) to keep bidding home prices skyward. On the other hand, during the past year the economy has added about 2 million jobs, enough to keep propping up demand. For the next 12 months, CSW sees price escalation slowing, with Los Angeles, for example, tumbling from a 25% gain to just 5%. CSW senior economist David Stiff isn't ruling out declines in the hottest markets. "Affordability is just such an issue," he says. But nationwide the firm is forecasting an increase of 7%.

That doesn't feel very bubbly. Any pop is unlikely to be nearly as severe as what can happen in the stock market. Local markets can drop 10% to 20%, but that's about as bad as it usually gets, thanks to what Wellesley College economist Karl Case calls "downward stickiness." When demand dries up, potential sellers simply hang on and wait for prices to rebound. And a crash is merely a paper loss as long as you don't need to move. Meanwhile, you get a roof over your head and, with a little luck, nice neighbors and good public schools too. "You don't worry about the value of your car going down," quips Case, the C in CSW. The more you treat real estate as something you use and not something you buy and sell, the less you need to worry about bubble talk.

The worst-case scenario isn't that your house declines in value for a few years. It's that your standard of living depends upon making small payments on a variable-rate loan or on tapping your rising equity, and you don't have a Plan B. This boom's gotta end someday, even if that day isn't tomorrow.