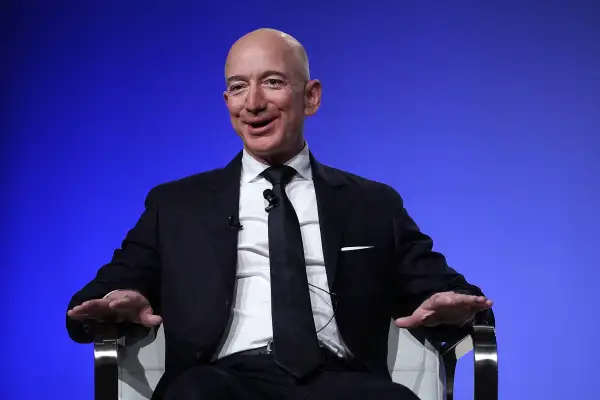

Jeff Bezos Got So Rich in 2018 That He Now Makes More Per Minute Than You Do in a Year

Jeff Bezos's 2018 was so rich, that at times he made more in a minute than the average American household makes in a year and a half. He also made more than his lowest paid employees — full-time, part-time, temporary, or seasonal — make in two years and eleven months.

At the start of 2018, the Amazon CEO's net worth crossed the 12-digit mark and as the year comes to a close, he's ending up with roughly $132 billion. Bezos is now one-and-a-half-times richer than the second-richest person on earth, Bill Gates, who he surpassed to claim the number one spot for the first time only a year and a half ago.

Bezos’ base salary is a modest $81,840, and his total compensation (which includes things like security and benefits) is $1,681,840. But his insane wealth is due to the 16% stake in Amazon he owns, which alone is worth about $125 billion today.

If you compare Bezos’s wealth (including his assets) to his employees’ salaries, at one point he was making more money in 10 seconds than half of Amazon’s employees made in 2017. (Although this length of time changes with fluctuations in Bezos's personal wealth.)

Money made the calculation comparing Bezos' wealth (including his assets) to his employees' salaries back in May, based on the $28,446 median salary an Amazon worker made in 2017. Amazon had just shared this figure in a filing, in compliance with a new SEC rule, which requires all public companies to disclose CEO salaries and median employee salaries.

In order to account for all of the money Bezos made in a year — which includes his stake in Amazon and not just his $1,681,840 compensation — we'll look at the difference in his net worths between two dates exactly a year apart.

Listening to the Critics

Since Amazon released its pay numbers, Bezos has announced an increase in the company’s minimum wage to $15 an hour, for full-time, part-time, temporary, and seasonal holiday employees, effective November 1.

“We listened to our critics, thought hard about what we wanted to do, and decided we want to lead,” Bezos said in a blog post about the announcement. “We’re excited about this change and encourage our competitors and other large employers to join us.”

It’ll be a few months before we know the 2018 median salary for Amazon employees, since these figures are released annually. But we do know, based on Bezos’ announcement, that the lowest-paid employees will make $15 an hour from here on out. If those employees work a 40-hour-week for 52 weeks, that salary comes out to about $30,000 a year — a little over last year’s median.

On September 4, when his net worth peaked at $168 billion and he had made $84 billion in the year prior, it took him a minute to make $160,000 — it would take his minimum wage employees almost five and a half years to earn the same. And on January 2, when his net worth was at its 2018 lowest, he made $67,790 in a minute; a sum that would take his lowest-paid employees more than two years to make.

A Bad Bezos Day

Around the time the company made its minimum wage announcement, Amazon’s stock started reacting to market fluctuations, and — just like everyone else in the country — Bezos was dealing with intermittent losses and gains.

His personal wealth took a few downward turns along the way, setting his net worth back about six months. But how ‘bad’ did it really get for Bezos?

Even on his worst day, when the market closed on October 26 and he had lost $11 billion (7.5% of his net worth), Bezos could go to sleep knowing that, on average, he made $87,500 in a minute. The median household income in the U.S. is $60,336 a year according to the U.S. Census Bureau, meaning it takes the typical U.S. household almost 1.5 years to make what Bezos made in one minute. By the end of that year leading up to his worst monetary loss of 2018, Bezos had made a total of $46 billion, which could pay the annual median income for 762,397 U.S. households.

Correction: A previous version of this story indicated Jeff Bezos's worst stock market day was still profitable due to a year-over-year comparison.