How Low Will They Go? 6 Mortgage Experts Predict the Future of Rates

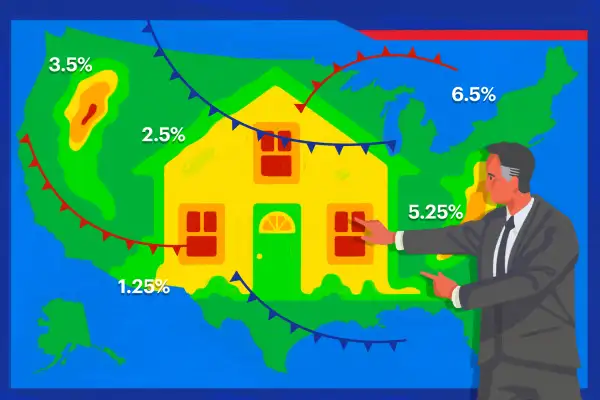

Monitoring mortgage rates has practically become a national pastime as a growing number of homeowners race to refinance their loans and potential home buyers clamor for a piece of the action.

With the coronavirus crisis slowing the economy to a crawl, the Federal Reserve cut its key interest rate to near zero in March. The dramatic move opened the door to record low mortgage rates.

Though mortgage rates fluctuate based on market conditions, the average rate of the most popular home loan, the 30-year fixed, was 3.13% as of June 25, the lowest rate in Freddie Mac’s survey history, which dates back to 1971. A year ago at this time, the 30-year fixed-rate mortgage averaged 3.84%.

“Mortgage rates have hit another record low due to declining inflationary pressures, putting many home buyers in the buying mood,” said Sam Khater, Freddie Mac’s chief economist, noting that demand has not been this high since January 2009. “However, it will be difficult to sustain the momentum in demand as unsold inventory was at near record lows coming into the pandemic, and it has only dropped since then.”

“New home construction needs to robustly ramp up in order to meet rising housing demand,” said Lawrence Yun, the National Association of Realtors' chief economist. “Otherwise, home prices will rise too fast and hinder first-time buyers, even at a time of record-low mortgage rates.”

Indeed, existing-home sales fell in May, marking a three-month decline in sales as a result of the coronavirus outbreak, according to NAR.

Here are six predictions from housing industry experts on where mortgage rates are headed. The text has been lightly edited:

Tendayi Kapfidze

Who he is: Chief economist for LendingTree, an online lending marketplace

What he expects: Mortgage rates could fall to a low near 2.50%, declining about 60 basis points from the current record low.

His reasoning: Since the start of the year, the fall in mortgage rates of 61 basis points has not matched the decline in the 10-year treasury of 118 basis points. Reasons for this include lenders increasing their profit margins; lenders raising rates to keep volume—particularly of refinances—manageable, and financial market stress causing an increase in the spread between mortgage and Treasury rates. The Fed’s commitment to buying mortgage-backed securities has helped narrow the financial market gap. If lenders increase capacity, that could cause them to lower their margins and drive rates lower.

Jeffrey Taylor

Who he is: Co-founder and managing director of Digital Risk, a mortgage technology company

What he expects: Rates will hover around the 2.8% to 3.5% mark for the next 12 months.

His reasoning: Home prices have increased again, primarily because inventory is so low, down 19% compared to May of 2019. Purchases by first-time buyers picked up to 34% in May, up from 33% last year. This means Millennials continue to be in the market.

New homes are looking good. Permits were up 14.4% in May, which is an important indicator for future production. Plus builder confidence is up. Tech markets are recovering first. Areas like Denver, Boston, Seattle, San Francisco and San Diego have rebounded fast with home sales and prices as strong as pre-pandemic.

States that may have been affected by the risk of slower economic recovery due to hospitality and tourism may still find the housing market robust due to residents leaving the Northeast for other states that were not as impacted by COVID-19 shutdowns.

While home sales were down nearly 10% in May, that reflects contracts signed in March and April, the low point of the pandemic and lockdowns. Sales are anticipated to pick up in the coming months.

There is a record amount of equity in the housing industry. Pre-pandemic it was $18.7 trillion and expected to remain so.

Keith Gumbinger

Who he is: Vice president of HSH.com, a mortgage information website

What he expects: We will likely set new record lows for conforming 30-year fixed rates on multiple occasions, reaching perhaps 2.8% or so.

His Reasoning: A combination of a slow-to-recover economy, low core inflation, Federal Reserve interest rate and bond-buying policies and persistent concerns about renewed viral outbreaks likely means mortgage rates will be flat to slightly lower in the months ahead.

Factors that may help keep mortgage rates from falling too far include an improving economy, likely additional fiscal stimulus and still-considerable risks to investors making or managing mortgages as borrowers experience difficulties in managing their obligations.

Sarah Pierce

Who she is: Head of sales at online mortgage lender Better.com

What she expects: If economic recovery continues at its current pace, with Fed support, rates will stay low over the next year. However, if COVID-19 begins more negatively impacting economic growth, loans could be seen as very risky, which will drive rates up swiftly.

Her reasoning: We have seen lower rates during this pandemic than we have seen over the past decade. Fannie Mae predicts record-low mortgage rates through 2021. Many homeowners who locked in higher rates in prior years have an opportunity to save money, consolidate debt and/or take out cash at an attractive rate. But, when considering this prediction, it’s important to consider the market is volatile and while rates are at all-time lows they could at some point be driven up.

When the Federal Reserve cut rates earlier this year, mortgage rates lowered significantly. However, increases in unemployment meant lenders were wary of risk of default in new loans, which led to loans becoming harder to qualify for. While rates are low today, we cannot guarantee that tomorrow’s rates will be higher or lower, and by waiting, you potentially risk missing out on benefiting from today’s historically low rates.

Jonathan Corr

Who he is: Chief executive of mortgage origination software giant Ellie Mae

What he expects: Interest rates have been trending downward all year and recently reached historical lows. There are a few factors that could drive rates even lower.

His reasoning: One, coronavirus cases are currently spiking in some areas of the country. As we have seen since March, upticks in cases at this scale lead to economic uncertainty, and in times of uncertainty, rates traditionally drop.

Second, lenders are facing a massive surge in refinance volume at a time when face-to-face meetings aren’t a viable option. Lenders that haven’t invested in digital mortgage technology aren’t clearing their pipelines as fast as they could. So it’s possible the market dictates lower rates, but the industry has not been able to process these loans, meaning it’s not reflected in the current data.

According to our data, this record refinance activity is showing signs of flattening as we continue to enter peak homebuying season. From April to May, purchase volume increased in every state in the U.S. except for Alabama, which saw a slight decline. Sixty percent of these purchase applications were from first-time homebuyers, so whether rates increase or decrease in the coming weeks, we’re keeping an eye on a potential resurgence of the purchase market as consumers take advantage of these low rates to become homeowners.

Cecelia Marlow

Who she is: Vice president with The Federal Savings Bank of Chicago

What she expects: Given the various economic indicators, rates will remain historically low.

Her reasoning: With uncertainty around unemployment and the timing of a viable COVID-19 vaccine, plus the continued demand in the housing market, we will continue to notice rates remaining steady in the current range. As we approach the election later in the year, we may see higher intra-day volatility.

Yet it still remains an amazing time to purchase or refinance with today’s low interest rates. When I started in the industry in 2003, with the wide array of products, interest rates ranged from 8% on a very traditional conventional loan, but were as high as 13% on more risky loans. Looking back at that time and where we are today, it is very easy for someone to say, money is on a fire sale. I cautiously say, I’m not sure we will see interest rates again this low in our lifetime.

More from Money

Is It a Good Time to Refinance Your Mortgage?

Why a Rate Lock Makes Sense Right Now, Even with Mortgage Rates Falling

With Mortgage Rates So Low, Getting a Floating Rate Mortgage Might Seem Crazy. Here’s Why I Did It Anyway

What the Fed’s 0% Interest Rate Plan Means for Mortgage Rates

Rates are subject to change. All information provided here is accurate as of the publish date.