Virtual Reality Makes Investing — Yes, Investing — Dangerously Fun

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

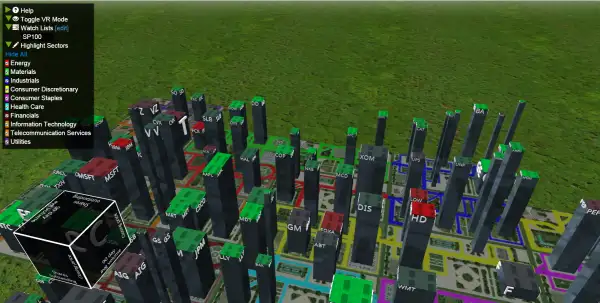

There's no question: Strapping on an Oculus Rift virtual reality headset and exploring StockCity, Fidelity's new tool for investors, is oddly thrilling.

Admittedly, the fun may have more to do with the immersive experience of this 3D technology—with goggles that seamlessly shift your perspective as you tilt your head—than with the subject matter.

But I found it surprisingly easy to buy into the metaphor: As you glide through the virtual city that you've designed, buildings represent the stocks or ETFs in your portfolio, the weather represents the day's market performance, and red and green rooftops tell you whether a stock is down or up for the day. Who wants to be a measly portfolio owner when you can instead be the ruler of a dynamic metropolis—a living, breathing personal economy?

Of course, there are serious limits to the tool in its current form. The height of a building represents its closing price on the previous day and the width the trading volume, which tell you nothing about, say, the stock's historical performance or valuation—let alone whether it's actually a good investment.

And, unless you're a reporter like me or one of the 50,000 developers currently in possession of an Oculus Rift, you're limited to playing with the less exciting 2D version of the program on your monitor (see a video preview below)—at least until a consumer version of the headset comes out in a few months, priced between $200 and $400.

Those flaws notwithstanding, if this technology makes the "gamification" of investing genuinely fun and appealing, that could be big deal. It could be used to better educate the public about the stock market and investing in general.

But it also raises a big question: Should investing be turned into a game, like fantasy sports?

There are dangers inherent in ostensibly educational games like Fidelity's existing Beat the Benchmark tool, which teaches investing terms and demonstrates how different asset allocations have performed over various time periods. If you beat your benchmark, after all, what have you learned? A lot of research suggests that winning at investing tends to teach people the wrong lesson.

"Investors think that good returns originate from their investment skills, while for bad returns they blame the market," writes Thomas Post, a finance professor at Maastricht University in the Netherlands and author of one recent study on the subject.

In reality, great performance in the stock market tends to depend more on luck than skill, even for the most expert investors. That's why most people are best off putting their money into passive index funds and seldom trading. It also means there's not a lot of value in watching the real-time performance of your stocks—in any number of dimensions.