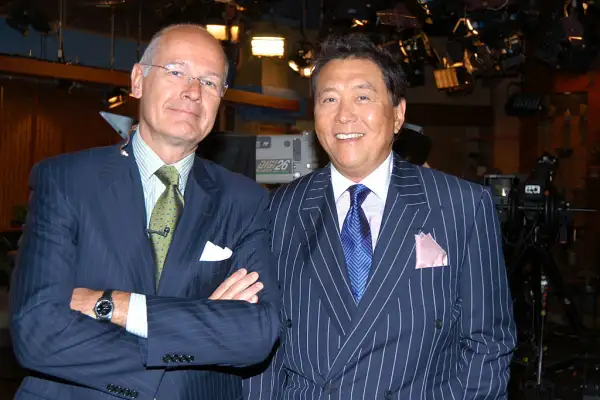

Robert Kiyosaki’s Real Definition of Wealth — and How to Reach It Faster

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

Robert Kiyosaki, author of the popular personal finance book "Rich Dad Poor Dad," believes that your net worth isn’t a sufficient measurement of your wealth. Instead, he argues it’s better to assess your finances based on how long you can live without working. In other words, financial freedom.

Cash flow, he says, is key. Here’s how you can use Kiyosaki’s mentality to allocate your money toward the right assets and reach your retirement goals.

Must Read

Different definition of wealth

A $1 million nest egg may be enough for one person to retire, and not nearly enough for the next.

Kiyosaki’s philosophy involves wealth coming down to having the freedom to choose how you spend your time. Your lifestyle can help determine how much cash flow you need.

Gold Investor Kit Offer: Sign up with American Hartford Gold today and get a free investor kit, plus receive up to $20,000 in free silver on qualifying purchases

Focusing on cash flow

Kiyosaki encourages people to focus on passive income. While savings will help, passive income — which can be generated with investments such as dividend stocks, rental properties and bonds — is money earned without a ton of effort on your part. That’s very different from the income you earn from a job.

However, passive income isn’t just tied to investments. You can build a business that sells online products and services that requires little time on your end once it's are set up. The cash flow you generate from these activities will give you more financial flexibility later down the road.

You will have to gradually deplete your savings when you retire. However, the fear of depleting your nest egg completely can be mitigated if your cash flow exceeds your living expenses.

Pet Protection: See How Spot Pet Insurance Can Help Your Dog or Cat

Why traditional retirement planning can fall short

The retirement industry is full of personal finance rules of thumb to help people make the most of their money, but often, these rules can fall short. For example, more experts are saying that the 4% rule, which assumes retirees can safely withdraw 4% of their retirement portfolio their first year then increase that based on inflation, may no longer work.

The best retirement savings and withdrawal plan for you will depend on your specific situation, goals, time horizon and risk tolerance. But increasing your cash flow will likely help. Dividend-paying companies regularly hike their dividends, for instance, which can help you keep up your costs of living.

Extra Money: Get up to $1,000 in stock when you fund a new active SoFi invest account

Practical application for retirees

Stashing away cash and hoping it will be enough for your long-term goals probably won’t be as effective as you need, since inflation pushes prices higher over time. Your purchasing power will gradually decrease. But you can protect yourself from inflation by investing in assets that keep up with inflation, generate income and increase in value over time.

If you’re considering buying dividend stocks and bonds, you don’t have to analyze the market for individual assets. Exchange-traded funds (ETFs) make it easy to get exposure to a diversified basket of stocks and bonds, as well as other assets like real estate investment trusts (REITs).