How Social Security Is Stiffing Seniors on the Growing Cost of Living

Earlier this fall I wrote about the news that there will be no Social Security cost of living adjustment, or COLA, in 2016. That's because the average of consumer prices for urban wage earners in the third quarter of this year is less than it was during the third quarter of 2014. Social Security retirees, of course, are not urban wage earners.

Lower oil prices drove the overall price index lower. But as a recent study confirms, retirees don’t commute anymore and thus lower oil prices don’t benefit them that much. Their living expenses are different, and especially, their health care expenses are higher.

When the COLA is zero, it triggers Social Security’s so-called hold harmless rule. This rule says Social Security benefits can’t decline from one year to the next. About 70% of all Medicare beneficiaries pay for some Medicare premiums by having them withheld from their Social Security payments. A zero COLA thus means these beneficiaries’ premiums can’t increase next year.

Medicare’s health care expenses, however, are expected to go up a lot next year. The agency is required to collect some of these amounts from the 30% of Medicare users who are not held harmless. This group includes people who will be new to Medicare in 2016, people who pay Medicare premiums directly to the agency because they haven’t yet begun receiving Social Security, and higher-income Medicare enrollees.

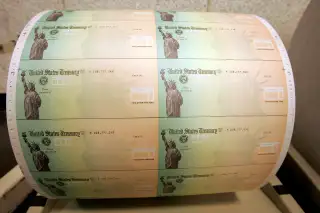

To avoid a calamitous projected 52% increase in this group’s 2016 Medicare Part B premiums, we now have a new law that will reduce this pain to “only” a 15% increase. This is being accomplished by a $7.5 billion loan from the U.S. Treasury to Medicare to help it pay its higher 2016 expenses.

Remember, this workaround comes from the same government that earlier this year gave us the “doc fix” law. It will raise Medicare payments to doctors, increase some consumer Medicare premiums, and raid the Treasury for upwards of $140 billion in unfunded costs during the next 10 years.

Meanwhile, those higher 2016 Medicare expenses are going to be visited upon the nation’s seniors in many ways: higher drug expenses, higher costs in some private Medicare insurance plans, and a 15% hike in Medicare’s annual deductible for Part B coverage for all beneficiaries, not just those who aren’t held harmless.

And we likely haven’t seen the last mayhem to be caused by the hold harmless rule. In an era of prolonged low rates of inflation, future Social Security COLAs are likely to be modest, if not zero again. So we could see this year’s mess repeated.

The liberal wing of the U.S. Senate, led by Massachusetts Democrat Elizabeth Warren, has introduced legislation that includes a one-time payment that would boost 2016 Social Security payments by an average of about $580, or nearly 4%. The measure would help compensate for the current COLAs' underweighting of actual senior spending. I don’t see this proposal going anywhere, but it helps pave the way for a needed debate on Social Security.

That debate should include changing the COLA so it accurately reflects actual living costs of older Americans. While higher-earning retirees may be able to tolerate meager or even zero COLAs, our most vulnerable seniors cannot.

Likewise, tying the COLA to Medicare premiums through the hold harmless rule is nonsense. Right now, Medicare recipients pay only about 25% of Part B expenses insurance for doctors, outpatient expenses, and medical equipment costs.

Increasingly, expecting Washington (and thus all taxpayers) to shell out the other 75% is long-term fiscal lunacy. We need a better funding approach for Medicare, and one that doesn’t tie us in knots because of old rules that no longer work.

Philip Moeller is an expert on retirement, aging, and health. He is co-author of The New York Times bestseller, Get What’s Yours: The Secrets to Maxing Out Your Social Security, and is working on a companion book about Medicare. Reach him at moeller.philip@gmail.com or @PhilMoeller on Twitter.