New Stimulus Law Erases a Big Student Loan Forgiveness Catch

Slipped into the more than 600-page stimulus package is a brief clause that helps lay the groundwork for student loan forgiveness.

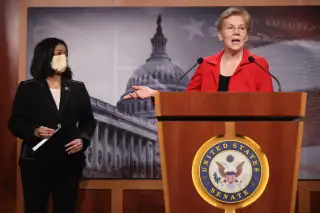

The clause, included in the $1.9 trillion bill that President Joe Biden signed into law on Thursday, ensures that student loan borrowers who see their debts wiped out in the next five years aren’t saddled with a massive tax bill. Advocates for universal student debt forgiveness cheered the amendment, while Sen. Elizabeth Warren, a co-sponsor of the provision, said in a statement that it “clears the way for President Biden to use his authority to cancel...student debt.”

Under current law, when the federal government cancels debt, it's considered income that can be taxed, unless the law explicitly exempts it. So with this change, if the administration or Congress cancels any student debt in the near future, the effect of the cancellation will be more powerful because recipients will get the full benefit, instead of the benefit minus taxes.

The change would save a student loan borrower earning $50,000 about $2,200 for every $10,000 of forgiven student loans, according to a press release from Sen. Bob Menendez, a Democrat from New Jersey. In addition to a one-time debt cancellation, the change also applies to any borrower who qualifies for forgiveness via an income-driven repayment plan before the end of 2025.

How the tax change helps the push for student loan cancellation

Biden campaigned on the idea of canceling a modest amount of student debt, and he's said repeatedly that he thinks $10,000 of cancellation for every federal borrower is a reasonable figure. But he's pushed back against demands from other Democrats and debt forgiveness supporters, who say he needs to cancel a larger sum and that he can do so without Congress passing legislation. Last month, he specifically said he did not support proposals to cancel $50,000.

The Biden administration says it is still researching whether the president legally has the power to cancel debt by executive authority. In the meantime, this change essentially removes one of the hurdles associated with canceling debt administratively — that borrowers would get a surprise tax bill if the president canceled debt. (If Congress were to pass legislation, lawmakers could just include a provision that cancellation is tax free.)

The tax-free status in the stimulus plan covers all types of forgiveness for all types of loans, including private ones. But it's temporary, applying to debt cancellations from Jan. 1, 2021 through the end of 2025.

John R. Brooks, a law professor at Georgetown University who has studied tax law and student debt, says that limited time period indicates that lawmakers were specifically trying to nudge the president toward canceling debt administratively.

"It's a very narrow strategy aimed at this particular issue," he says.

Without the change, researchers at the Urban Institute calculated that borrowers earning at least $122,000 would owe $2,400 under the proposal to cancel $10,000 of debt, and $6,160 under the proposal to cancel $50,000. A borrower earning less than $25,000 would owe about $800 and $1,893, respectively.

The change doesn't address future tax liabilities of loan forgiveness

Currently, most student debt wiped out by the federal government is considered taxable income, though there are exceptions. Cancellation via the Public Service Loan Forgiveness, which is offered to professionals like teachers and non-profit employees is exempt from taxes, so is any cancellation for death or disability discharges and for students who were defrauded by their college.

Yet forgiveness available through the government's four income-driven repayment plans is not exempt. The plans, which are open to most borrowers, set monthly payments based on earnings, and after 20 or 25 years of payments, any remaining debt is canceled. Millions of borrowers are enrolled in these plans, and the Congressional Budget Offices estimates billions of dollars of debt will eventually be forgiven every year.

It is not uncommon for borrowers in income-driven plans to qualify for payments that are smaller than the interest that accrues each month. So even though a borrower may pay on-time for two decades, it's possible her debt never shrinks. That's why the forgiveness element is a key piece of income-driven plans.

In theory, borrowers who get forgiveness through income-driven repayment could benefit from this temporary tax-free clause. But it ends in 2025, whereas large number of borrowers won't hit their window for forgiveness via income-driven repayment until 2030 or later.

The tax liability of such forgiveness has been a concern of financial planners and borrower advocates for years, so much so that it's known as the "student loan forgiveness tax bomb." Financial planners who work with clients with large student debt burdens often advice them to start saving money for their pending tax bill, which could be as many as 20 years away.

The size of your hypothetical tax bill depends on how much you’re earning at the time and how much debt you have canceled, but it’s safe to assume you could owe 20% to 25% of the forgiven amount.

From the government's point of view, Brooks says, the taxes it would collect on student loan forgiveness are modest — a drop in the bucket of the government's budget. But at the individual level, the tax liability could be devastating, he says. Some borrowers are on track to have much more than $10,000 or $50,000 wiped out, and so they could see a five- or six-figure tax bill if the situation isn't addressed, Brooks says.

So while the change in the stimulus bill is a step in right direction, Brooks says, it doesn't address the larger problem, that many borrowers are on track for an unaffordable tax burden unless the government were to wipe out the entire $1.5 trillion of outstanding student debt and make college more affordable so up-and-coming students won't need to borrow.

"All they're doing is kick the can down the road here," he says.

More from Money:

Third Stimulus Check: Here's When You'll Get Your New $1,400 Payment

About 2 Million Borrowers Missed an Opportunity to Get Their Student Debt Forgiven: Report

Best Balance Transfer Credit Cards of 2021