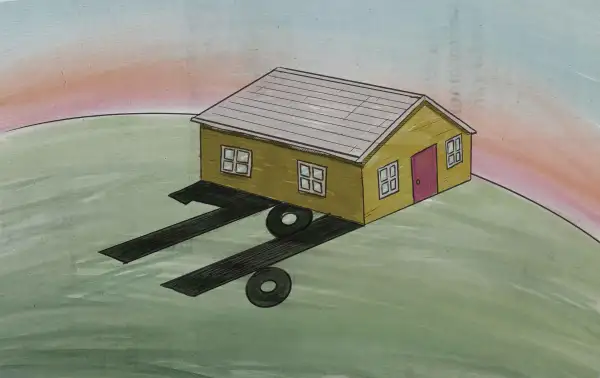

What Mortgage Rates Soaring Past 7% Means for Buyers, Sellers and the Housing Market

What seemed unthinkable just a few months ago has come to pass — Freddie Mac’s benchmark mortgage rate has surpassed 7%.

The average rate on a 30-year fixed-rate loan came in at 7.08% this week, according to Freddie Mac’s weekly lender survey. That’s the highest average rate since 2002.

Rates started the year at just 3.22%. The increase since has been one of the fastest in the survey’s 51-year history.

“The rate of increase caught us by surprise,” said Len Kiefer, deputy chief economist at Freddie Mac, in a webinar entitled A Conversation About the Economy.

“That’s got enormous consequences for the housing market, the mortgage industry and the broader U.S. economy,” he added.

Mortgage rates have taken flight thanks to inflation, which has been running at more than 8% since March. In order to slow inflation, the Federal Reserve has increased the federal funds rate — the rate banks charge each other for overnight borrowing — by a total of 3.25% this year.

That has pushed interest rates on all sorts of consumer credit products, including mortgages, higher.

The psychological toll of 7% mortgage rates

That swift turnaround in rates has the market in a tizzy, says Jerimiah Taylor, vice president of real estate and mortgage at housing technology company OJO Labs. Taylor likens the situation to driving your car down a highway at 150 miles an hour and abruptly slowing down to the speed limit.

“Suddenly that speed limit feels real slow in comparison to how fast you’ve been going,” Taylor adds.

Buyers may perceive a 7% rate as significantly more expensive than 6.8%, says Ralph McLaughlin, chief economist at real estate start-up Haus. In reality, the dollar difference won’t be that big, however, just $40 for a $300,000 loan.

The net effect of hitting 7% will be a faster cooldown in demand, especially since it coincides with what McLaughlin refers to as a “black hole,” the period between Halloween and New Year's Eve when home sales traditionally slow.

But rather than seeing the slowdown as a negative, he sees it as a necessary step toward bringing the market back into balance.

“The housing market the last two years has been way out of whack and was never sustainable,” he says. The longer an unsustainable market lasts, he explains, the more severe the inevitable correction will be.

“If it takes 7% mortgage rates to help get to a more normal level, then so be it.”

Fewer people can afford to buy homes

Higher rates mean higher monthly payments, as a home purchase becomes more costly, more buyers are stepping away from the market.

In September, the median monthly payment on a typical mortgage was $1,941 — up more than 40% compared to a year earlier, according to the Mortgage Bankers Association.

As a result of higher payments, there are an estimated 32% fewer active buyers compared to a year ago, says Orphe Divoungay, senior economist at listing site Zillow.

With rates now at 7%, that number of buyers is likely to drop even further. “If affordability gets squeezed further due to higher mortgage rates, even fewer buyers will likely take the plunge, especially potential first-time home buyers,” says Divoungay.

Home sales have been steadily decreasing. The number of existing homes sold in September was a seasonally adjusted annual rate of 4.71 million homes, a 1.5% drop from the previous month and almost 24% lower year over year, according to the National Association of Realtors.

Buyers have more ‘breathing room’

With fewer buyers actively looking for a home, those that remain have more power.

In September, 17% of home sales under contract were canceled and a record-high 22% of homeowners slashed list prices, according to brokerage Redfin.

The typical home spent a median of 50 days on the market in September, three days longer than in the previous month and a full week longer compared to a year ago, according to Realtor.com. In March, when rates were in the 4% range, homes spent about 30 days on the market.

Bidding wars have also been declining. Roughly 45% of purchase offers in August faced at least one competing bid down from nearly 70% of offers during the first two months of the year, according to brokerage Redfin.

All this means slower price growth. The median sales price for all types of homes in September was $384,800, down from a record-high of $413,800 in June, according to NAR. Compared to September 2021, however, prices were 8.5% higher.

“Those who can afford to buy in this environment have some breathing room,” says Divoungay.

Homeowners feel stuck

For most of the pandemic, homeowners and sellers have had the upper hand. Now, they are feeling the effects of higher rates in a number of ways.

According to Kiefer, the average rate on outstanding mortgages is currently 3.3%, thanks in large part to a flurry of refinancing activity in the last two years. Now that rates are up, homeowners don’t want to give up their low rates by selling and taking on a new loan for a new house.

In a recent survey by the New Home Trends Institute, 92% of current mortgage holders said they would not buy again if rates exceeded 7% — up from 85% who said the same at 6%. All of this means fewer homes for sale. The total number of homes for sale has decreased for the past three months and as of September, there was just a 3.2-month supply of homes at the current pace of sales, according to NAR.

“I wouldn’t be surprised if we get into a stalemate situation because of these rising rates from February or March until this time next year,” says McLaughlin.

More from Money:

Current Mortgage Rates Are Now Above 7%

10 Million More People Could Qualify for Mortgages Thanks to New Credit Score Rule

The Housing Market Is Shifting Almost Everywhere — But Are We in a Buyer's Market Yet?

Rates are subject to change. All information provided here is accurate as of the publish date.