5 Tricks to Get More From Your Paycheck This Year

January is the perfect time for reflection: to review your old habits and, if needed, set yourself up for change.

That includes your pay stub.

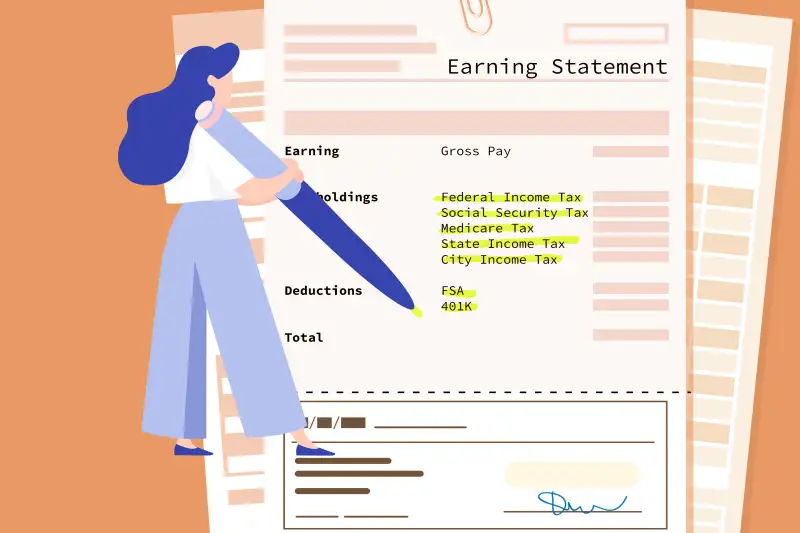

If you've ever looked closely at your paycheck, you'll notice there are tons of line items that come out of your wages before the money reaches your bank account. Amy Richardson, a certified financial planner with Schwab Intelligent Portfolios Premium, explains there’s a difference between gross pay, or the full amount of your salary, and net pay, or the amount you actually take home.

This is because of the withholdings and deductions that must come out of each check. Withholdings are mandatory; they include federal, state and city taxes (if applicable). Employers are also required to withhold 6.2% and 1.45% of wages for Social Security and Medicare, respectively, in addition to putting up that much themselves.

Deductions, on the other hand, are voluntary. They’re determined by the benefits you select through your employer, like health care, dental insurance and retirement savings.

If you're unhappy with or simply curious about your withholdings and deductions, Richardson suggests conducting a paycheck checkup. And she's not just talking about taxes. You should take this opportunity to go over every part of your paycheck.

That way, you'll know you're in a solid financial position for the months ahead.

“Taking the time to sit down and review your pay stub is critical to understanding your total compensation,” Richardson says. “[It] will help you feel more empowered and confident about managing your budget and planning for the future.”

Here's exactly how to review — and maybe even increase — your paycheck for 2021.

1. Run the numbers

First things first: Make sure you're actually getting paid what you're supposed to. Courtney Dominguez, a senior wealth advisor with Payne Capital Management, says to start by doing the math.

“Look at how you’re paid,” she says. “Divide your annual salary by the amount of paychecks per year to make sure it’s coming in accurately.”

This might seem obvious, but you need to make sure the numbers you calculate match the gross pay numbers on your pay stub. You should also make sure any recently promised bonuses are reflected. If your manager forgot to submit the paperwork for that raise she approved, it’s better to find out — and fix that — sooner rather than later.

2. Review your benefits

Not only do some 49% of people not fully grasp their benefits, but Mint CFP Brittney Castro points out that lots of people are also paying for benefits they don’t need anymore.

Maybe you got married recently and never got around to switching to your spouse’s better health care plan. Maybe you had a baby and want life insurance. Now is the time to make changes.

3. Adjust your withholding

Your third task is to fine-tune your withholding. Though it may be fun to get a huge refund when you do your taxes every spring, it’s not the best financial habit because you're letting the government hold onto your hard-earned cash for most of the year. You're not alone — according to the IRS, about three-quarters of taxpayers are guilty of over-withholding — but you are missing out.

Here's an example using nice, round numbers. If you're getting an annual refund of $5,000 from the IRS, “you should say, ‘Oh, $5,000 divided by 12 — that’s over $400 a month I could have back in my paycheck,’” Castro adds. “‘I could save it, invest it, earn interest on the money.’”

Avoid giving Uncle Sam an interest-free loan by using the IRS’s withholding estimator. After answering some questions about yourself, it’ll tell you exactly how much to withhold. You can update your Form W-4 accordingly.

4. Plan for retirement

Dominguez said that, ideally, you'd max out your 401(k) by putting away $19,500 by the end of the year. If you can’t swing that, you should at least take advantage of your company match (if offered). Because retirement contributions reduce your taxable income, they ultimately benefit you in more ways than one.

“You’re not getting that money in your pocket, but it is going to you,” she says.

5. Automate your savings

There are a couple of ways to achieve this. You can ask the HR department to split your direct deposit across different accounts, or you can use an app to automatically transfer money right after you get paid.

All of these little changes can add up fast, Castro says. If changing your withholding frees up $50 a paycheck to pay off high-interest debt faster, you're avoiding falling prey to interest. If you're directing $50 more a month into your 401(k), you're making the most of compound interest.

“This is what gets you to the big milestones in your financial life,” she adds.

More from Money:

How Much Should You Have Saved by 30? Here's Some Surprisingly Reassuring Expert Advice

It's Crucial to Enroll in Your Company's 401(k)

The Secret to Saving the Perfect Amount of Money Every Time You Get Paid