Almost No One Saves for College. Can New 529 Apps Help?

Saving to pay for college tuition will never be easy. But a crop of new mobile apps is hoping to make the process easier — or at least, more convenient.

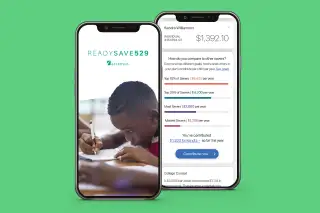

Ascensus, a major player in the college savings space, launched its own mobile app earlier this month. It joins fintech startup CollegeBacker in bringing account access into the palm of college savers’ hands.

College savings plans, which offer tax-free growth and spending on qualified education expenses, are still a comparatively niche financial product. Surveys show the majority of parents don't even know the savings vehicles exist, and SavingforCollege.com calculates that just 18% of children in the country have a college savings account set up for them.

Still, there are nearly 14 million 529 accounts with combined assets totaling $398 billion, according to ISS Market Intelligence. And until recently, it’s an industry that hadn't embraced many of the newer technologies, like a user-friendly app, that younger parents in particular have adopted.

Ascensus, a financial services firm that supports dozens of 529 plans, decided to prioritize an app at the end of 2019, says Peg Creonte, president of Ascensus Government Savings. Leaders there agreed that investors increasingly expect to interact with their accounts through their mobile phones and that college savers were looking for the same kind of functionality, she says. In the new app, users can check their balance, make contributions and see their investment allocation.

“Our assumption is that if people have easier access to their 529, they’ll interact with it more and saving for college will be more front of mind,” Creonte says.

Using behavioral psychology to help families save more for college

The company is also actively trying to nudge more savings with one feature in particular — a peer comparison feature only available to app users. When Ascensus was developing the app, it surveyed clients and found that people were really interested in knowing how they stack up against other savers, Creonte says. That was a detail company honed in on, particularly after learning from the Common Cents Lab, a financial behavior research center at Duke University, that peer comparisons can serve as a "nudge" to get people to save more.

The use of social norms are especially motivational in cases where we might not have a lot of experience, like long-term savings goals such as college, says Margaret Bolton, a behavioral researcher with the Common Cents Lab at Duke.

Of course, the key is in finding the right comparison and sharing the right amount of information to motivate people to save more or to keep saving, she says. If you’re ahead of your peers, for example, it's more motivational to get vague feedback, like a quick congrats for doing better than average without telling you how much better. If, on the other hand, you’re so far behind your peers that a comparison will be discouraging, then a new peer comparison group might be more beneficial, she says.

Those are details Ascensus will be tracking and seeking feedback on specifically. As the country's largest 529 administrator, Creonte says, it has access to a tremendous amount of data that it can slice in different ways, whether it be age or geography, for example.

For now, Ascensus’s app is only available to three state plans — Missouri's 529 Education Plan, Rhode Island's CollegeBound Saver plan, and Nevada's SSGA Upromise 529 plan — but the company plans to expand it this year into all 26 states (plus the District of Columbia) where it manages a direct-sold 529 plan.

Start-ups aim to shake up college savings industry

College savings plans sometimes have a reputation for serving a more affluent family, in part because those are the families who have extra money in their budget to save, but also because they're the ones most eager for the tax benefits. Just 25% of families earning between $25,000 and $75,000 save in a 529 account, versus more than 50% of savers earning more than $100,000, according to a 2020 survey from ISS Market Intelligence.

The team at CollegeBacker, a robo-advisor for college savings, saw stats like that and wanted to expand access to what it sees as a valuable savings product.

"What we've set out to do is broaden the audience for 529s by helping younger parents take advantage of them," says Jordan Lee, CEO of the company . "Part of making that happen has been meeting them where they are, which is primarily on their phones." More than three-quarters of the CollegeBacker users have a household income under $100,000, and 40% are Black and Hispanic, he says.

The app has a choose-what-you-pay model, with a $1 per month minimum fee. First-time users to the app answer a handful of questions to get an assessment of their risk tolerance, which CollegeBacker then uses to turn into advice for an investment game plan. The app also offers guidance on figuring out how much to save — something families often struggle with.

CollegeBacker can enroll you in its integrated 529 plan, the Utah my529 plan. But if you already have an account in another state, or want to open your account in your home state to take advantage of state income tax benefits, you can link your account with CollegeBacker’s app and services after the fact.

The company also encourages a team-based approach to saving for college, where grandparents, aunts, uncles, and family friends all contribute to your goal. Users get an easy-to-share gifting page for every account beneficiary, and the company sends email reminders about birthdays and holidays to encourage gifting. Now, more than a third of the CollegeBacker's $16 million in assets come from gifts, Lee says.

Apps bring a new convenience to college savings

The convenience of these apps — particularly the ones where you can open an account from your phone — can help families who might not be motivated to fill out old-school paperwork and mail it in, says Dean Lyman, a certified financial planner in Missouri who works with families on college savings.

Once you have the account, that same convenience of tapping a couple keys on your phone to make a deposit whenever the mood (or the extra money) strikes, is great, he says.

On the downside, with long-term savings, you don’t want to get constant notifications about your investments, he says. In most cases, the best way to go is a target-date fund or age-based track, in which your money shifts mostly automatically from primarily stocks to primarily bonds as the child gets closer to college age.

So, pay attention to whether the app is simply encouraging you to save more or whether it is making you obsess over the ups and downs of your account. If it makes it easier to churn through investments, that would be a downside, Lyman says.

That churning is, thankfully, a limited risk with 529 plans. Regulations around 529 plans only allow customers to change their investment structure twice a year, says Mary Morris, CEO of Virginia's college savings plan, the country's largest.

Plus, clients of direct-sold accounts (which anyone can open, as opposed to accounts that are only sold by a financial advisor) have limited investment options, Morris says. Savers aren’t picking and choosing which company stocks to invest in.

Virginia’s 529 plan also has considered developing a mobile app, but it's focusing first on improving its existing customer portal so it’s accessible across multiple platforms, Morris says. But she welcomes other apps in the space. In her view, any product that increases awareness of 529 plans and help families with goal-setting is a good idea.

How families can save for college

Even with access to an app, families will still have to do the hard work of setting aside money to save. Here’s some advice to get started and stay on track.

Just start: One of the slogans in the world of 529s, Morris says, is that “it’s never too early to start and it’s never too late to start.” While it will of course be easier to save more the earlier you start, you'll still be better off if you have a little savings than nothing at all. If you only save for a couple years, for example, you likely won’t be able to cover tuition, but you could pay for books and other learning expenses that can add up, she says.

Focus on smaller pieces: The sticker price of college can be paralyzing. It’s such a large expense and, if you start when your child is young, it’s so far away, that it can feel like you’re never going to get there, Bolton, with Duke's Common Cents Lab, says. She recommends breaking down your goal into more manageable chunks.

“You shouldn’t try to eat the elephant whole," she says. "Focus on one bite at a time.” Maybe you have a goal to start by saving $100 a month for three years straight, or to hit $10,000 in savings by your child’s 10th birthday. Whatever it is, be sure to celebrate when you hit your milestones.

Label your savings: One of the built in benefits of a 529 plan is that they designed specifically as college savings accounts, so by opening one, you’re already setting aside of separate pot of money for college. But even if you don’t want to open a 529 account, it still pays to have a separate savings bucket for college.

“We tend to categorize in our heads, but when we explicitly use labels, it can help us focus on a goal and also keep us from spending that,” Bolton says.

Use a “commitment device”: For long-term goals, you want to make it more difficult for yourself to access that money so you're not tempted to spend it on things you don't need, Lyman says. The 529 accounts (and retirement accounts) are actually great for this, because you have to pay a penalty if you spend the earnings on items the accounts weren’t intended for.

But you don’t have to use a specific account to stop yourself from spending. Bolton says she's heard all kinds of stories about ways people use what's known as a commitment device without realizing it. In one case, she says, a woman dropped money behind her dresser where there were a bunch of spiders. She hated spiders, so she knew she’d only reach back and get the cash if it was a genuine emergency.

Take advantage of windfalls: And write down your intention to use them. This can be especially useful for people who find it difficult to set aside money to save in their monthly budgets. Tax refunds, bonuses from work, and this year, stimulus payments, are all good examples of windfalls. You don't have to put the entire check into savings, but make an intention to set aside a portion of those toward college savings.

And remember, any amount you save is going to help your kids in the long run, experts stress. It will reduce what they have to borrow or how much they have to work while studying. So do want you can, and recognize that’s enough.

The article has been updated to correct the name of Ascensus Government Savings.

More from Money:

What's the Best Way to Save for College? The Pros and Cons of 529s vs. UTMA Accounts

9 Best Life Insurance Companies of 2021

How Much Should Parents Really Pay for College? An Expert Explains in a New Book