Are Chip Cards Truly Protecting You? Here's What Experts Say

Welcome to Dollar Scholar, a personal finance newsletter written by a 27-year-old who’s still figuring it out: me.

Every week, I talk to experts about a money question I have, whether that’s “Are online banks sketchy? or “How many credit cards do I need?” As I learn, I share simple ways to improve your financial life… and post cute dog photos.

This is (part of) the 16th issue. Check it out below, then subscribe to get future editions of Dollar Scholar every Wednesday.

Nobody asked, but here are my definitive chip power rankings:

- 3D Doritos. I used to devour these chips in elementary school, and now every couple of months I check food news sites to see whether Frito-Lay has come to its senses and undiscontinued them. (No luck so far.)

- Chip Skylark, a Fairly OddParents character voiced by *NSYNC's Chris Kirkpatrick.

- Barbecue Fritos. Sadly, they are also no longer sold in stores. (Honey BBQ Twists can go to hell. They're not the same, and 15,000 of us know it.)

- Toffee chips, specifically Heath Bits o' Brickle.

- This one gigantic cheddar and sour cream chip I talk about to anyone and everyone who will listen.

You know what didn't make the list? Chip cards. I'm not a fan of chips, even though they seem to be everywhere nowadays. They take too long to use. Instead of speedily swiping and being on my merry way, I have to stand uncomfortably in front of the cashier until the card reader starts angrily beeping at me.

But with all the data breaches in the news lately, I've begun to wonder whether my annoyance is foolish. Should I shut up and trust the chip?

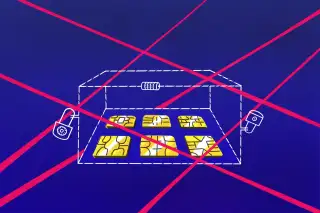

The short answer is yes, according to Julie Conroy, research director at the financial analyst firm Aite Group. The EMV chip, which is that tiny metal square embedded in most credit and debit cards, is wayyy safer than the magnetic stripe from days of old.

The mag stripe was highly vulnerable to fraud because all of a person's payment data was contained within it. Whoever captured the mag stripe got that information, and that's how situations like the 2013 Target breach arose. Criminals were able to steal credit and debit card info from store payment terminals, which collected mag stripe data whenever customers swiped their cards. As many as 110 million people were affected.

Conroy told me that chip cards are "exponentially" safer. That's because when I dip my card, it transmits "a dynamic cryptogram that generates a unique code, and only the issuer on the other side of the equation has the key to that code," she says.

Basically, the chip makes it harder for bad guys to get and use my personal info. Love a good thwarting!

Because chip-supported shopping is so much safer, the payments industry has been working fast to get as many merchants as possible on board. It has long been trendy in Europe, but the U.S. didn't truly get moving until 2011/2012ish. That's when the major card companies announced they were making chips a priority.

Part of the way they forced retailers to switch was by setting a fraud liability shift date. Starting in October 2015, if a business didn't accept the chip and had fraud committed at their store, they were liable for the charges.

Amy Zirkle, the vice president of industry affairs for the Electronic Transactions Association, told me a lot of progress in this migration has been made in the past year or so. That could be why I'm seeing chips pop up more often in my life.

According to Visa, there are more than 3.5 million storefronts that now accept chip cards. (The changeover for gas pumps is ongoing.) It is having the intended effect: Chip-enabled merchants have seen a 76% decrease in fraud.

More good news: The amount of time I have to spend making awkward eye contact with the 7-Eleven worker when I just want to buy my Coke Slurpee and GTFO is shrinking. CardFellow reported there used to be a 15-second delay between inserting a card and having the payment go through. Now it's down to one second.

"At the end of the day, it's about protecting consumers and creating a more seamless, speedy experience," Zirkle says. "It may not have seemed that way initially, but that's what the goal is."

Bottom line: I should stop complaining about chip cards. Contactless payments are on the rise and wait times are decreasing, but the security is really the big improvement over the mag stripes I'm used to.

"The chip is like a sophisticated computer," Zirkle says. "The minute you insert the card, you're in a much safer environment."