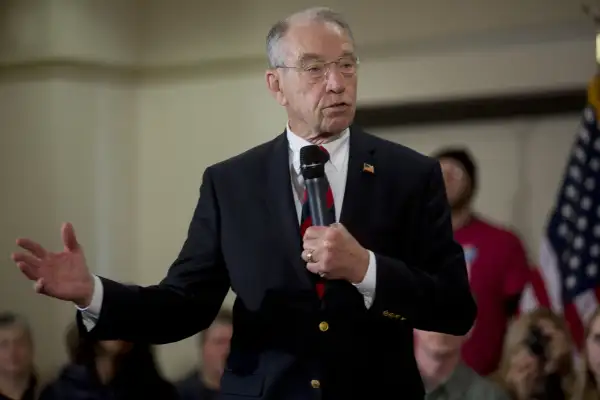

Sen. Chuck Grassley Says the Tax Plan Should Reward Millionaire Investors, Not People Who Blow Money on ‘Booze or Women'

A top Republican senator defending his party's tax overhaul efforts said lowering federal estate taxes would benefit investors instead of spenders who waste their money "on booze or women or movies."

"I think not having the estate tax recognizes the people that are investing, as opposed to those that are just spending every darn penny they have, whether it's on booze or women or movies," Iowa Sen. Chuck Grassley said in an interview with the Des Moines Register over the weekend.

The seven-term senator drew ire for his comments after the House and Senate passed bills that would eliminate or heighten the minimum for the estate tax, respectively.

In a statement on Monday, Grassley, who is also a senior member of the Senate Finance Committee, said his comments were misinterpreted.

“My point regarding the estate tax, which has been taken out of context, is that the government shouldn’t seize the fruits of someone’s lifetime of labor after they die," Grassley said in a statement to Money. "The question is one of basic fairness, and working to create a tax code that doesn’t penalize frugality, saving and investment."

Grassley's controversial comments left some on social media questioning how he interpreted the spending habits of American taxpayers.

Long an issue for Republicans, the so-called "death tax" impacts 0.2 percent of the country's wealthiest individuals. The current law stipulates an estate will be taxed 40 percent on assets inherited from an individual who died that exceed $5.5 million, or $11 million for married couples.

The Republican-led House and Senate passed bills with different plans for the estate tax. The House bill would eliminate the tax entirely by 2024, while the Senate version would raise the minimum of the value of assets necessary to be charged.

The Iowa senator, along with other Republicans and President Donald Trump, has argued the estate tax negatively impacts farmers "who have to break up their operations to pay the IRS following the death of a loved one," he said Monday. The Tax Policy Center estimates that just 80 small businesses or farms will face an estate tax in 2017.