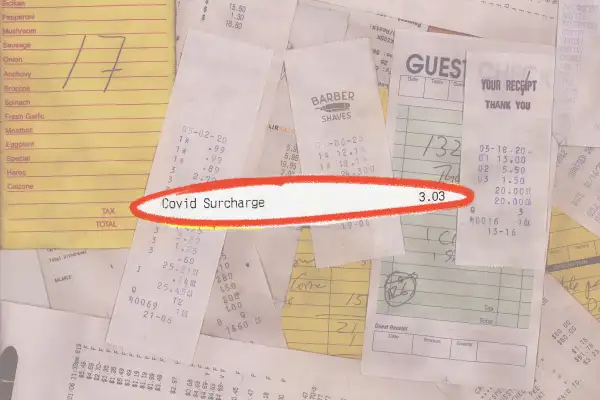

What's a 'COVID-19 Surcharge' and Why Are Businesses Adding Them to Customer Bills?

Businesses across the country are slowly beginning to reopen following months of closed doors due to the coronavirus. But if you’re excited to finally go out to eat a restaurant, get a haircut, or perhaps even visit your dentist for a cleaning, you should be on the lookout for an unexpected charge on your bill.

To offset the cost of closing or adjusting operations for months, some businesses are adding "COVID-19 surcharges" to customer bills. The owner of Goog’s Pub & Grub, a restaurant in Michigan, told Fox17 that he was implementing a $1 per meal charge to make up for costs, including rising food and takeout costs. The Kiko Japanese Steakhouse & Sushi Lounge in West Plains, Missouri, told TODAY Food that a 5% surcharge was put into practice after a price increase on meat, seafood and vegetables from the restaurant’s local supplier.

It’s not just restaurants. Rachel Gower, the owner of the Upper Hand Salon in Houston, Texas, added a $3 "sanitation charge” to bills, local ABC13 affiliate KTRK reported.

"The cost of reopening includes all the extra supplies that we need and all the cleaning supplies that we need,” Gower told KTRK. “It's worth it! It's absolutely worth it!"

A woman in Chicago was told by her dentist’s office that a $15 infectious disease charge would be added to her bill, CBS Chicago reported. The owner of another dentist’s office, Pediatric Smiles in Jacksonville, Florida, told CBS affiliate Action News Jax that she added a new copayment for personal protective equipment for $10 per appointment.

So far, charges seem to be limited to service providers and restaurants, not retailers selling goods like clothes or electronics, Ted Rossman, an industry analyst at CreditCards.com, tells Money via email. But he wouldn’t be surprised to see it elsewhere.

“Right now, I’d call COVID surcharges a trickle rather than a flood, but I am seeing them from all corners of the country with more likely on the way,” Rossman says. There have been examples from all different regions, including urban, suburban and rural areas, he adds.

Surcharges like this are not entirely unheard of. In California last year, some restaurants began adding an optional 1% surcharge to bills to support farmers who use practices that reduce carbon emissions in an effort to battle climate change. Meanwhile, two restaurants in Austin, Texas, added a surcharge to cover the cost their full-time employees health coverage, ABC affiliate KVUE reported. Back in 2016, some restaurants started tacking on "living wage" surcharges so they could pay their staff more without taking a cost hit themselves.

Customers haven’t been reacting lightly to the COVID-19 surcharges, often taking to social media to air grievances. The Kiko Japanese Steakhouse & Sushi Lounge faced so much backlash after implementing its surcharge that it removed the charge entirely.

"‘Scuse me ... what? A covid surcharge...?," one Twitter user said, while showing a photo of a receipt from the restaurant in the post.

"I will happily tip extra to my server but you aren't slapping a made up charge unless you tell me first. My pay has been cut though I've been able to work. Should I charge all my clients an extra fee to cover my bills at home?," another Twitter user added.

“Calling attention to a specific line item rubs a lot of customers the wrong way,” Rossman says. “They would rather pay one price they view as fair, rather than being nickeled and dimed with miscellaneous fees.”

As shelter-in-place orders are slowly lifted around the U.S., eyes will be on receipts to see where these charges are popping up.

More From Money:

Mandatory Temperature Checks Could Soon Be a Part of Your Daily Work Routine

The Best Mattress Deals Right Now — and How to Buy a Bed Online