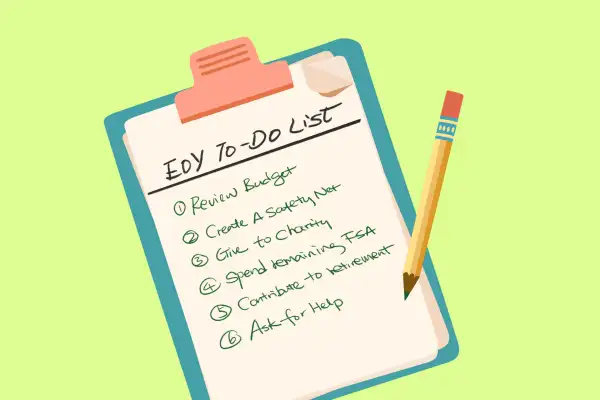

Here's Your End-of-Year Financial To-Do List

Between the pandemic, the election and the death of Alex Trebek, you're probably more than ready to leave 2020 behind and never think about it again. Before you can do that, though, there are a few financial tasks you need to complete — even amid the uncertainty.

“[With] the craziness that’s happened in 2020, trying to prepare for 2021 sounds like it’s very, very difficult to do, because we don’t know what 2021 looks like,” says Jason Katz, CFP and principal at Bartlett Wealth Management.

But there are ways to plan ahead anyway. Getting your finances in order now will benefit you later on. We promise: Your future self will thank you.

Check these six items off your to-do list before New Year's Eve.

1. Review your budget

The end of the year is a good opportunity to scrutinize your budget. Because everything changed in March, though, you shouldn’t use recent numbers to set guidelines for 2021. Katz encourages you to look back at your goals and spending from early 2020.

“What you did in January and February — what did that look like?” he says. “Look at 2021 and possibly build some of those things back into the budget as we all hope to return to some sort of normalcy.”

2. Create a safety net

Having an emergency fund is crucial. Charity Falls, senior wealth strategist at the Private Bank at Union Bank, says there’s no time like the present to start building one. (See here for more on how, exactly, to do that.)

3. Give to charity

When the Tax Cuts and Jobs Act increased the standard deduction, millions of people stopped itemizing their taxes — and therefore stopped taking deductions for charitable contributions. But there’s a provision in the CARES Act that allows taxpayers to take a charitable deduction of up to $300 without itemizing. It’s good for the community and for your tax burden.

“It’s a 2020-only opportunity,” Katz says. “Make those cash contributions up to $300 before the end of the year, and you’ll get that deduction.”

You should look for a tax-exempt organization you believe in, and donate using check, credit or debit. You’ll want to keep my receipts just in case, and you’ll want to move fast: The deadline is Dec. 31.

4. Spend remaining FSA money

New Year’s Eve is also the deadline for some employees to use or lose their Flexible Spending Account dollars.

The IRS did change a handful of FSA policies earlier this year, and grace periods do exist, so you should check the rules for your individual plan before making any big moves. But generally, you want to spend your FSA funds by Dec. 31. Eligible expenses include at-home COVID-19 tests, thermometers, glasses, tampons, allergy meds, bandages and more.

5. Contribute to your retirement account(s)

Katz says that if you can max out your 401(k) contributions before the end of the year, “that’s an awesome goal.” (For most people, the limit is $19,500.) You may want to talk with your company’s payroll department to see if you can have more taken out of your next few paychecks.

Falls, meanwhile, says to consider contributing to an Individual Retirement Account “if you have some extra cash going into year-end.” The deadline isn’t technically until April 15, 2021, but it might be simpler to do it now for record-keeping. The general limit on IRA contributions is $6,000.

6. Ask for help from an advisor

According to Falls, a financial advisor (slash fiduciary) can “help you look holistically at your financial picture, including understanding your income and your savings and helping you determine what your cash flow needs are.” Given the volatility of 2020, it’s not a bad idea to check with an expert to make sure you're on track going into 2021.

More from Money

The Window for Penalty-Free 401(k) Withdrawals Closes Soon

The Secret to Saving the Perfect Amount of Money Every Time You Get Paid