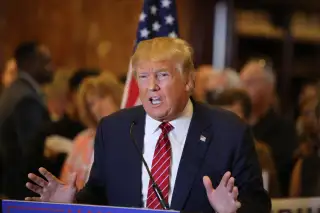

What 3 Tax Experts Think About Trump's Loopholes

In the latest of many bombshells in this presidential election campaign, The New York Times reported Tuesday that in the early 1990s, Donald Trump used a tax loophole so "legally dubious" his lawyers advised him against it.

This is how the scheme apparently worked, according to documents obtained by the Times: As the billionaire businessman's casino empire tanked in 1990, Trump asked his backers to forgive hundreds of millions of dollars in debt. While doing so revived Trump's casinos, it created another problem: Since the IRS views canceled debt to be the same as taxable income, Trump would now have to report hundreds of millions of dollars as though it were taxable income.

However, the Times claims that Trump, who at that point was so cash-strapped he had just several million dollars in a few bank accounts, used a loophole to avoid reporting that chunk of change. The strategy, known as a "stock-for-debt swap," exchanged equity in a partnership for the debt that Trump could not repay. That way, it would look like Trump's debt had been paid in full — and the tax bill for it would vanish.

According to New York tax attorney Peter Faber, these debt-for-equity swaps were typically used to exchange debt for stock in a corporation. However, Trump borrowed through a partnership he controlled, with his interest in the partnership actually worth less than the amount of debt. Faber said:

Swapping debt for stock is used all the time; it's not some evil scheme. But I think the question is whether the partnership could do the same thing. I’ve never heard of a partnership issue and whether that principle would apply.

The partnership raises a red flag for some tax experts, who say it provided Trump with a way to unfairly escape debt. As Alan Cole, an economist with the Center for Federal Tax Policy at the Tax Foundation, a nonpartisan think tank, put it: "It's like in the movie Indiana Jones: Raiders of the Lost Ark, when Indiana Jones exchanges a bag of sand for something that's actually valuable. [Trump and his creditors] have each come up with their way of interpreting events."

As Cole noted:

A debt-for-equity swap could theoretically be fine. But if it’s used to misvalue an asset to allow two people to claim the same loss, then that’s bad for the public. You want the Treasury to be accurately counting people’s income, and it looks like this is the beginning of a situation where they could wind up counting income incorrectly.

Others, like David Herzig, a professor of tax law at Valparaiso University, say at the time of Trump's transaction his behavior was aboveboard:

I think today in hindsight, it looks pretty aggressive ... When you look in 1990, 1991, 1992, the law was really murky, not the same as 2016. Nowadays it’s pretty clear that this debt-to-equity swap is not allowed. And the only reason it’s not allowed is because in 2004, there was new legislation that passed banning it ... I'm not as convinced as the New York Times was that there was illicit activity. When they said he 'pushed the envelope,' I was kind of shocked by that language, considering no one knew what the law was.

Still, Herzig said that Trump's tax strategies could be a indicator of future behavior in the Oval Office.

It may be worrisome to people that you only look at the economics of a transaction; not everything is dollars and cents. That's why people advocate for full disclosure of tax returns: If you continually take aggressive positions, it could be in the voter's interest to know that.