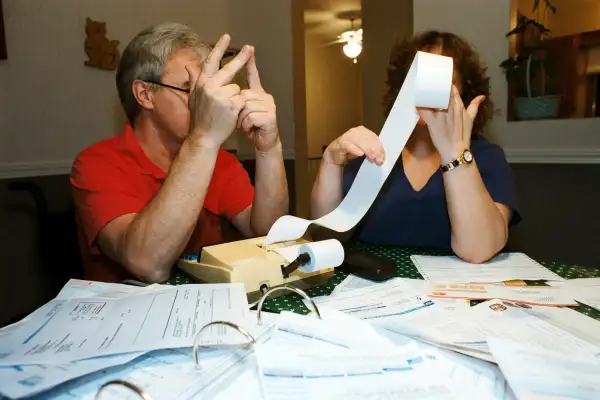

When Filing Taxes Separately From Your Spouse Makes Sense

If you're a newlywed this tax season, you may be filing together with your spouse for the first time. The conventional wisdom is that filing a single, joint income tax return makes the most economic sense—95% of married couples file jointly, according to IRS data—and while that's true for many couples, it is not a universal rule.

Depending on each spouse’s job and income, filing jointly could result in a lower tax rate, especially if there is a significant discrepancy in the couple's earnings. If, for instance, one spouse works part-time or wants to stop working outside the home, a joint filing could yield a better financial outcome for the family. Filing jointly also entitles taxpayers to a higher threshold for claiming the earned income tax credit.

On the other hand, when both spouses earn similar incomes, especially if both are high-income earners, they might pay less in taxes if they elect to file separately. Their combined income could be enough to bump them into a higher tax bracket.

Read next: The Right Way to Itemize These Common Tax Deductions

There isn’t a dollar amount or a hard-and-fast rule that will apply to every married couple, but dual high-income earners may want to do the math, said Lisa Greene-Lewis, a CPA and tax expert at TurboTax. Typically, couples who earn more than $200,000 in total combined income "may see it more beneficial [to file separately], because when you get into the $200,000 range, that’s where some of your deductions may be limited," she said.

The IRS lets taxpayers take miscellaneous deductions that total 2% or more of adjusted gross income, or medical expense deductions totaling 10% of AGI (7.5% for taxpayers over age 64). If one spouse has considerable deductible expenses, filing separately makes it likelier that their expenses will pass that threshold, since their income isn’t being combined with that of their husband or wife.

“If you have a lot of those expenses, married filing separate will result in a lower AGI and get them into the deductible phase much quicker,” said Richard Baum, CPA and tax partner at Anchin, Block & Anchin in New York.

There are some caveats, though: If you’re married and filing separately, you won’t be able to claim some education-related tax breaks, the earned income tax credit, and (in some cases, according to TurboTax) a dependent child or adoption tax credit.

Read next: Is It Ever Okay to Pay Your Taxes With a Credit Card?

Since everyone’s situation is different, and since a couple’s finances can change from year to year if one partner gets a raise or loses income, it might be worth the effort to do a side-by-side comparison, Baum said.

“You really have to sharpen the pencil and run the numbers to see how it comes out in a particular situation.”