It's Easy to File Your Taxes Online for Free in 2019. Here's How

The tax law changes designed to make filing quicker and easier mean that it is likely you can file taxes online for free in 2019.

Why is it easier to file federal taxes for free now? The Tax Cuts and Jobs Act of 2017 raised the standard deduction to nearly double what it had been, to $12,000 for single filers or $24,000 for married couples filing jointly.

“In general, we estimate about 90% of taxpayers will be taking the standard deduction, up from 70%,” says Lisa Greene-Lewis, CPA and tax expert for TurboTax.

This is good news for filers, since most free tax software products are geared for the standard deduction, not for people who itemize their taxes. If you’re wondering how to file taxes online for free when taxes are due in 2019, you have a few options.

The Best Ways to File Taxes for Free in 2019

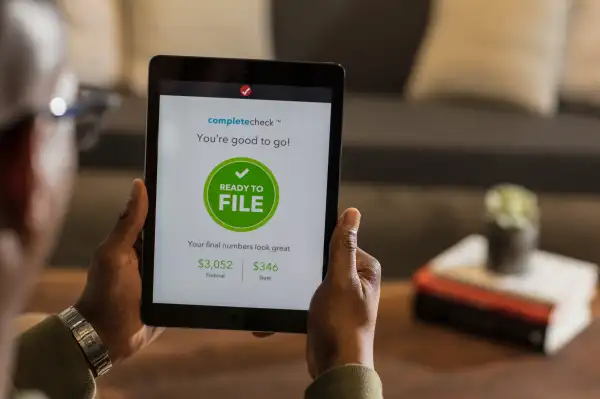

Most of the big tax software companies now have a free option for federal income tax filing. The TurboTax Free Edition covers W-2 income as well as the Earned Income Tax Credit and the child tax credit, and a previous income threshold of $100,000 has been eliminated, Greene-Lewis says.

“New this year, we have free data transfer for existing customers and new customers can upload PDFs no matter how they filed their taxes before,” she says, which reduces the chore of data entry if you’re switching from another tax provider.

Taxpayers using TurboTax will also be able to figure out how the new tax law will impact them specifically, thanks to a new interactive feature you can use to figure out if you’re going to be better off taking the standard deduction versus itemizing.

H&R Block offers online users a calculator to help determine how the changes to the tax law will impact you. Its online free filing tool is also simple to use, with features that make switching from another provider easy.

After plugging your numbers into the H&R calculator, or the similar feature at TurboTax, you'll be able to see whether it's wise for you to take the standard deduction (and file taxes for free) or to itemize. Also, both TurboTax and H&R Block now let you upload your W-2 via your mobile device by snapping a picture of it.

TaxSlayer also has a free offering for 1040EZ tax form filers. The free tax software from TaxAct includes offerings for 1040 form filers, and also includes retirement income in addition to income earned from wages or salary.

Finally, people who earn less than $66,000 have another option to file taxes for free online. They can use the I.R.S. Free File portal, which is a partnership between the agency and top tax-prep software companies that gives taxpayer access to name-brand (and free) tax software of their choice.

Do I Need to File Taxes?

Even if you don’t think you need to file a tax return, it’s a good idea to do so, says Kathy Pickering, vice president of regulatory affairs and executive director of The Tax Institute at H&R Block. “Each year, roughly $1 billion of tax refunds go unclaimed just from people who did not file a tax return,” she says. “That is an expensive mistake.”

And hey, since it’s easy to file your taxes for free, why not give it a shot?