Don't Expect the IRS to Answer Your Tax Questions This Year

National Taxpayer Advocate Nina E. Olson delivered her 2014 annual report to Congress, and expectations for the level of service you will receive in 2015 are looking pretty grim.

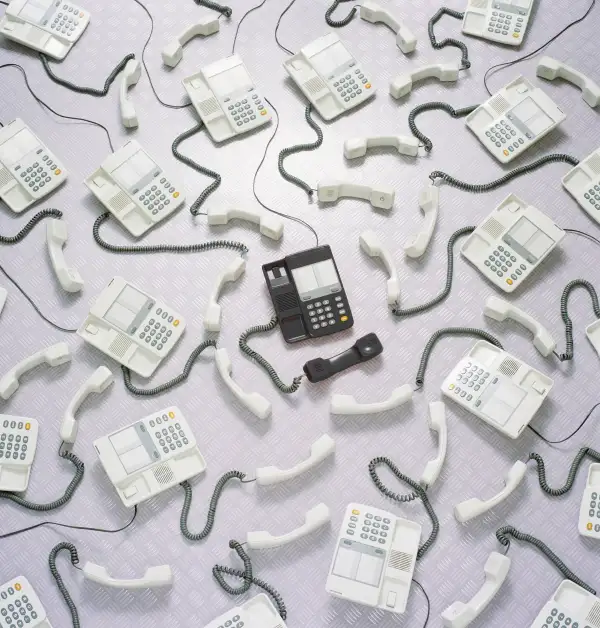

According to the report, taxpayers can expect the worst levels of taxpayer service since at least 2001, when the IRS implemented its current performance measures. This filing season, the IRS is unlikely to answer half the telephone calls it receives, and those that do get through can expect average wait times of 30 minutes. By comparison, in fiscal year 2004 the IRS answered 87% of calls from taxpayers wishing to speak with a tax assistor and had an average hold time of 2.5 minutes.

Additionally, the IRS will only answer "basic" tax law questions in the upcoming filing season, and if you're one of the 15 million taxpayers who file later in the year, you might not get any answers at all.

The report highlights an increased workload and a shrinking budget as some of the reasons for the expected service upheaval. Through fiscal year 2013, the agency has received 11% more individual returns, 18% more business returns, and 70% more phone calls than it did a decade ago. The implementation of the Affordable Care Act and the Foreign Account Tax Compliance Act are also expected to add to the workload. Overall, the IRS interacts with nearly 200 million Americans each year, more than three times as many as any other federal agency.

Top it off with the elimination of nearly 12,000 employees and about 17% of the budget (after adjusting for inflation) since 2010, and it's no wonder you'll be enjoying some elevator music while on hold this filing season.