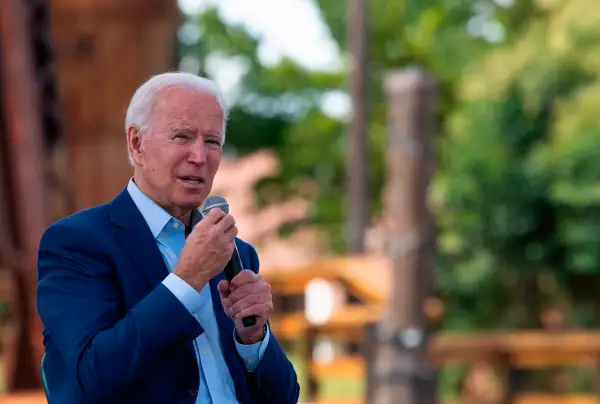

Joe Biden's Tax Plan: Who Would Benefit Most From His Proposed Tax Credits?

As the campaign between Democratic presidential candidate Joe Biden and President Donald Trump progresses, there's a question top of mind for many: what will the results of the 2020 election mean for my taxes?

Biden’s tax policy proposals feature several changes to the status quo, including new or expanded tax credits for low- and middle-income Americans. While the plan is still not fully formed and leaves a lot of questions about what it would look like in practice, experts say that tax credits would make a difference for many Americans.

“Tax credits really work well because they’re actual dollars — cash — that reduces taxes dollar-for-dollar,” says Ed Slott, CPA and founder of IRAhelp.com.

For instance, if you owe $2,000 in federal taxes but get a $2,000 tax credit, you owe zero dollars.

Bear in mind that tax credits are just one part of Biden's overall tax plan, and not everyone would benefit from his proposed policies. High earners and corporations would face higher taxes under Biden's plan.

Joe Biden's Tax Plan: Who Benefits?

President Trump has not outlined changes he might make to current policies, so it's unclear how, if at all, people's taxes might go up or down if he wins a second term in office. On the other hand, if Biden becomes the next president and his proposed tax credits and broader tax plan take effect, here are three groups that would benefit.

Caregivers

Biden is proposing an expansion to the Child and Dependent Care Credit, which currently gives caregivers — parents or guardians with kids under age 13 or those who live with a disabled dependent — a tax credit to offset the cost of care. Currently, the non-refundable credit is worth between 20% and 35% of $3,000 for one dependent ($6,000 for two or more), with lower percentages for higher earners.

Under Biden’s proposal, that credit would increase the limit for eligible expenses from $3,000 to $8,000 ($16,000 for more than one dependent) and bump the 35% credit percentage up to 50%, according to the Committee for a Responsible Federal Budget, an independent, non-profit, bipartisan public policy organization. It would also reportedly make the credit refundable. A non-refundable credit requires you to pay the full amount of the credit in taxes in order to benefit. So if you had a non-refundable credit worth $6,000 but only paid $5,000 in tax, you would not receive the $1,000 excess credit. If the credit were refundable, however, you would pocket the $1,000.

It's not clear whether that bump up to 50% would be across the board; it's possible that higher earners would see a smaller percentage (somewhere between the current 20% minimum and the 50%). But if it was increased to 50% for all those eligible for the tax credit, Jason Deshayes, director of Tax Planning at Cook Wealth Management Group, offers an example of what this could look for someone who has two kids and — with their spouse — brings in a total annual income of $80,000. If the couple pays $10,000 per year for childcare, under current law they only get to count the first $6,000 when calculating their credit. This gives them a credit of $1,200 — or 20% of $6,000. Under the Biden proposal, the credit could amount to as much as $5,000 (50% of $10,000). So under current law, this couple would pay $8,800 in net childcare cost, after factoring in the credits, compared to potentially just $5,000 under Biden's plan.

“That is a substantial cost reduction for the average working family,” Deshayes says.

The presidential candidate’s plan mentions a $5,000 tax credit for informal caregivers to cover expenses or caring for a loved one as well. The proposal doesn’t specify what this would cover, but Deshayes says it could include making modifications to a house or getting equipment necessary to care for someone — both of which are potentially very expensive investments.

Biden is also proposing to increase the Child Tax Credit from $2,000 to $3,000 per child for those between 6 and 17 years of age, and $3,600 for those under 6 — but only for the “duration of the crisis.” The expansion of the credit was initially proposed in the HEROES Act, which the House of Representatives passed in May. The credit would also be full refundable.

First-time homebuyers and renters

If you’re in the market for a house — and it’s your first time buying one — Joe Biden is looking to reinstate and increase a tax credit that could help you save.

Back in 2008, when America was trying to pull itself out of the Great Recession, President Barack Obama enacted the First Time Homebuyers’ Tax Credit. Worth $7,500 (which was later bumped to $8,000), it expired after two years. Biden’s plan would bring back the credit permanently and up it to $15,000.

A first-time homebuyers tax credit is not currently available. But previously, if someone bought a house in March of one year, for example, they would have had to wait until March or April of the following year for that credit, when they filed their tax returns. The Biden proposal says the credit would be timed with the purchase of the property, not with the tax returns, so the person buying the property could get the money much faster.

Meanwhile, the plan for renters is not an expansion of a previous credit, but brand new: a tax credit for low-income renters that caps rent and utilities at 30% of someone’s income.

It’s not clear how this credit would be distributed. Deshayes says it could be a lump sum of money added to federal tax refunds that people can use for rent.

Here’s what this might look like, according to Slott: if someone’s income is $30,000 and their rent is $12,000, their credit would be $3,000. That way, they're not paying more than $9,000 themselves (30% of their income). But whether or not the credit is refundable really matters here, he adds. If it is refundable, someone with a tax bill of zero would still get that $3,000 credit; but if it is a non-refundable credit, they would not get the money.

Health insurance purchasers

Those buying health insurance on the individual marketplace whose income falls between 100% and 400% of the federal poverty level — between $12,760 and $51,040 for a single-person household — can currently get a tax credit to help with the monthly cost. As the Center on Budget and Policy Priorities illustrates, a 24-year-old with an income of $25,520 would be eligible for a credit of $3,337. But Biden says it isn’t enough.

The presidential candidate is proposing to get rid of the 400% cap, which would allow more families with middle incomes to take advantage. He would also make the tax credits bigger by having them calculated using the cost of the gold plan versus the silver plan (the gold plan has a higher monthly premium but lower cost when you need care).

This would presumably change the cost of health insurance for middle-income families who make above the current 400% cap, like a single-person household that makes $60,000, or a two-person household that brings in $70,000.

Biden's plan also includes lowering the maximum someone can spend on health insurance, from 9.86% of one's income, down to 8.5%. He also wants to bring back the individual mandate for health insurance, which the Senate removed in 2017. That would mean that people who have opted out of health insurance could be once again required to have coverage or face a penalty.

More from Money:

Extra $300 Unemployment Benefits: All the States Still Sending out Weekly Bonus Checks

5 Numbers That Show the Unemployment Crisis Is Probably Even Worse Than You Think