Meme Stock Flop: GameStop Investors Lost Over $13 Billion Last Week

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

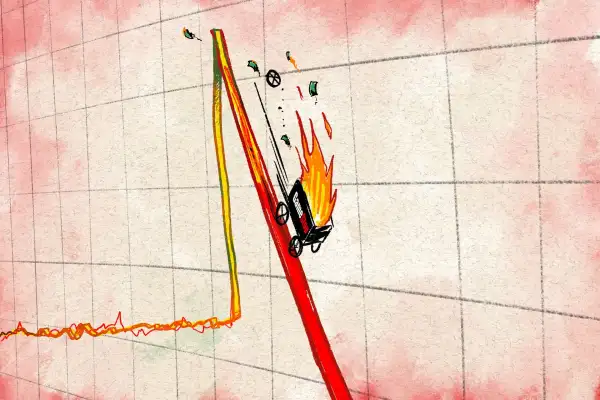

If you missed out on last week's meme stock rally, consider yourself lucky. The second iteration of GameStop mania ended as abruptly as it arrived, leaving retail investors on the hook with exceptional losses and erasing any hopes of repeating 2021's "moonshot."

Last week's well-publicized return of Keith Gill, a.k.a. Roaring Kitty, coincided with shares of GameStop (GME) rising 179% from market close Friday, May 10, to market open Tuesday, May 14. However, the rally was short-lived. By market close at the end of the week, GameStop investors had lost $13.1 billion, according to an Investor's Business Daily analysis.

As of Monday morning, the stock had plummeted 70% from its recent high, underscoring the dangers of investing in GameStop or other meme stocks, which are widely regarded as fundamentally flawed companies.

In fact, the $13.1 billion loss experienced by investors is nearly double GameStop's entire market capitalization — or the total value of a publicly traded company's outstanding shares owned by stockholders — of $6.6 billion.

Why did GameStop shares tank?

Fewer traders hopped on the GameStop bandwagon this time around, in part suggesting that some of those left holding the bag after the first meme stock rally learned a valuable lesson and didn't join the fray more recently. Daily trading volume for GME reached a high of 368.8 million Feb. 27, 2021; last week, daily trading volume maxed out at 96.08 million, or nearly 74% lower than in 2021.

Fundamentally, GameStop remains a flawed business. It has posted negative earnings per share 9 of the past 11 quarters and showed a net loss 10 of the past 12 quarters. Its assets have decreased from $3.76 billion in the third quarter of 2022 to $2.71 billion in the fourth quarter of 2023, and its operating expenses increased nearly 60% from the last quarter of 2023 to the first quarter of 2024.

Additionally, analysts' forecasts for GameStop may have curbed some enthusiasm. The Wall Street Journal's one-year median price target is $7, MarketWatch gives GME a consensus rating of "Strong Sell," and both outlets state there is 68.55% additional downside for the stock.

At the time of writing, shares are trading for $19.67, down from an intraday high of $67.40 last week. In other words, if you bought $1,000 worth of GameStop stock around that recent high, it would worth about $300 now.

More from Money:

The Dow Just Crossed 40,000 for the First Time Ever