These 28 Underpriced Stocks Can Make You Money

With the economy on a tear, it's harder and harder to find bargains in the stock market. But they're still there, if you look.

It's no secret stocks are pricey. In August, the bull market, which began nearly a decade ago in the wake of the 2008 financial crisis, became the longest in history. Despite retreating slightly from it's late September record highs, the S&P 500 is still up 2% this year. The upshot is that stocks in the index are trading at 24 times earnings over the past 12-months' profits, compared to an historical average of just 17 times.

Still, not all corners of the market are overpriced. Some sectors like technology and healthcare have outperformed, making these stocks especially expensive, while others, like telecommunications have lagged, remaining relatively cheap. Then, of course, there are individual companies in all industries that have suffered missteps or just bad luck – but whose long-term prospects remain bright.

Earlier this month, investment researcher Morningstar named 28 of the market's biggest values – stocks that are trading at discounts but nonetheless enjoy competitive advantages among peers. Money then worked with Morningstar analysts to single out five standouts that offer the best long-term prospects, without being enormous risks.

Read on to see the picks:

Company Name: BlackRock

Ticker: BLK

Price: $385

P/E: 11.9

BlackRock is the world’s largest asset manager, overseeing more than $6 trillion. But it’s not immune to the investor anxieties – over trade disputes, rising interest rates and emerging markets turmoil – that have dogged the industry for the past several quarters. Investors pulled a net $3.1 billion from BlackRock in the third quarter – including $17 billion from stock funds – in what was the firm’s first net outflow since 2015. While Blackrock’s third-quarter profit rose 27% – thanks to last year’s tax cut – it’s $3.6 billion in revenue was nearly 2% short of what analysts expected. So far shares are down about 20% this year.

Despite this industry-wide slowdown, BlackRock continues to take advantage of the larger shift from actively-managed investments into lower-cost options like index funds. Passive investing accounts for two-thirds of the firm’s assets under management and nearly half of its revenue. BlackRock is especially dominant in the exchange-traded fund business, and its well-known iShares brand took in $34 billion during the third-quarter, despite the company-wide outflow.

BlackRock is currently trading at just under $390, or roughly 12 times its earnings, but Morningstar argues that because of its strong brand, the stock price should be roughly 20 times earnings, about $580 per share. The market’s volatility may hurt revenue in the short-term but it won’t last forever.

Company Name: Intel

Ticker: INTC

Price: $44

P/E: 18.5

Intel is facing a host of high-profile problems this year. One is that the chip maker has had trouble keeping up with an unexpected uptick in P.C. sales – leading to a shortage of its computer chips that has rippled through the tech industry. Another is product delays as Intel moves to update its line-up, rolling out a new generation of smaller, faster chips. The delays have meant that, for the first time in years, Intel won't be releasing a new microchip in 2018, likely ceding market share to rival American Micro Devices. All in all, Intel's shares are down 6% this year, despite record second-quarter revenue of $17 billion.

While issues like the chip shortage have led to bad press, Intel's bigger problem is that P.C. sales – which until 2018 have declined each of the past seven years – are gradually shrinking. The good news is that Intel has been investing heavily in projects to help it expand elsewhere. These include recent purchases such as server processor company Altera in 2015, A.I. companies Nervana and Movidius in 2016, and last year Mobileye, a firm that could help Intel play a role in the burgeoning driverless car business. Morningstar thinks Mobile eye could boost Intel's revenue roughly $3.7 billion by 2025.

Intel currently trades at around $45 per share. But, taking into account how the company’s diversified growth strategy, Morningstar values the stock at $65 – almost a third higher than its current price. Intel is also cheaper than its competitors, trading at almost 19 times earnings, compared to 91 for AMD’s and 36 for Nvidea.

Company Name: Anheuser-Busch InBev

Ticker: BUD

Price: $83

P/E: 17.6

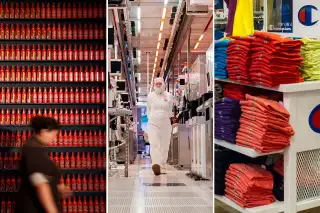

Anheuser-Busch InBev – the world’s largest brewer with brands like Budweiser, Corona, and Stella Artois – has struggled in the face of a strengthening dollar, which has lowered the the value of profits it earns in Brazil, its second largest market. Currency headwinds have helped knock down the price of AB InBev’s stock to $83 from just over $110 in January.

There are other problems too. The company has been laboring to pay off its $109 billion in debt, largely the result of its 2016 purchase of SABMiller. And in the U.S. market, AB InBev’s largest, it’s gradually losing market share to the rise of craft beers. Last quarter, U.S. revenue fell 3%, even as total revenue grew nearly 5% to $14 billion.

But Morningstar, which values the company at $124 a share, thinks these problems will offset by the company’s longer-term advantages. Not only is AB InBev globally diversified; it enjoys a near-monopoly in several Latin American and African markets, giving it significant pricing power over its peers, according Morningstar. What’s more, the SABMiller acquisition is already bearing fruit – by the end of last year, AB InBev had already wrung $2.1 billion in annual savings from the deal, out of the the $3.2 billion it expected.

Company Name: Telefónica

Ticker: TEF

Price: $8

P/E: 12.4

The Spanish firm became one of the largest telephone operators in the world after recent purchases of E-Plus in Germany and GVT in Brazil gave it dominant positions in those two countries. But telecommunications stocks have been left behind by tech and others sectors during the global bull market. What’s more, regulatory problems and exposure to falling Latin American currencies have crimped Telefónica's revenue, which declined slightly to $52.01 billion in 2017 from $52.04 billion, a year earlier. The stock, trading at $8, is near five-year lows.

That said, Telefónica looks primed to grow again. It is an industry-leader in Europe for converged services, which bundles fixed-line and wireless telephones together. That infrastructure should give the company a big leg-up when customers eventually move beyond 4G mobile technology, and embrace 5G. Morningstar values the telecom giant at $15 per share, in part because analysts see Telefónica's advantage extending not just to Europe but also Latin America, where it has started rolling out its converged services product. The upshot, according to Morningstar, should be a return to revenue growth by 2020.

Company Name: Hanesbrands

Ticker: HBI

Price: $17

P/E: 138.9

This maker of classic Hanes t-shirts and other duds under brands including Polo Ralph Lauren took a hit recently when Target, one if its largest distributors, decided not to renew its exclusive contract for the C9 line of Champion sports clothing. Investors’ verdict was swift. The stock, which had been trading at around $22, immediately dropped 19% to just under $18 – its worst daily drop since the financial crisis. But today’s pullback may have been an overreaction by the market, says Morningstar.

While a big loss, the C9 contract only represents $380 million in yearly sales, or about 6% of overall revenue. The company’s position otherwise looks sound. Its business extends far beyond the U.S. – 32% of sales are international, with Hanes a leading brand in places from Europe to Australia. Another big advantage: a global and vertically integrated supply chain means it can make garments as cheap or cheaper than its competitors. In 2017, over 70% of units sold were produced in company-owned manufacturing plants or through dedicated contractors. While maximizing low-cost production, Hanes has also been successful in making acquisitions, purchasing one or two brands a year, which has helped boost earnings growth.

Hanes stock has yet to recover while trading at around $17. Morningstar said that although the lost Target contract would hurt, they value the company at $27 per share because the growth of online – currently 11% of 2017 revenue – and international sales are expected to continue at a steady clip and offset Champion losses. “It’s certainly a name that we’ve liked for a while,” says Markets Editor Jeremy Glaser.

Company Name: BT Group

Ticker: BT

Price: $16

P/E: 9.6

Company Name: Comcast

Ticker: CMCSA

Price: $36

P/E: 7.1

Company Name: Cameco

Ticker: CCJ

Price: $11

P/E: 110

Company Name: Compass Minerals International

Ticker: CMP

Price: $52

P/E: 57.6

Company Name: Martin Marietta Materials

Ticker: MLM

Price: $167

P/E: 14

Company Name: Imperial Brands

Ticker: IMBBY

Price: $34

P/E: 18.2

Company Name: Philip Morris International

Ticker: PM

Price: $88

P/E: 21.5

Company Name: Cenovus Energy

Ticker: CVE

Price: $9

P/E: 4.5

Company Name: Enbridge

Ticker: ENB

Price: $32

P/E: 34.3

Company Name: Enterprise Products Partners

Ticker: EPD

Price: $27

P/E: 20

Company Name: American International Group

Ticker: AIG

Price: $43

P/E: N/A

Company Name: Credit Suisse Group

Ticker: CS

Price: $13

P/E: N/A

Company Name: Cardinal Health

Ticker: CAH

Price: $52

P/E: 64

Company Name: McKesson

Ticker: MCK

Price: $128

P/E: 6.8

Company Name: Roche Holding

Ticker: RHHBY

Price: $30

P/E: 20.4

Company Name: Anixter International

Ticker: AXE

Price: $64

P/E: 20.7

Company Name: Boston Properties

Ticker: BXP

Price: $116

P/E: 42.4

Company Name: Welltower

Ticker: WELL

Price: $65

P/E: 73.4

Company Name: Broadcom

Ticker: AVGO

Price: $225

P/E: 8.3

Company Name: Microchip Technology

Ticker: MCHP

Price: $66

P/E: 122.3

Company Name: Dominion Energy

Ticker: D

Price: $73

P/E: 16

Company Name: PPL

Ticker: PPL

Price: $31

P/E: 15

Company Name: Scana

Ticker: SCG

Price: $38

P/E: 11.7