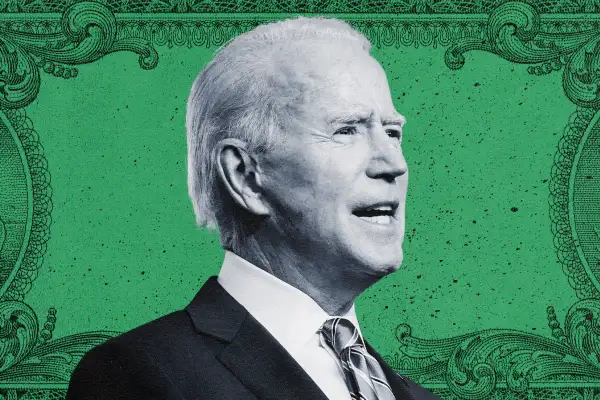

Joe Biden Is the President-Elect. Here's What It Means for Your Wallet

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

On Saturday morning, major media outlets called the presidency for Democrat Joe Biden. While Americans now have more certainty about the next occupant of the White House, what that means for pocketbook issues — like the stock market, health care and taxes — remains unclear.

President Donald Trump has contested the election results, but so far his legal challenges have failed to gain traction. Meanwhile, control of Congress is still very much up in the air. Democrats went into the election hoping to hold the House of Representatives and wrest control of the Senate from Republicans. While they appear to have succeeded on the first goal, Republicans will retain the Senate unless Democrats can prevail in a pair of close races in Georgia that won't be decided until a January runoff.

The upshot is that President-Elect Biden's ambitious economic agenda is likely to face a divided government or, at best, one which Democrats control by only the thinnest of margins.

Here's what we know so far about how Biden's electoral victory will affect your wallet.

Stimulus

President Trump promised to pass a sweeping stimulus package after election day, under his assumption that Republicans would win control of the House, Senate, and White House. Now that Biden is set to be sworn in this coming January, it's unclear what, if any, action will be taken to mitigate the financial crisis between now and inauguration day. Even if President Trump wants to end his term with a final push to pass a bill, House Democrats would need to be on board.

The most likely scenario is that the country won't see any more attempts at economic relief until after January 20. The president-elect has proposed a robust Emergency-Action Plan to Save the Economy, which includes an ambitious “restart package” that provides grants to small business, funds Title I schools and child care centers, and pushes for another round of stimulus checks.

There is also a likely chance that the newly Democratic executive branch will work with Democratic House leaders to design a stimulus package. But with a blue House and a red Senate, Senate Majority Leader Mitch McConnell and House Speaker Nancy Pelosi could remain deadlocked over the price of the proposed stimulus bill. The waiting game will continue until an economic relief bill that passes both chambers of Congress is signed by President-Elect Biden.

Stocks

Wall Street is grappling with what a gridlocked government could mean for the stock market — and investors seem to like what they’re seeing. Stocks jumped during the week as investors priced in a Biden presidency and a possible Republican-controlled Senate.

“It’s like the best of all worlds from a stock market perspective,” says Sam Stovall, chief investment strategist at CFRA Research.

The country’s GDP grew 33.1% between July and September — faster than expected — after seeing its worst drop on record during the three months earlier. A Biden presidency raises hopes for continued economic stimulus, even if a stimulus package will be smaller than what it would have been under a Blue Wave. And the U.S. will likely see improved international relations and trade under Biden, as under Trump the country’s relations with both friends and competitors have been very confrontational, Stovall says. A Biden presidency also increases the likelihood of an infrastructure plan, in which spending would boost public and private construction and the overall economy, says Michael Englund, chief economist at Action Economics. At Moody's Analytics, economists are forecasting that under a Biden presidency and a divided Congress, U.S. real GDP would grow by 4.4% in 2021, 4.8% in 2022, 3.5% in 2023 and 2.5% in 2024.

The other positive for Wall Street is that Biden likely wouldn’t be able to pass big regulations that could hamper corporate profits (like strict antitrust laws), or increase taxes as he’s planned.

Investors had felt like they had a bullseye on their back under a possible Blue Wave scenario, says Jack Ablin, chief investment officer at Cresset Capital Management. And they should still be careful about certain industries where a president does have executive power to impose policies, like energy and banking, Ablin adds. For example, while the Consumer Financial Protection Bureau has been more friendly to businesses under Trump, that could switch with Biden. But now that it looks like a Biden presidency would come with a divided Washington, investors are likely taking a lot of the tax and regulatory negatives off the table.

Taxes

President Trump's $1.8 trillion tax cut was his signature legislative achievement. Economists credited the 2017 law — which lowered corporate tax rates and doubled the standard deduction for individual tax payers, among other provisions — with boosting U.S. GDP growth. Critics pointed out its benefits skewed toward the wealthy and helped balloon the budget deficit, which Trump had promised to close when he ran in 2016.

As a candidate, Preident-Elect Biden advocated a different set of tax priorities, promising to raise corporate taxes and income taxes on households making more than $400,000, raising upwards of $2 trillion over the next decade. At the same time, Biden would also temporarily expand the Child Tax Credit to a maximum $3,000 from $2,000 for children under 18, and provide a $600 credit for children under 6. Biden also proposed tweaking the tax treatment of 401(k) retirement accounts, in an effort to make the system's benefits skew less toward the wealthy.

Given Republicans' deep aversion to tax hikes, it seems unlikely that key parts of Biden's plan would advance if Democrats fail to retake the Senate. One important wrinkle: Many provisions of the 2017 Trump tax cuts aren't permanent, and are set to expire during the upcoming Biden Administration, which could force the parties to negotiate on at least some issues. However, the key provisions affecting individual's income taxes are not slated to expire until December 2025.

Health care

More than 20 million Americans get their health insurance under the Affordable Care Act. Biden ran on a platform of protecting and expanding the law, which passed in 2010 when he served as vice president under Barack Obama. It established key protections, including barring insurers from discriminating against people with pre-existing conditions.

But the law, also known as Obamacare, faces an immediate threat in the U.S. Supreme Court. On Nov. 10, the court is scheduled to hear oral arguments in a case that seeks to overturn the Affordable Care Act. The case, brought by a group of Republican attorneys general, argues that the law is unconstitutional because its requirement to buy health insurance has no teeth. As originally passed, the law required most consumers to buy coverage or pay a penalty, but in 2017 Congress reduced the penalty to $0. A group of Democratic attorneys general, led by California, is defending the law.

A ruling on the case, Texas v. California, is expected no later than June, 2021. In his first months in office, Biden could try to get the case thrown out of court — but to do that he’ll need Congress’ help. If Congress were to reinstate a financial penalty for going uninsured, then lawyers for the defendants could argue that the case is moot. Alternatively, lawmakers could eliminate the individual mandate altogether (the reason they didn’t do that in 2017 is that it required fewer votes to just cut the penalty to $0.)

Democratic control of the Senate would make it easier for lawmakers to modify the individual mandate. But even under a Republican Senate, it’s possible that Democrats could enlist some Republicans to vote with them. After all, protecting the health insurance of millions of Americans during a pandemic could be seen as a winning issue on both sides of the aisle.

“Maybe there is some kind of grand bargain to be made,” says Sabrina Corlette, research professor at the Center on Health Insurance Reforms at the Georgetown University McCourt School of Public Policy.

But even with Congressional action, the Supreme Court would still have to agree to dismiss the case.

When (or if) the Court rules on the case, justices could vote to overturn the Affordable Care Act, to uphold it, or to keep some parts and invalidate others. If justices uphold the law, then the Biden administration could set to work bolstering Obamacare after years of efforts by the Trump administration to weaken it, including by slashing marketing funding for open enrollment and by promoting skimpy short-term health insurance plans. These moves would not require legislation.

More from MONEY:

How Much Should You Save for Retirement?