The Fed Just Raised Interest Rates Again. Here's What That Means for You, According to Market Pros

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

The U.S. economy has been humming along – helped by near-record low interest rates. But that's slowly changing. On Wednesday, the Federal Reserve raised its benchmark interest rate by a quarter point to a range between 2.25% and 2.5%. It was the fourth time the Fed has done so this year.

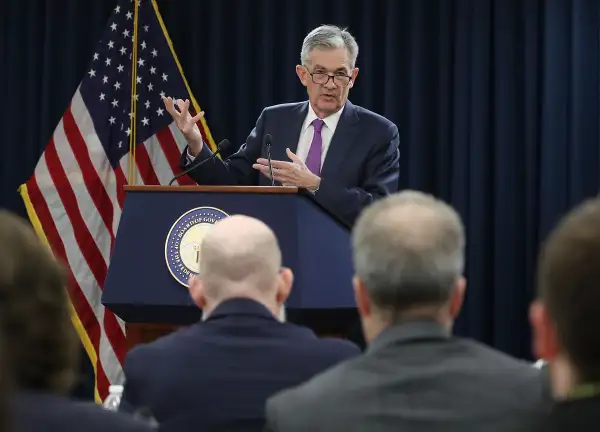

The market reacted badly, with the Dow shedding 500 points as Fed Chair Jerome Powell delivered the news. Can the economy – not to mention a jittery stock market – handle the higher rates?

Over the past few weeks, we talked to five investing experts to find out what's in store for 2019. Here's what they told us:

Watch for "Tighter Credit"

Kate Warne, principal and investment strategist at Edward Jones:

"Rising rates so far have been good for retirement savers, but they've also resulted in lower bond returns, since they push down bond prices. We're still at low enough levels that there's been only episodic effects on the stock market, but if credit gets tighter, there could be cause for concern. For now, credit remains relatively easy, and the Fed is likely to continue slowly raising short-term interest rates in 2019. But when signs of tighter credit begin to appear, the Fed will likely pause rate hikes to assess how strong the economy remains."

"Markets Likely to Get More Volatile"

Matthew McLennan, head of global value team and portfolio manager at First Eagle Investment Management:

"While the U.S. has enjoyed strong economic growth relative to the rest of the world, that's at risk in 2019, especially as the dampening effect of higher interest rates starts to kick in. On the other hand, from the saver's perspective, those rates, while more attractive than a couple of years ago, are still well below historical levels. In fact, with global interest rates below the rate of nominal global GDP growth, you can't even count on preserving your purchasing power with just bonds. That said, with markets likely to get more volatile, putting 10% to 20% of your portfolio into cash in the short term might not be the worst decision. That will let you take advantage of new opportunities as they arise. You just have to be careful about preserving your long-term purchasing power."

"Good in the Long Term"

Mohamed El-Erian, chief economic advisor at Allianz:

"Rising interest rates are painful for bondholders in the short term because as bond yields go up, prices fall. If you own U.S. Treasuries or a government bond mutual fund, that will show up as a loss on your brokerage statement. But rising rates are good in the long term for two reasons: They will lead to government bonds being better risk diversifiers for investment portfolios than they've been in the past, and if you need safe, risk-free income, you're actually going to get paid above the rate of inflation, which hasn't happened for a very long time—since 2008."

"Rise at a Steady Rate"

Saira Malik, managing director and head of global equities at Nuveen:

"As long as interest rates rise at a steady rate and without spiking unexpectedly as a result of inflation, the market can handle them. When the 10-year Treasury rate hits approximately 4%, we should be worried, but at 3%, we're nowhere near there yet. Ideally, U.S. rates will move up in a coordinated fashion without the yield curve inverting, while the rest of the world shows some growth and foreign currencies achieve more parity with the dollar. A less strong U.S. dollar would be positive for international markets because it would allow emerging-market countries to pay back dollardenominated debts. So what we need is to go back to across-theboard global growth in 2019, which we did not see last year."

"Savers Are Rewarded"

Nicholas Sargen, senior vice president, chief economist, and senior investment advisor at Fort Washington Investment Advisors:

"The gradual rise in interest rates is a healthy development for investors because when interest rates are above inflation, savers are rewarded and corporate profit margins improve, assuming the source of rising rates is a strong economy. On the other hand, when wages rise faster than productivity—that is, economic output per hours worked—that eats into corporate profits, which can spell trouble for both the stock and bond markets. I just don't see that as a major risk right now; the trade issue is a bigger deal because it's dragging down economic growth, and it's not going away anytime soon."