What Financial Advisors Are Telling America's Richest People to Do With Their Money

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

When I was invited to attend a wealth management conference at a tony South Florida resort, I jumped at the opportunity. Life's too short to not experience the opulence of a five-star, waterfront retreat designed by architect Addison Mizner — and tap into the collective brain of the finance world.

South Florida, or "Wall Street South" as it's recently been labeled, has been luring the investment world from its New York roots since the pandemic. Ken Griffin, for example, relocated his hedge fund Citadel — and its $62.3 billion in assets under management — to Miami in 2022. And just a few towns to the north, billionaires have flocked to Mar-a-Lago to rub elbows with the president.

As Money's investing and banking editor, I wanted a glimpse of that evolving landscape. Specifically, I was curious what financial advisors are recommending for their high-net-worth-individual (HNWI) and ultra-high-net-worth-individual (UHNWI) clientele these days.

So I embarked on a three-day journey to discover which asset classes and corners of the market are the most (and least) appealing, according to a slew of registered investment advisors, chartered financial analysts and certified financial planners.

Investing in disruptive times

Upon entering the gates of the resort, I was led down a royal palm-lined path reminiscent of Beverly Hills' Rodeo Drive. And while my 2014 Jeep stood out like a sore thumb, it wasn't until I approached the valet that I realized my backseat was littered with my son's chocolate ice cream-covered napkins from a recent trip to the beach.

Great start.

Brushing it off, I headed to my first session. Decision-Making in Disruptive Times was hosted by Rafia Hasan, chief investment officer of Perigon Wealth Management, who began the day echoing a familiar sentiment: uncertainty.

"We caution our clients against impulsivity," she explained. "Nobody really knows what's going to happen. Maybe not even the people in the [Trump] administration."

Hasan also cautioned against sidelining cash, arguing that heightened tariff-induced volatility under President Donald Trump doesn't fundamentally change the investment thesis — younger investors in the accumulation stage should still maintain exposure to equities.

"A lot of what we're advising them [to do] is similar to what we've been telling them prior to April and Liberation Day: Stock exposure is going to be your driver of returns," Hasan said. "In terms of more aggressive or diversified exposures, we advise some younger clients to have exposure to alternatives."

That word — alternatives — emerged as a theme throughout the day. To the average investor, incorporating alts could mean diversifying a traditional stock-led portfolio by adding precious metals or cryptocurrency. But the smart money has more nuanced tricks up their sleeves.

Alternative investments for the long term

Hasan said she believes alts, as an asset class, present additional risk despite sometimes being marketed otherwise. So what, specifically, qualifies as an alt?

Alts include "things like reinsurance, alternative lending, private equity and private credit," according to Tyler Gilley, associate wealth advisor at Halbert Hargrove. (I interviewed Gilley at an on-site cafe selling $15 bagels and $10 watermelon spears.) These are investments that, by and large, average investors can't get through traditional brokerages due their inherent illiquidity, complexity and risk.

"If you go to your Fidelity or Schwab broker and you say, 'I want to buy this' for a retail client, a lot of these things aren't available to them," says Gilley. "So we're able to get access to other markets that go beyond the S&P 500 and bonds."

Reinsurance — a risk management tool used by insurance companies — is one of those private markets. " It is high-risk," Gilley cautions. "But one of the things that's most attractive about that type of investment for us is that it's a very truly uncorrelated asset class."

Uncorrelated assets are particularly alluring during periods of heightened market volatility, since their price movements are independent of other asset classes or the broad stock market. Because of this, some alts are capable of providing outsized returns while public markets endure downturns.

"When you're looking at portfolio construction, you want something that zigs when other things zag," says Gilley.

Overlooking this asset class is a mistake, according to Luke Melms, managing director of Firm Foundation Family Wealth, who spoke on a panel titled Alts for HNW Clients.

"The number of companies listed on stock exchanges in the 1990s was around 7,000. Now it's around 4,000," Melms said. "If you're limiting your clients to the public market, you're missing this great space."

Melms stressed that because alts often have lock-up periods — fixed times during which investors are restricted from selling shares — and therefore can be illiquid, they are better suited for investors focused on the future.

"I liken alt funds to homeownership. People live in their house. It's illiquid. If its value goes down 5% tomorrow, you don't wake up and say you're going to sell it," he said. "Alts can be illiquid, but they have a long-term purpose."

Tariffs create opportunities in emerging markets

After sating myself at lunchtime with rock shrimp salad and mango-glazed mahi, it was time to dive into tariffs. The "sell America" trade has grabbed headlines this year as many investors vacated U.S. equities and moved capital into international markets that they believe offer more attractive upside.

Stephen Kolano, chief investment officer at Integrated Partners, participated in a panel discussion on international investing. He noted that "emerging markets tend to attract investors who are higher up on the wealth spectrum," adding that domestic market volatility and a weakened U.S. dollar often cause them to search for opportunities abroad.

That's something the data backs. "This year, developing markets are up 15% over the U.S.," Kolano said. "This is why you want to own a globally diversified portfolio. You never know when things are going to shift."

Kolano used China as an example. Despite Trump claiming in May that the country was "doing no business whatsoever," the slowdown in U.S. trade only accounts for 5% of China's overall trade.

"Tariffs are waking up the rest of the world that they cannot rely on the U.S.," he said, also pointing to Poland's attempts to increase its defense spending as an example of opportunities in European emerging markets.

These opportunities extend to commodities — specifically, rare-earth elements (REEs), which have applications ranging from smartphones and electric vehicles to hard drives and military hardware. According to Kolano, 69% of the world's REE supply comes from China.

What they don't like

Although U.S. equities have mostly recovered from their April lows, some advisors maintain reservations about certain corners of the market.

"The energy sector is in a difficult spot," Gerry Goldberg, division president at Focus Partners Wealth, wrote in an email. "The administration wants to boost domestic production of traditional sources through lower regulatory costs, but that leads to lower prices."

Energy's lackluster performance in 2025 was expected in the wake of the election. Despite prices rising in June alongside heightened geopolitical conflict, crude oil is down more than 8% on the year, with the price per barrel falling below $57 in May from its year-to-date high of $78.

While alts were as popular at the conference as the German luxury vehicles lined up outside of the resort, they're not exempt from energy's fallout in 2025. Melms noted that he is "not touching oil and gas with a 10-foot pole."

On a granular level, there are other areas of concern within the alts space. Chelsea Ganey, chief strategy officer at Moran Wealth Management, noted that although the private market space hasn't been as volatile as the S&P 500 this year, she's concerned about headline risk in private credit, which could take hold if economic contraction continues.

My takeaway

On the final day of the conference, I interviewed James Bogart, CEO of Bogart Wealth, whose practical advice refreshingly spanned income brackets.

" I think financial literacy is one of the biggest pandemics we're having to endure right now," Bogart says. " A lot of people are not truly aligned with what level of risk they're actually taking."

Between a market environment rife with uncertainty and young investors increasingly turning to speculative assets like crypto, assuming additional risk can have long-term implications, especially for retirement planning.

Bogart's recommendation should sound familiar to Money readers: "DCA and look away," he says, using shorthand for dollar-cost averaging, in which you invest a fixed amount of money in the same investment at regular intervals. "Have a plan as early as possible. Wealth accumulation happens by having a deliberate process associated with saving: investing and truly not looking at it."

Bogart suggests investors continue adding to their positions — especially during times of volatility, when stocks are essentially on sale — and not fixating on market timing.

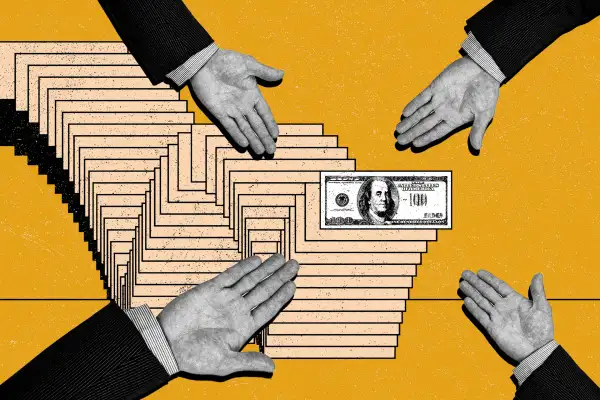

For everyday investors, learning to navigate the byzantine labyrinth of bespoke investment vehicles — or, for that matter, spending three days at an exclusive Wall Street South resort surrounded by financial advisors who cater to the nation's wealthiest — isn't necessary.

" If you want to carve off a portion of your wealth to do whatever the latest hot thing is, sure," Bogart says. "But remember the fundamental discipline of what you built out. Long-term, it does work."

More from Money:

Can Skipping Avocado Toast and Lattes Really Help You Buy a House?

How a 'Blended Income' Strategy Can Boost Your Retirement Cash Flow