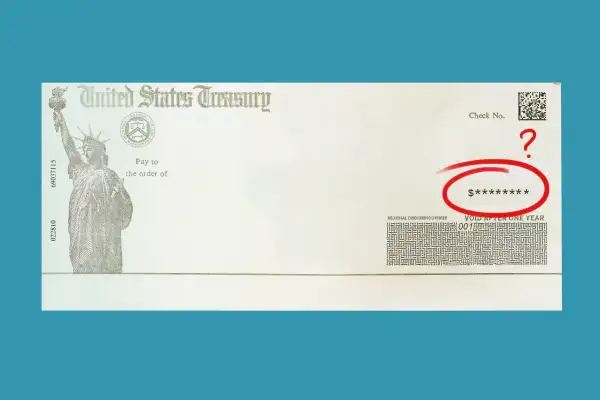

Can Your Stimulus Check Be Wrong? (Yes)

If it feels like Christmas morning, that's because the government has officially deposited the first wave of stimulus checks into Americans' bank accounts.

By now, you probably know the basics. To help the economy weather the coronavirus outbreak, the CARES Act is providing $1,200 for adults who make under $75,000, plus $500 per dependent and special rules for joint filers. The IRS began sending out the payments last month, starting a lengthy process that'll take months to complete.

But as many taxpayers are rejoicing, others are fretting over the exact amount they received from the IRS. Some stimulus checks did not come in the expected amount.

If yours is one of them, here's what you need to know.

Can my stimulus check be wrong?

Yes. The check is technically an advance payment of a refundable credit on your 2020 tax return, which you won't have to file until April 15, 2021. But since this is an urgent situation, the government is using the information it already has to determine the amount you get now. So it's looking to your 2018 or 2019 tax return, assuming you were required to file for those years.

Those details can be out of date, according to Richard Winchester, tax policy expert and visiting professor at the Seton Hall University School of Law.

"The information on your return can change from year to year," he says. "That means it’s possible that someone might get paid less than they should, while others might get paid more than they should."

Online, there are reports of people missing $500 apiece for their eligible dependents, as well.

If my stimulus check is too big, do I need to pay back the government?

Probably not. As with all money-related questions, it depends on the situation.

Generally, Winchester says, most discrepancies work out in the taxpayer's favor. This is the case if, say, your income goes up this year and you cross the $75,000 threshold on your 2020 taxes.

"If your check is larger than it would be if it were based on the information in your 2020 return, you don’t have to return the difference," he says.

If my stimulus check is too small, can I get more money?

Again, it depends. But maybe.

Say you had a baby after filing your 2018 return but before filing your 2019 return. If you haven't claimed the dependent yet, you won't get the extra $500 in your stimulus payment — but the Tax Foundation says you can claim a $500 credit for the child on your 2020 taxes.

Or say your income goes down this year. You will be eligible for any remaining stimulus money you couldn't previously access due to your 2018/2019 tax returns. If you are eligible for more money, you'll get it via a larger refund on your federal taxes than you would have received, or you'll wind up owing less had the stimulus payments not been factored in.

"If your check is smaller than it would be if it were based on the information in your 2020 return, you will receive the difference," Winchester says.

I got stimulus money intended for someone who recently died. What now?

This happened last time the government paid out stimulus checks, too. In 2009, the Social Security Administration was in charge of sending out money during the Great Recession. The Wall Street Journal reported that it gave about 72,000 stimulus payments of $250 each to dead people. Oops.

On May 6, the IRS issued new guidance on the subject, saying that stimulus payments made to a person who died "should be returned to the IRS" in full. (If you filed jointly with a now-deceased spouse, you only have to return their $1,200.)

The IRS wants you to do this by voiding the uncashed check and mailing it back to an IRS office with a note saying why you're sending it back. If you already cashed it or received it via direct deposit, you're supposed to write a check or money order for the amount and then snail-mail that in.

Confused? You can read more detailed instructions by clicking Q41 at the bottom of this page.

What should I do if I think my stimulus payment is incorrect?

First, according to a May 11 update from the IRS, "Everyone should review the eligibility requirements for their family to make sure they meet the criteria." Then, wait and see what happens.

The IRS is going to send all stimulus recipients a letter in the mail 15 days after paying them. An IRS spokesman says the letter will confirm how the money was sent and tell taxpayers the best way to alert the IRS if anything needs to be corrected. So, assistance is TBD — but it is coming. Keep an eye on your mailbox.

In an April 29 update to its economic impact payment FAQ, the IRS indicated that the long-term solution will come in 2021.

"If you did not receive the full amount to which you believe you are entitled, you will be able to claim the additional amount when you file your 2020 tax return," it wrote. "This is particularly important for individuals who may be entitled to the additional $500 per qualifying child dependent payments."

Help! I got an email/text/call about a stimulus overpayment that I need to give back.

Don't do anything; this is probably fake. The Federal Trade Commission warns that fraudsters are preying on check recipients by posing as the government and requesting a return via cash, gift cards or money transfer.

"If you get an official-looking check for more than what you were expecting — say, for $3,000 — the next call you’re likely to get is from a scammer," the FTC says.

Remember: The IRS does not call, text or email people to ask for personal information or money. It also never threatens to bring in the police or take away your driver's license.

Prachi Bhardwaj contributed to this story.

More from Money:

Who Gets Stimulus Checks First?

The IRS's Get My Payment App Is Live, So You Can Track Your Stimulus Check