Coronavirus Continues to Tank the Stock Market. Here's Why — and What To Do About It

It happened again!

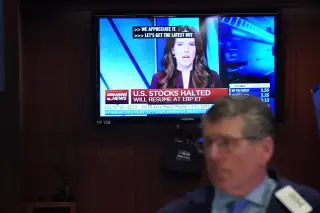

On Monday, the Dow Jones Industrial Average fell 13%, its biggest single-day drop since 1987. You probably thought, "Can this get any worse?"

Then on Wednesday came the answer everyone was dreading: The Dow dropped another 6% to 19,899, its lowest level since early 2017. That means in the past month, stocks have lost about a third of their value and, so far, there's no end in sight.

If you are worried, fair enough. So is every other investor. But it never pays to panic. Here's why the market keeps falling, and what you should do about it:

Nobody Knows Anything

When it comes to the coronavirus, health professionals keep telling us we need to "bend the curve" so the cases don't increase exponentially. But, outside of a few countries like China and South Korea, the number of new cases keeps spiraling upwards. Governments, meanwhile, realizing they've been caught flat-footed, seem to up the ante every few days, with new travel restrictions and additional economic stimulus.

On Wednesday, U.S. and Canadian policymakers agreed to close their nations' 5,500-mile border except for "essential travel," and Washington is debating whether to send checks of $1,000 or more to every American. But to many — maybe most — investors, it seems unlikely these will be the final steps in combating the outbreak. Instead, many envision an Italy-like nationwide shutdown.

While the worst-case scenario is certainly not good, in a lot of ways what the market hates most is the uncertainty. The markets reacted the same way during the 2007-2008 financial crisis, at one point dramatically dropping 7% as Congress voted on live television against authorizing President Bush's plan to bail out the banks. Markets didn't ultimately stabilize until it became clear the government was committed to doing whatever it would take to overcome the economy's problems. Right now, with the coronavirus, we're just not there yet.

Companies Need Cash

Stock market investors know — or should know — that stock prices rise and fall quickly. That's why most financial professionals recommend balancing the risk of your stock portfolio with bonds, a safe-haven asset which typically gains in value as stocks drop. That was one of the most jarring features of Wednesday's sell off. While the Dow was down sharply, many bonds, even rock-solid U.S. Treasury bonds, also saw losses. Yield on the 10-year U.S. Treasury Note rose 0.096% to 1.178%. (Bond yields move in the opposite direction as prices.)

So what gives? Just like you, many big companies are worried the U.S. economy could essentially shut down for a matter of weeks or even longer. You'd think that would prompt investors to sell stocks and buy safe assets like Treasury bonds, pushing prices up. To some extent that's been happening in recent weeks. But on Wednesday, many investors seemed to face an even more pressing need. With economy about to hit a hard stop, they needed cash — to pay employees, to pay rent, to meet other short-term obligations. They appear have ended up selling even the safest assets that nonetheless risked tying their money up for months or years.

“For pension funds, it is sell anything you can sell to build up reserves so you can tell your trustees that you have enough cash to pay pensions over the next nine or 10 months,” hedge fund manager Sushil Wadhwani told The Wall Street Journal Wednesday, referring to some of the markets biggest players.

Stay the Course

So where does this leave you? Riding out a bear market is never fun. And that's especially true when bonds — which are supposed to be the bedrock of your portfolio — start acting unpredictably. That doesn't mean you should abandon your investing plan. Remember you are focused on the long run. Even the direst of predictions about the coronavirus envision its economic impact as a short-term event, playing out over weeks or months, not decades — where your focus should be.

Of course, depending on your industry, there is a chance a coronavirus recession means you lose your job or part of your income. If you didn't follow financial planners' recommendation of building of a cash reserve of up to six months' expenses (and let's face it, that's most of us), it may be time to sit down and try to figure out what you can do make sure you have a big enough short-term cushion to pay your bills.

But as for your 401(k) or other stock market investments, try remember their value to you depends on what the U.S. economy looks like five, 10 or even more years from now, not over the next few months.

More from Money:

Every Major Hotel Chain's Coronavirus Cancellation and Refund Policy

Can't Pay Your Credit Card Bill Because of Coronavirus? Here's What to Do