Trump's Executive Order Means You Can (Probably) Put Off Paying Your Student Loans Until 2021

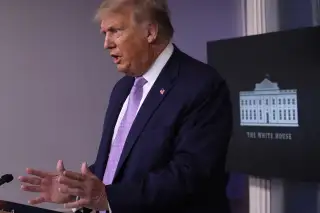

More than 35 million student loan borrowers are set to get additional relief on their monthly payments, after President Donald Trump said his administration would waive payments through the end of the year.

The move was one of four executive orders Trump issued Saturday to provide relief to millions of Americans who are still unable to work in an economy hobbled by the coronavirus. Congress has so far been unable to reach an agreement on a larger relief package, which would include a second round of stimulus checks.

Trump also moved to postpone payroll taxes through the end of the year, add up to $400 to unemployment insurance to replace the weekly $600 federal benefit that expired in July, and asked officials to consider an eviction ban. It's unclear when (or even if) any of these other presidential orders will take effect. Experts expect legal challenges — possibly from Democrats who want to offer more robust aid — since only Congress has the power to approve federal spending.

But the president's announcement on student loans is perhaps the least controversial. When Trump announced he was suspending interest on federal loans back in March — before the CARES Act made it official — Education Secretary Betsy DeVos supported the plan. While some may disagree that the Education Department has the authority to reset interest or cancel payments without Congressional approval, it's unlikely there'd be resistance to this move, which has widespread political appeal.

Most federal student loan borrowers have been in administrative forbearance since March, under terms set by the CARES Act. Interest rates are set to 0%, and there are no payments due until after Sept. 30.

Trump’s order essentially extends that period through Dec. 31, though it's unclear whether it will be automatic for borrowers, like it was with the CARES Act, or whether borrowers will have to opt-in to the relief.

Consumer advocates have been warning of a coming wave of defaults if the government did not act before Sept. 30 to continue helping borrowers. But Trump's order still falls far short of what many advocates wanted to see. For one, it doesn't help all of the country's more than 40 million borrowers. The order doesn't apply to anyone with private student loans, and also leaves out about 8 million borrowers who have older loans through the Federal Family Education Loan or Perkins Loan programs. Many of those loans, while managed by the federal government, are actually held by private banks. (Read more about that here.)

The executive order also doesn’t include any debt forgiveness, something some Democrats had originally pushed for in the next stimulus package.

Since the Education Department hasn’t said how it would carry out Trump’s order, there are still some unanswered questions about it will actually work. Among them: whether the period of waived payments will count toward loan forgiveness, including for those working toward Public Service Loan Forgiveness. The six-month period covered by the CARES Act does count toward forgiveness for public service workers as well as borrowers enrolled in longer income-driven repayment plans.

It's also unclear what will happen with wage garnishments and collections for borrowers who are in default. Most of those actions were also stopped under the CARES Act.

More from Money:

Here's Who Gets a Second Stimulus Check, and How Much It'll Be — Most Likely