Donald Trump Says The Government Profits on Student Debt. Is That True?

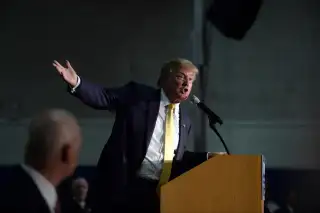

As part of a Twitter campaign that Republican presidential candidate Donald Trump launched on Monday (#AskTrump), the GOP-frontrunner addressed the hot-button issue of student loan burdens.

About $100 billion of more than $1 trillion in student loan debt is in default, according to the Government Accountability Office.

Trump said he'd "fix" the problem. He didn't offer any details, but did make this surprising claim: The U.S. government is turning a profit on student loans.

Trump said:

Right now, it’s not fair. It’s one of the only places, frankly, where our country actually makes money. And they make a lot of money. And that should not take place.

Is that right? Does the government actually make money off of student loans? The official answer is yes. But there's an asterisk. A private lending business wouldn't do accounting like the federal government.

At the simplest level, if profit simply means that the government expects to bring in more from student loans than it pays out, then student loans are indeed a gain for taxpayers. According to Congressional Budget Office estimates, over the next decade the four largest student loan programs will yield budget savings of $135 billion. Helping students pay for college doesn't add to the deficit, but reduces it.

That makes sense: The Federal government can borrow at a very low rate—a bit over 2%—and then charges borrowers a higher interest rate of more than 4%. Even assuming some expected defaults, that's enough to leave the loan programs in the black.

But Jason Delisle, director of the Federal Education Budget Project at The New America Foundation, says that the accounting practices that the government uses here (by law) wouldn't be used in the private sector. “If Donald Trump used the accounting method that the federal government uses to calculate loans, he’d be subject to serious fines, his businesses would go under," says Delisle.

The CBO itself has suggested a more "comprehensive" way to calculate to cost of its loan programs. It would show that instead of earning taxpayers $135 billion over ten years, student loans actually cost about $88 billion. Here's why: Not only are some people likely to default on loans over time, but they are especially likely to do so when the economy is in trouble. For a private lending business, that possibility—the CBO calls it market risk—is something you'd need to account for. So a private business would likely demand higher rates than the government does.

"On average, the Federal government will come out ahead on the loans," says Delisle. "But the issue is that no one invests on average, everyone hedges for the bad times."

If this all seems wonky—it is!—here's a simple way to think about it. On average, the government comes out ahead on student loans. But at the same time, it is still lending to students at a rate you'd be hard pressed to get from a bank. So the profit doesn't necessarily mean students are getting a raw deal.

Federal student loan borrowers also get “favorable repayment options and consumer protections” that aren’t available in private-sector loans, says the Center on Budget and Policy Priorities. (However, student loans are difficult to discharge in bankruptcy court.)

How much federal loans should cost or gain the government is certainly debatable. One point of running student loans through the government is that the U.S. Treasury can handle risks private businesses cannot.

But perhaps the real reason student loans burdens are so high isn't that borrowers are paying high rates—it's that fast-rising tuition has pushed so many students to borrow in the first place.