5 Super Dumb Financial Moves Encouraged by Trump University

According to documents released this week under court order, former managers at Trump University have slammed the school as little more than a high-pressure sales scam. “I believe that Trump University was a fraudulent scheme," a former Trump U sales manager named Ronald Schnackenberg wrote plainly in testimony, as the New York Times reported. "It preyed upon the elderly and uneducated to separate them from their money.”

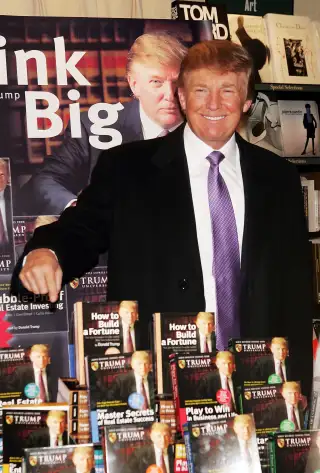

Now out of business, the for-profit Trump University was launched by Donald Trump in 2005 as a real estate investing instructional operation in which aspiring entrepreneurial tycoons could supposedly learn how to make money The Donald way—and pay upwards of $35,000 for the privilege. Trump University has since been hit with multiple lawsuits alleging fraud.

Now that a federal judge has unsealed nearly 400 pages of documents related to one of the lawsuits, including a "playbook" used by Trump U salespeople, we can see exactly how would-be students were badgered into buying courses. And we can see how students were encouraged to make some extremely sketchy financial decisions in the process, like these.

Go into credit card debt. Most people consider credit card debt to be embarrassing, not to mention a big turnoff to potential love interests. More importantly, credit card debt is regarded as "bad debt" that can result in huge interest payments over time and is to be avoided if at all possible—including using cash or debit only to pay for things. Personal finance expert Dave Ramsey even goes so far as to suggest that "Responsible use of a credit card does not exist."

Read Next: 8 Epic Business Failures with Donald Trump’s Name on Them

Yet Trump University salespeople were instructed to advise students to not only use credit cards but to willingly go into credit card debt as a way to pay for tuition and cover bills related to real estate investments. “What most people do,” salespeople said according to one script, “is handle the tuition by putting it on their credit cards because it gives them the ability to make very small monthly payments and maintain a low overhead to run their real estate project.” Here's another way students were pitched: "If a seller will take $10,000 down on a fixer-upper that you expect to make $20,000 on, why not use credit cards?"

And what happens when the profits from that fixer-upper are never realized? Well, the student is left with a potentially huge pile of credit card debt, with interest accumulating monthly. The bottom line is that if you can't pay off your credit card bill in full each month, you shouldn't be using credit cards—especially not for risky investment schemes.

Borrow from your retirement plan. Big financial penalties must be paid when borrowing from your 401(k) plan. So it's universally considered a bad idea to withdraw cash from a retirement account. It's a move of last resort, after you've exhausted all other options. Nonetheless, this too is suggested to students in the Trump U playbook: “Check with a tax attorney to see how you might borrow from your own retirement account to finance real estate investments."

Keep up with the Joneses. "Do you enjoy seeing everyone else but yourself in their dream houses and driving their dream cars with huge checking accounts? Those people saw an opportunity, and didn't make excuses, like what you're doing now." This too is another hard-sell prompt from the Trump U playbook that's supposed to be made to would-be customers who are unsure if they want to bite. And it's a recipe for debt, stress, and unhappiness.

Read Next: Hotel Bookings at Donald Trump’s Hotels Are Way Down

Psychologists and personal finance experts say that it's extremely unwise to make decisions based on envy and the "keeping up with the Joneses" mentality. When you're motivated mainly by the desire to match the success and material possessions of others, you "are sacrificing a great deal of what would really make us happy along the way," as one Psychology Today story put it.

Make big financial decisions based on emotion. Here's another tip Trump University salespeople were supposed to use in their pitches: "Don't ask people what they THINK about something you've said. Instead, always ask them how they FEEL about it. People buy emotionally and justify it logically."

Yes, the salespeople were basically telling customers to NOT THINK about the decisions they were making. This may be a good marketing pitch to get somebody to justify an unnecessary purchase, but it's a horrible approach for an individual facing a hardnosed business decision. As a Harvard Business Review story explained regarding big decisions such as buying a new house, starting a business, or making a substantial new investment: "Our emotional reactions to these choices may be useful in directing our attention and energy toward what we feel are the most important aspects of the decision. Yet intense emotions may lead us to make misguided decisions or outright disastrous ones."

Read Next: Why Everyone Is Suddenly Talking About Trump Mortgage

Spend cash on a useless investing course. "Sometimes your best investments are the ones you don't make." A certain famous entrepreneur and current presidential candidate is known for this quote. He has also said, "As an entrepreneur, I choose my teachers carefully, very carefully."

Would that Donald Trump think that salespeople hellbent on pushing a dubious $34,995 Gold Elite real estate investing course qualified as good teachers?