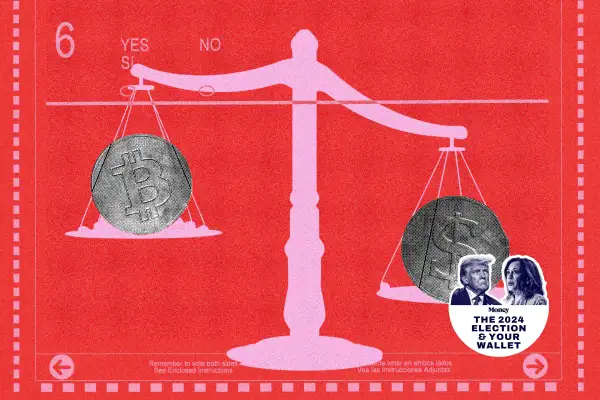

Election 2024: How Trump Set Himself Apart From Harris on Crypto

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

From border security and inflation to reproductive rights and climate change, there are many contentious issues shaping the 2024 presidential election. But one topic that hasn't made it to the forefront of candidates' platforms is quietly swaying a certain demographic of voter: crypto investors.

According to Federal Reserve data, just 7% of Americans invest in cryptocurrency. Nonetheless, adoption rates of digital assets continue to rise, and the respective policy positions of former President Donald Trump and current Vice President Kamala Harris regarding decentralized finance (DeFi) and potential regulation could have an outsized impact on how the average crypto investor votes on Election Day.

It's not just voters who have a vested interest in the election's outcome. Corporations are leading the push to influence federal crypto policy. In late August, a report by progressive nonprofit Public Citizen found that donations from Big Crypto have totaled $119 million, accounting for 44% of all corporate money contributed during this year's election cycle. Crypto corporations have been the primary corporate political spenders in 2024.

Ahead of Nov. 5, here's a detailed look at where Trump and Harris stand on crypto.

Trump's about-face on crypto

In 2021, Trump referred to bitcoin as a "scam" and argued that the digital asset was a "disaster waiting to happen." Fast-forward to 2024, and his sentiment has shifted. Bitcoin's market cap is now an astounding $1.355 trillion, and the former president has become a vocal proponent of crypto.

On Oct. 16, CNBC reported that since early June, a political action committee called Trump 47 Committee has raised about $7.5 million in crypto donations — including bitcoin, ether, XRP and USDC — per a Federal Election Commission filing.

The bump in crypto donations has come in the wake of Trump's increasingly public support for the DeFi community and the recent launch of his backed token, World Liberty Financial. The token, per its official website, aims to lead "a financial revolution by dismantling the stranglehold of traditional financial institutions." But its initial rollout restricted access to accredited investors (i.e., high-income individuals or professional investors).

According to Martin Leinweber, chartered financial analyst and director of digital asset research & strategy at MarketVector Indexes, although that move ran against one of the fundamental appeals of digital assets — their availability to broad audiences — it was due to current regulatory requirements rather than an intentional exclusion.

Trump is attempting to appeal to the broad crypto landscape through a multifaceted approach, according to Leinweber, who explained each aspect in detail to Money:

- Support for bitcoin mining: He has expressed strong support for bitcoin mining, likening it to a function of domestic manufacturing. Trump has met with miners and received donations from them, indicating a commitment to policies that might encourage mining operations in the U.S.

- Banking regulations: Trump has pledged to end initiatives like Operation Chokepoint 2.0, which could remove barriers for crypto businesses in accessing banking services. He supports allowing national banks to engage with blockchain technologies, potentially fostering greater integration between traditional financial institutions and the crypto industry.

- Opposition to central bank digital currencies (CBDCs): He has voiced opposition to the development of a U.S. CBDC, aligning with those in the crypto community who favor decentralized digital currencies over government-issued ones.

- Self-custody rights: Trump has indicated support for individuals' rights to self-custody their digital assets, emphasizing the importance of personal control without reliance on third parties.

These concepts are briefly outlined in the former president's official 2024 platform, though details are scarce.

Beyond promoting digital currencies, Trump holds a significant amount of crypto himself. As of Oct. 15, his publicly disclosed wallet was valued at over $6.7 million, with sizable holdings in ethereum and wrapped ethereum, according to financial news portal FXEmpire.

Harris quietly courts crypto

Despite not being as vocal about her position on crypto as Trump, Harris has touted a crypto regulatory framework. But details of the vice president's plan have been sparse.

The word "regulatory" is often maligned in the DeFi community, but Leinweber argues that it could be a positive development — and a way for Harris to differentiate herself from the Biden administration's position on crypto.

"By addressing regulation rather than advocating for prohibitive measures, she signals an openness to integrating cryptocurrencies into the mainstream financial system," Leinweber says. "This approach could be seen as an improvement over the current administration's stance, which some perceive as less accommodating to the crypto industry."

Research from financial services firm Morningstar found that while demographics of crypto investors run the gamut, the highest concentration of holders is among young men of color, which may also be contributing to how Harris approaches her messaging. According to Leinweber, the vice president's recent statements have linked crypto to her Opportunity Agenda for Black Men, promising protections for owners and investors in digital assets.

However, skepticism lingers. Leinweber says that "some critics view this approach as vague and are uncertain about how it would translate into concrete policies that foster innovation within the crypto sector."

That hasn't stopped some of the crypto community's most influential people from backing the vice president, though. Ripple co-founder Chris Larsen, for example, has made more than $11.8 million in donations to the Harris campaign, which could be indicative of a larger turning of the tide for the crypto lobby.

"The substantial contributions from the cryptocurrency industry ... represent a marked increase in political engagement from this sector," says Leinweber, adding that those donations are "likely driven by the industry's growing recognition of the importance of political advocacy in shaping favorable regulatory environments."

Leinweber expects this trend to strengthen as crypto adoption continues to push digital assets into the mainstream.

"It is reasonable to anticipate that the crypto lobby will continue to be a significant presence in future elections," he says. "The trend suggests a strategic effort by the cryptocurrency industry to engage more deeply in the political process, indicating that such involvement is likely to persist and potentially grow in subsequent election cycles."

Which candidate is better for crypto?

Trump, who has pivoted his stance on crypto to attract the support of the community, has made his position clear to the public through proposed policies. Harris has recently voiced support for crypto but has been scant with details, suggesting that her primary interest is in providing a regulatory framework with the aim of protecting investors.

On Oct. 14, Galaxy Digital Holdings' head of research Alex Thorn shared a scorecard on X that provides a comparison of the crypto policies and legislation of Biden, Harris and Trump. The findings suggest that Trump would be more favorable for the industry, but Galaxy is more optimistic about Harris' stance than Biden's.

More from Money:

Is Online Sports Betting the New Stock Market?

This Stock Market Stat Has Predicted 83% of Presidential Elections in the Past Century