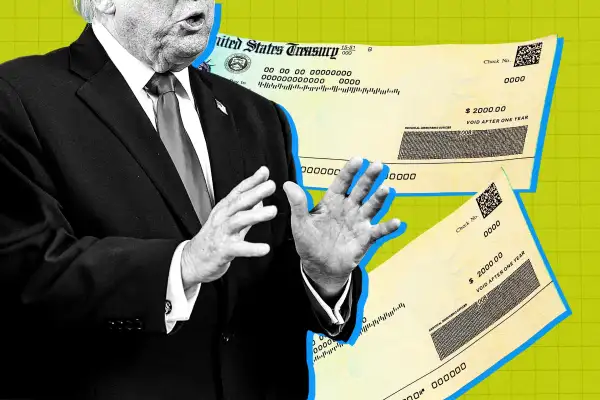

Are Trump's $2,000 Tariff Refund Checks Still Happening?

In a wide-ranging interview with the New York Times recently, President Donald Trump revisited the subject of $2,000 tariff-funded stimulus payments, an idea he teased in a series of social media posts and interviews in November.

When asked by a Times reporter when Americans could expect to see those payments, the president initially asked, "When did I do that?" He then said the checks could come “toward the end of the year.”

Previously, he said payments would go out “probably in the middle of next year, a little bit later than that.”

Will Trump really send Americans $2,000 checks?

Although the White House has repeatedly asserted that other countries are bearing the costs of Trump's aggressive tariff policy, economists generally agree that American consumers and businesses are shouldering the expense. The Urban-Brookings Tax Policy Center calculated that tariffs will cost the typical family $2,110 this year.

Restarting the conversation about tariff “stimulus” or “dividends” is one of a handful of recent ideas that Trump has floated recently, along with 50-year mortgages and a 10% cap on credit card interest rates.

Pundits and economists have characterized these proposals as tacit acknowledgment that affordability — a key campaign issue — is still elusive for many, and that Americans’ financial worries could have a steep political cost for the GOP.

Skeptical economists say Trump's math doesn’t add up. The government collected $195 billion in tariffs last fiscal year and is projected to take in between $300 billion and $350 billion this year. Meanwhile, watchdog group the Committee for a Responsible Federal Budget estimated that Trump’s tariff-refund-check proposal could cost as much as $600 billion.

If the payments were annual rather than a one-time distribution, they would raise the deficit by $6 trillion over the next decade, the group estimated. And if the Supreme Court strikes down Trump’s tariffs, the government could be forced to refund money it’s already collected from importers, whittling down federal coffers even further.

Is the president allowed to just give away money?

Trump told the Times he didn't believe he needed to go through Congress to send people payments.

Just about everyone else, including members of the president’s own administration, seems to think otherwise. Kevin Hassett, director of the National Economic Council, suggested that congressional approval would be needed in a December Face the Nation interview, saying that issuing the payments would "depend on what happens with Congress."

Kimberly Clausing, nonresident senior fellow at the Peterson Institute for International Economics, says the law is unambiguous: Legislation is the only way for the White House to send people money.

“Only Congress has the power of the purse, so Trump could not issue these payments without congressional approval,” she tells Money via email. “This is very clear; it is not a matter of subtle legal interpretation.”

It’s also unlikely. The president would have to overcome opposition from others — including in his own party — who have demurred or outright panned the idea, and earlier legislative efforts haven’t borne fruit. Trump previously voiced support for a bill introduced by Sen. Josh Hawley, R-Mo., for $600 payments, but that bill didn’t advance beyond the Senate Finance Committee.

Last month, Rep. Tim Burchett, R-Tenn., introduced a bill that would fold tariff payments into the tax code by increasing the standard deduction — although it wouldn’t authorize sending Americans checks.

Cornell University Law School professor Michael C. Dorf says there’s a good chance the executive branch might just rebrand some other tax break or already-authorized transfer of funds and tie it to tariffs. In a recent blog post, Dorf noted that money for the $1,776 “warrior dividends” Trump announced would go to military members was actually a congressionally authorized boost to service members’ housing allowances.

“That’s just a matter of marketing,” he says in an interview with Money. “It’s not accurate in any real sense.”

Stephen Myrow, managing partner of Beacon Policy Advisors, also says there’s no legal path for Trump to send out fiscal stimulus that doesn’t go through Congress. He suggests that this is more of a political talking point than a serious policy proposal.

“It's a messaging issue, it’s not a policy issue,” he says. “Trump just likes to talk about this.”

Figuring out tariff refund checks would be a 'formidable undertaking'

Determining who would be eligible for payments, how the program would be structured and the logistics of the rollout would be a big job, to say the least. Trump specifically said high earners would be excluded but provided no details about what the income threshold would be or if it would phase out for high-income people. (The Treasury Department did not respond to a query from Money.)

Fleshing out those details would require considerable time and money.

“It is a pretty formidable undertaking,” Myrow notes. “You need the IRS, and the IRS is already underwater right now,” he points out, with tax season about to start and the agency’s ranks thinned by personnel cuts.

Dorf speculated that the White House ultimately might settle for talking up tax breaks in the One Big Beautiful Bill Congress passed last year.

“The simplest thing to do would be to point to reductions in tax liability,” he says. “I think if they're going to basically do nothing but declare victory by pointing to something they've already done, it’s most likely going to be something in the tax code.”

In a November interview with ABC News, Treasury Secretary Scott Bessent suggested that tax breaks included in last year’s One Big Beautiful Bill could be construed as tariff rebates.

“That’s a political exercise… rebranding,” Dorf says.

Whether or not it’s enough to win over voters is the $600 billion question.

More from Money:

Tariff Checks: Will Trump Actually Send You a $2,000 'Dividend'?

What's Next for Trump's Tariffs After Supreme Court Oral Arguments