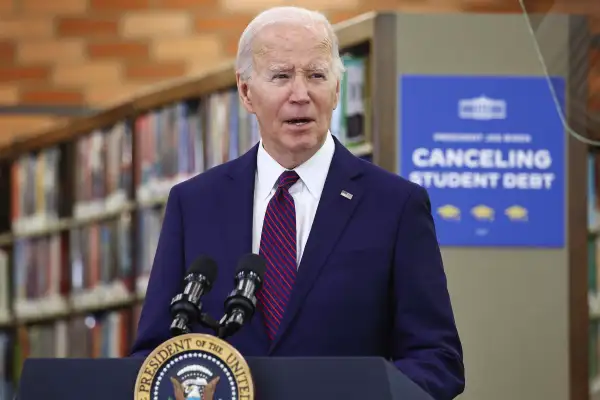

Biden's New Student Loan Forgiveness Plan Could Cancel $150 Billion of Debt

This story has been updated to include new information released this week about the cost of the plan.

The Biden administration’s new student loan forgiveness initiatives would wipe out nearly $150 billion of debt for some 30 million borrowers.

The administration published the official forgiveness proposal to the Federal Register on Tuesday, kick starting a 30-day public comment period. The plan was first announced last week.

It marks the second major attempt by the Biden administration at broad student loan forgiveness. This latest batch of proposals is far narrower in scope than President Joe Biden’s first forgiveness plan, which called for canceling up to $20,000 for borrowers earning less than $125,000 before it was struck down by the U.S. Supreme Court in June. That plan was estimated to cost about $380 billion, according to the Education Department (though outside analyses priced it even higher).

Biden's new proposal focused on debt forgiveness for borrowers with specific situations like runaway interest, financial hardship or remaining loan balances after paying down their student loans for more than two decades.

“What does that really mean for people?” Education Secretary Miguel Cardona said on a press call last week. “It means breathing room, it means freedom from feeling like your student loan bills compete with basic needs, like groceries or health care.”

In crafting the new plan — which is still undergoing a formal negotiated rulemaking process that started in October — White House officials said they “studied the Supreme Court’s decision carefully” and believe the administration has strong legal standing to cancel debt using the Higher Education Act.

That said, the White House appears to be primed for a legal fight. Officials noted several times the Republican-led lawsuits that have overturned or stalled Biden's previous student debt relief efforts. But ultimately, officials told reporters this plan was different enough that they feel confident going forward.

Barring any legal challenges, the administration expects to begin forgiving debt early this fall, likely before the November presidential elections. The vast majority of the relief will be automatic, an official said.

The Biden administration has already used several existing debt relief programs to cancel approximately $150 billion worth of student loan debt for over 4 million borrowers. The latest forgiveness program would nearly double that amount.

What’s in Biden’s new student loan forgiveness proposal?

Biden’s second attempt at broad student loan forgiveness includes a series of debt relief measures aimed at canceling debt for borrowers in certain circumstances and fixing what Secretary Cardona repeatedly called “a broken system.”

Here’s a closer look at what’s included.

Up to $20,000 of forgiveness for ‘runaway interest’

More than 25 million borrowers owe more than they originally borrowed due to interest accrual, according to White House estimates. Biden’s plan would cancel up to $20,000 of a borrower’s accrued interest, regardless of income. For borrowers who earn $120,000 (for individuals) or $240,000 (for married couples), any amount of interest can be forgiven if they enroll in an income-driven repayment plan, such as SAVE.

“There’s an end to the nightmare of working hard, making loan payments and still watching your loan balances get bigger and bigger month after month,” Cardona said.

Automatic forgiveness through existing programs

The White House says “paperwork requirements, bad advice or other obstacles” have kept millions of borrowers from forgiveness they are already eligible for through existing programs like Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness and others.

Under the new proposal, borrowers who qualify for forgiveness through an existing program like the ones above can get their debt canceled without enrolling into the program. The Education Department will identify this group of around 2 million borrowers using data it already has on hand.

Debt cancellation for long-time borrowers

Borrowers who have been in repayment for 20 years or more could see their remaining balances zeroed out under Biden’s new plan.

The administration says that borrowers with undergraduate debt that originated 20 years ago — July 1, 2005, or earlier — will have their remaining balance forgiven. For graduate debt, the threshold is 25 years (July 1, 2000, or earlier).

Borrowers don’t need to be enrolled in an income-driven repayment plan to receive the relief. Only Direct loans or consolidated Direct loans are eligible.

Loan forgiveness for ‘low-value’ education programs

The Biden administration says it plans to provide debt relief to borrowers who were "cheated by their schools."

For example, some education programs abruptly closed down, leaving their students with debt and no credential to show for it. Other schools may charge exorbitant prices but don’t provide graduates with earnings any better than what someone with a high school diploma earns.

According to an analysis by the HEA Group, a higher-education research firm, more than 1,000 schools in the U.S. leave most of their students who attended worse off than the typical high-school grad.

Biden’s proposal aims to assist those in similar situations by canceling the debt they’ve racked up from the “low-value” programs. Preliminary plans suggest the Biden administration will be scrutinizing schools with attendees who have poor job prospects and earnings as well as schools that aren't eligible (or lost eligibility) to participate in federal student aid programs. But precisely what constitutes a low-value program will be finalized when the official rule is published in the coming months.

Debt relief for borrowers with financial hardship

Biden’s new student loan forgiveness plan also includes a provision to provide debt relief to borrowers who are experiencing financial hardship and can’t fully pay back their loans "now or in the future."

While the details of who would be eligible for this type of relief are still being ironed out, it could include aid to borrowers who are at high risk of defaulting on their loans or are struggling with other expenses like child care or medical debt.

Administration officials said this portion of the plan is likely to require borrowers to apply because the Education Department doesn’t already have specific information on what hardship could be keeping a borrower from being able to pay their loans fully.

Why the focus on student loan forgiveness?

The White House says it’s pursuing student loan forgiveness to fix what it sees as a broken repayment system — and to provide relief to borrowers who have had to manage soaring college costs over the last several decades.

As sticker prices have skyrocketed in the last 20 years especially, wages for college graduates have not experienced comparable growth, according to an analysis from the White House’s Council of Economic Advisors.

While debt relief won't solve the underlying problem — the high cost of college — the administration argues that does help mend issues with the repayment system. And it's necessary to help borrowers who have been saddled by student debt buy a home, start a business or family, improve their credit scores and more.

Critics of the Biden administration’s plan say that student loan forgiveness can increase inflation while essentially transferring the student debt onto the backs of taxpayers who did not go to college or take out student loans. Some opponents also say that by forgiving student debt, the Biden administration is inadvertently incentivizing colleges to keep charging high prices because the debt their students rack up might be forgiven.

What’s next?

Borrowers eager for broad student loan forgiveness will have to wait and see how the proposals play out.

First, the proposals must undergo a public comment period as part of the official rulemaking process. Borrowers and other stakeholders can weigh in on the plan until May 17.

The feedback could lead to changes in the final rules, which are expected to be published in the coming months. Then, officials said, the goal is to start delivering relief early in the fall. The first round of forgiveness is likely to go to borrowers who have accrued interest that pushed their balances above their original loan amounts, officials said, because the Education Department already has the necessary information on these borrowers to deliver forgiveness.

Other forgiveness measures, especially plans that may require borrowers to apply (like for financial hardship), are expected to come later. Details on who exactly would qualify for the financial hardship provision aren't fleshed out yet.

Opponents of Biden's plan are expected to challenge this next attempt at broad forgiveness in court, which could delay the forgiveness timeline by several months — or halt it entirely.

"The Biden administration is lawlessly ignoring the Supreme Court and Congress by launching another massive student loan bailout program," said Elaine Parker of the Job Creators Network Foundation, a conservative advocacy group that successfully sued in 2022 to halt Biden's first forgiveness plan.

More from Money:

FAFSA Delays Spur Dozens of Colleges to Postpone Deadlines for Accepted Students

4 Million Student Loan Borrowers Have Monthly Payments Cut to $0