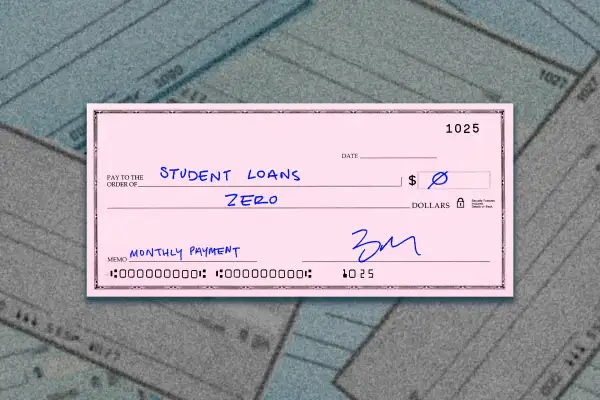

4 Million Student Loan Borrowers Have Monthly Payments Cut to $0

It’s not student loan forgiveness, but it may be the next best thing for many borrowers.

Under President Joe Biden’s new income-driven repayment plan, 3.9 million federal student loan borrowers have been approved for $0-a-month loan payments, according to new figures released from the Education Department.

In total, 6.9 million borrowers have enrolled in the Saving on a Valuable Education (SAVE) plan, a federal repayment plan that ties borrowers' monthly bills to 10% of their disposable income. However, if borrowers have no disposable income, as defined by a formula based on the federal poverty level, they're payments are set to $0.

These new figures mean more than half of those who have signed up so far have income levels low enough to qualify for $0 loan bills. On average, all borrowers in the plan have had their monthly bills reduced by $117, amounting to a savings of over $1,400 a year from pre-SAVE levels.

“SAVE is doing what it said it was going to do, which is to provide significant relief,” says Betsy Mayotte, the president of The Institute of Student Loan Advisors, a nonprofit organization that provides free student loan advice to borrowers. “Especially to borrowers whose loan balances are high compared to their income.”

Biden unveiled the SAVE plan last June after the U.S. Supreme Court blocked his marquee forgiveness plan to cancel up to $20,000 of federal student debt per borrower. That day, he also vowed to find a new legal avenue for broad forgiveness, the specifics of which are currently being determined.

In the meantime, there’s SAVE. Because it's an income-driven repayment (IDR) plan, those who sign up have their bills calculated based on how much money they earn — not how much debt they owe. After making between 10 and 25 years of qualifying payments on SAVE, borrowers will have their remaining balances forgiven. As soon as February, forgiveness is coming early for some borrowers who have been paying for at least a decade, the White House says.

The SAVE plan is more generous than other IDRs the federal government has offered in the past, in part because the Biden administration changed the methodology it uses to calculate monthly payments.

Under the old Revised Pay As You Earn, or REPAYE, plan, monthly payments were equal to 10% of a borrower's discretionary income, defined as any income above 150% of the federal poverty guideline. With SAVE, that threshold is 225%. That means single borrowers who earn less than $32,800 per year or those in a family of four making less than $67,500 have a $0 payment.

What is a $0 student loan payment?

A $0 payment may sound like an oxymoron, but successfully making required payments each month puts borrowers on a path toward total loan forgiveness — and borrowers get credit even if their quote-unquote "payment" is $0.

In addition, so long as borrowers continue making on-time payments, any interest that would increase the balance of their loan would be waived. This waiver is huge, Mayotte says. Under older IDRs, someone could be approved for, say, a $100-a-month payment, but if that $100 didn’t cover their loan balance’s interest, they would still see their balance increase month after month.

“I hear from borrowers all the time how incredibly demoralizing it is to make a payment every month only to see their balance go up,” Mayotte says.

The Education Department says that if you have a $0 payment, you do not need to pay or do anything that month — you'll still get credit toward IDR forgiveness and the SAVE interest waiver.

However, while the plan promises major relief, SAVE has had a rocky rollout thus far. Student loan payments restarted in the fall for the first time since 2020, and many borrowers who signed up for SAVE got approved for low monthly payments but received incorrect bills from their loan servicer for hundreds — or even thousands — of dollars higher than the approved amount.

The Education Department acknowledged widespread errors by loan servicers — estimating that more than 200,000 borrowers had issues specifically related to SAVE, and more than 3 million borrowers weren’t properly notified of their bills.

Early forgiveness — with more benefits coming in July

Starting next month, borrowers in SAVE who initially took out less than $12,000 in federal loans and have been in repayment for at least 10 years will get their remaining student debt canceled, the White House announced Friday.

For each additional $1,000 borrowed, the required payment history to receive forgiveness increases by one year.

For example, if you initially borrowed $16,000, you could receive forgiveness starting in February so long as you have 14 years of payment history. After 20 years of payments on undergraduate loans — regardless of balance — the remaining loans will be forgiven. For graduate loans, the maximum repayment timeline is 25 years.

These forgiveness benefits related to the SAVE program were originally slated for July. Now, the first wave of folks who qualify for forgiveness will see their balances wiped out as early as February.

Come July, the Education Department still intends to implement more perks for those enrolled in SAVE. Notably, monthly loan bills will be recalculated based on 5% of discretionary income, down from the current 10%. Other consolidation, forbearance and automatic-enrollment benefits are set to roll out that month, as well.

This story has been updated to clarify who is eligible for forgiveness beginning in February.

More from Money:

The New FAFSA Is Finally Open — Here Are 6 Big Changes Affecting Financial Aid

Some Student Loan Borrowers’ Payments Paused Due to Billing Errors