The Magic of Compound Interest

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

Compound interest is almost like magic. It makes dollars multiply before your eyes.

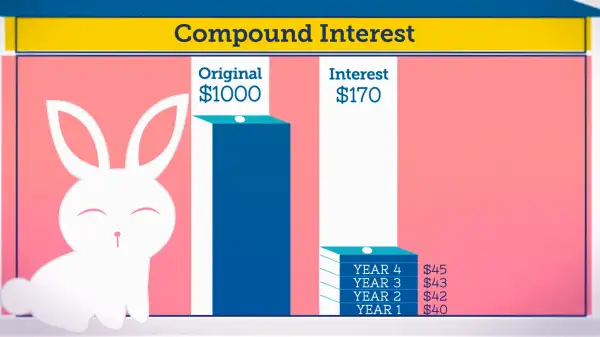

Let's say you start with $1,000 in the bank. If the interest rate is 4%, you'll have $40 more in the account at the end of the year. That's simple interest. But in a year or two, you earn interest not just on the original $1,000, but also on the $40 in interest you've already earned.

In other words, your interest earns interest. That's compound interest. And as long as interest rates don't fall, the amount you receive in interest grows each year you keep your money in the bank.

The same principle works when you invest in stocks or mutual funds, where annual returns are, on average, higher than they are at the bank. With compounded returns, the money your investments earn one year will earn money for you in following years — as long as you reinvest it.